Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 6 June 1 2 3 5 6 7 10 11 14 17 20 21 24 Becky Wang invested $30,000 cash to start a new

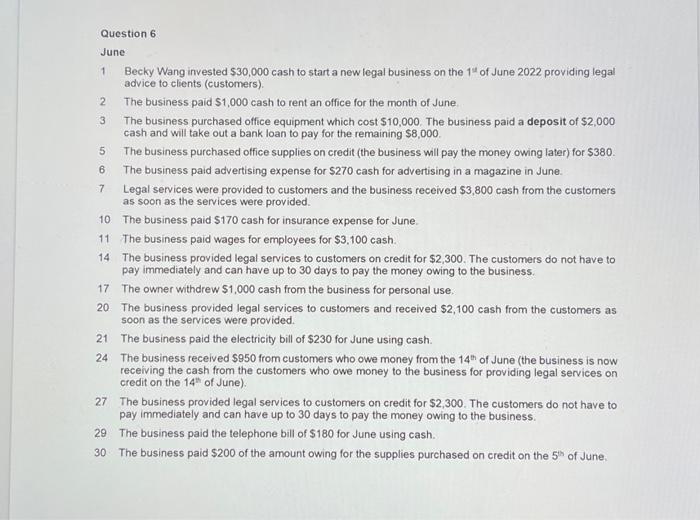

Question 6 June 1 2 3 5 6 7 10 11 14 17 20 21 24 Becky Wang invested $30,000 cash to start a new legal business on the 1st of June 2022 providing legal advice to clients (customers). The business paid $1,000 cash to rent an office for the month of June. The business purchased office equipment which cost $10,000. The business paid a deposit of $2,000 cash and will take out a bank loan to pay for the remaining $8,000. The business purchased office supplies on credit (the business will pay the money owing later) for $380. The business paid advertising expense for $270 cash for advertising in a magazine in June. Legal services were provided to customers and the business received $3,800 cash from the customers as soon as the services were provided. The business paid $170 cash for insurance expense for June. The business paid wages for employees for $3,100 cash. The business provided legal services to customers on credit for $2,300. The customers do not have to pay immediately and can have up to 30 days to pay the money owing to the business. The owner withdrew $1,000 cash from the business for personal use. The business provided legal services to customers and received $2,100 cash from the customers as soon as the services were provided. The business paid the electricity bill of $230 for June using cash. The business received $950 from customers who owe money from the 14th of June (the business is now receiving the cash from the customers who owe money to the business for providing legal services on credit on the 14th of June). 27 The business provided legal services to customers on credit for $2,300. The customers do not have to pay immediately and can have up to 30 days to pay the money owing to the business. 29 The business paid the telephone bill of $180 for June using cash. 30 The business paid $200 of the amount owing for the supplies purchased on credit on the 5th of June.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started