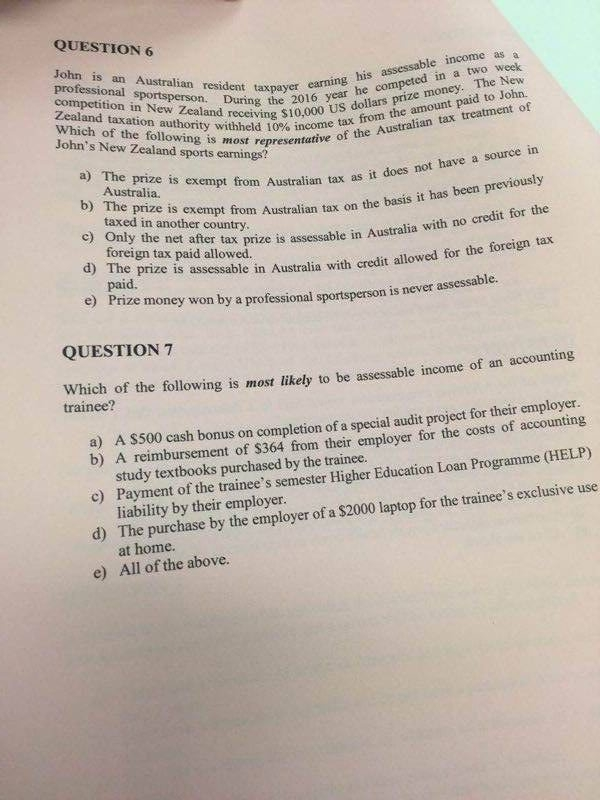

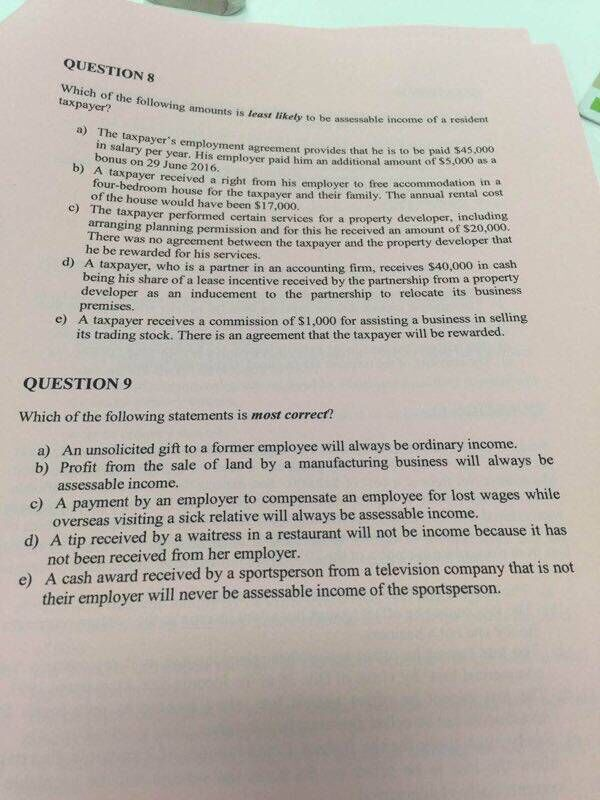

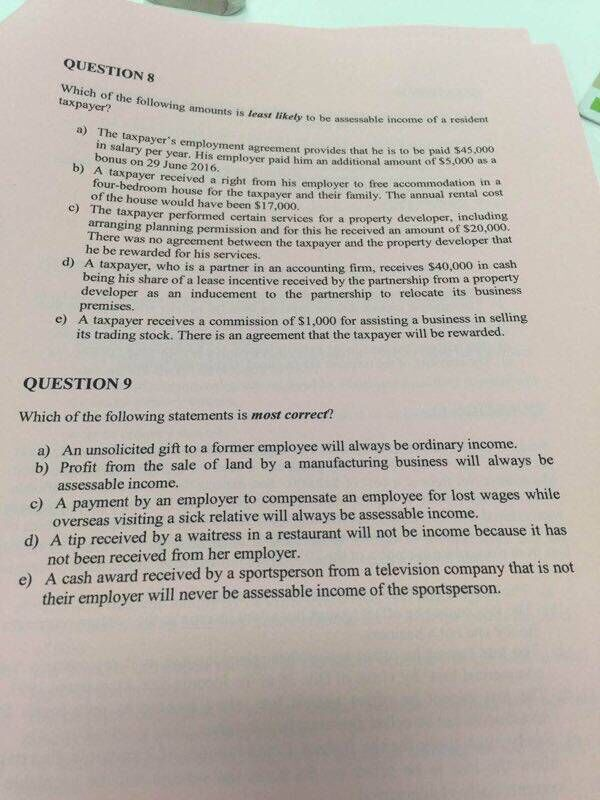

QUESTION 6 John is an Australian resident taxpayer earning he compze moneyid to John professional sportsperson. During payer earning his assessable income as the 2016 year he com in a two week competition in New Zealand receiving s10,000tx from the alan tax Zealand taxation authority withheld 10% income Which of the following is most representative John's New Zealand sports earnings? from the amount paid to John. ost represent ative of the Australian tax treatment of a) The prize is exempt from Australian tax as Australia it does not have a source in b) The pize is is exempt from Australian tax on the basis it taxed in another country c) Only the net after tax the prize is assessable in Australia with no credit for in Aus foreign tax paid allowed prize is assessable in Australia with credit allowed for the forcign tax paid. e) Prize money won by a professional sportsperson is never QUESTION 7 Which of the following is most likely to be assessable income of an accounting trainee? a) A S500 cash bonus on completion of a special audit project for their employer. b) A reimbursement of $364 from their employer for the costs of accounting c) Payment of the trainee's semester Higher Education Loan Programme (HELP) d) The purchase by the employer of a $2000 laptop for the trainee's exclusive use e) All of the above. study textbooks purchased by the trainee. liability by their employer. at home. QUESTION 8 Which of the following amounts is ng amounts is least likely to be assessable income of a resident a) The taxpayer's emplo impkoyer paid ployment agreement provides that he is to be paid S45.000 enployer paid him an additional amount of $5,000 as a in salary per year bonus on 29 June 2016. A taxpayer received a right from his employer to free accommodatn cost b) commodation in a four-bedroom house for the taxpayer and their family. The annual rental e house would have been $17.000 c) The taxpayer performed certain serv ices for a property developer, including anging planning permission and for this he received an amount of $20,000 Th ere was no agreement between the taxpayer and the property developer that he be rewarded for his services. a) A taxpayer, who is a partner in an accounting firm, receives $40,000 in cash being his share of a lease incentive received by the partnership from a property developer as an inducement to the partnership to relocate its business premises A taxpayer receives a commission of $1,000 for assisting a business in selling its trading stock. There is an agreement that the taxpayer will be rewarded. e) QUESTION 9 Which of the following statements is most correcf? a) An unsolicited gift to a former employee will always be ordinary income. b) Profit from the sale of land by a manufacturing business will always be assessable income. overseas visiting a sick relative will always be assessable income. not been received from her employer. their employer will never be assessable income of the sportsperson. ent by an employer to compensate an employee for lost wages while c) A paym ) A tip received by a waitress in a restaurant will not be income because it has e) A cash award received by a sportsperson from a television company that is not