Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 6 Jennifer is a single mother, with a child who is dependent (5 years old). She has significant income and is a higher

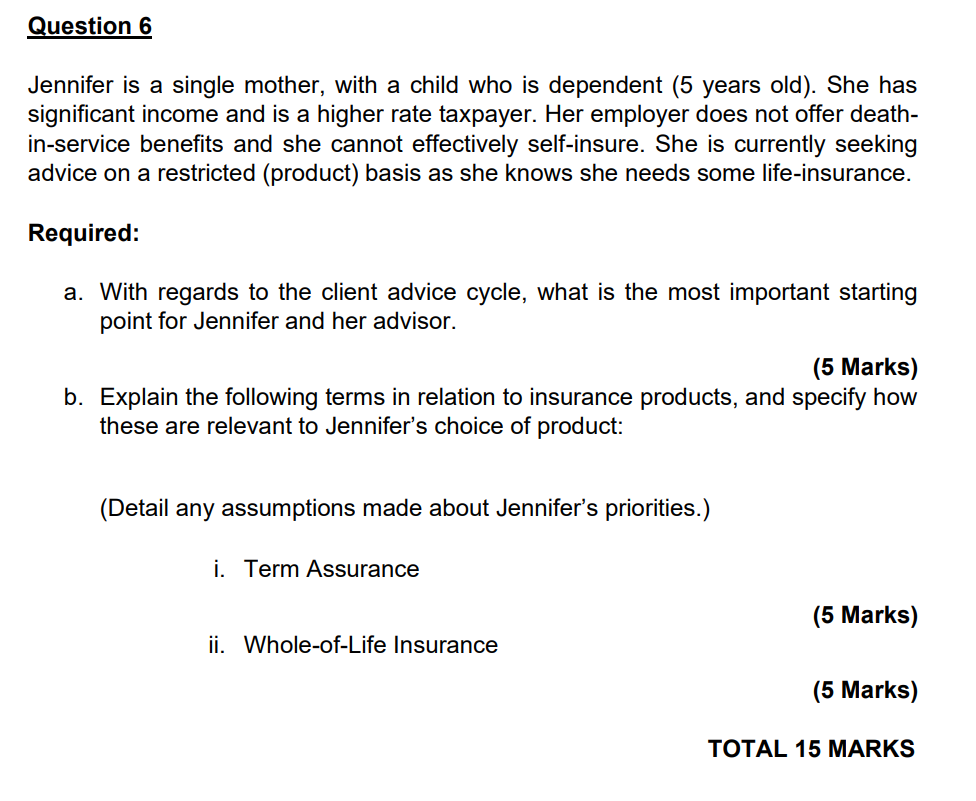

Question 6 Jennifer is a single mother, with a child who is dependent (5 years old). She has significant income and is a higher rate taxpayer. Her employer does not offer death- in-service benefits and she cannot effectively self-insure. She is currently seeking advice on a restricted (product) basis as she knows she needs some life-insurance. Required: a. With regards to the client advice cycle, what is the most important starting point for Jennifer and her advisor. (5 Marks) b. Explain the following terms in relation to insurance products, and specify how these are relevant to Jennifer's choice of product: (Detail any assumptions made about Jennifer's priorities.) i. Term Assurance ii. Whole-of-Life Insurance (5 Marks) (5 Marks) TOTAL 15 MARKS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The most important starting point for Jennifer and her advisor in the client advice cycle is to conduct a thorough factfinding process This involves ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started