Answered step by step

Verified Expert Solution

Question

1 Approved Answer

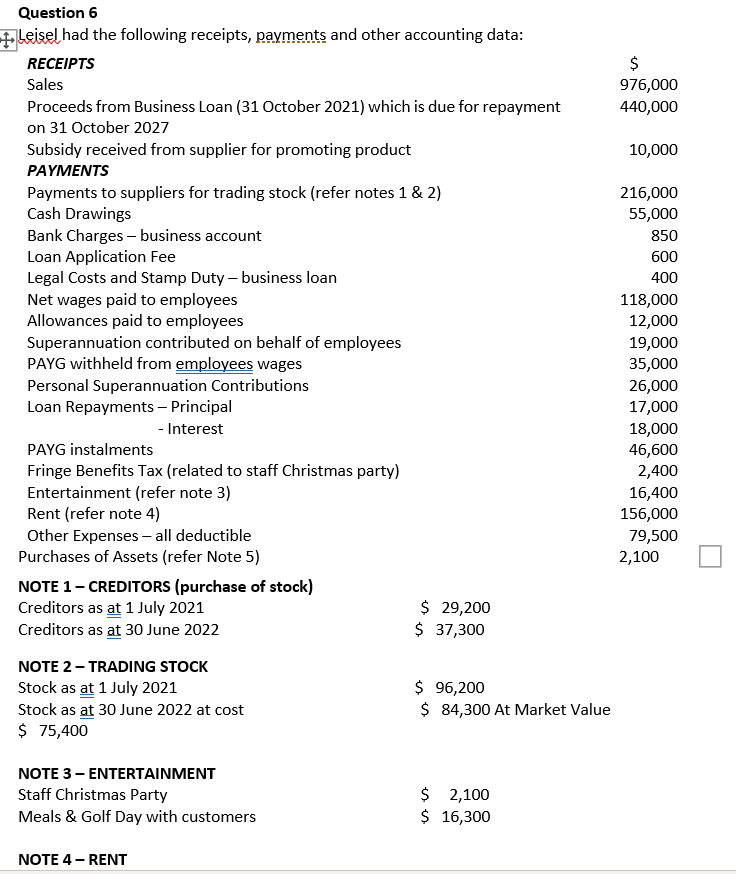

Question 6 + Leisel had the following receipts, payments and other accounting data: RECEIPTS Sales Proceeds from Business Loan (31 October 2021) which is

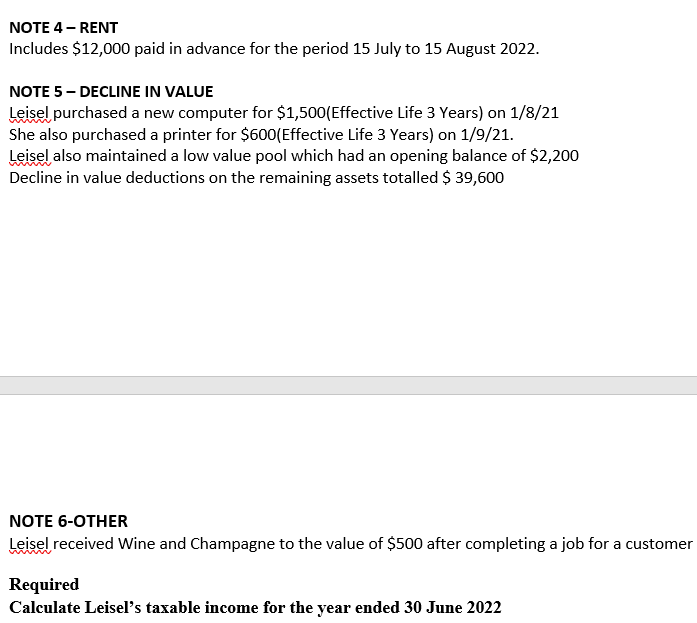

Question 6 + Leisel had the following receipts, payments and other accounting data: RECEIPTS Sales Proceeds from Business Loan (31 October 2021) which is due for repayment on 31 October 2027 Subsidy received from supplier for promoting product PAYMENTS Payments to suppliers for trading stock (refer notes 1 & 2) Cash Drawings Bank Charges - business account Loan Application Fee Legal Costs and Stamp Duty-business loan Net wages paid to employees Allowances paid to employees Superannuation contributed on behalf of employees PAYG withheld from employees wages Personal Superannuation Contributions Loan Repayments - Principal - Interest PAYG instalments Fringe Benefits Tax (related to staff Christmas party) Entertainment (refer note 3) Rent (refer note 4) Other Expenses - all deductible Purchases of Assets (refer Note 5) NOTE 1 - CREDITORS (purchase of stock) Creditors as at 1 July 2021 Creditors as at 30 June 2022 NOTE 2 - TRADING STOCK Stock as at 1 July 2021 Stock as at 30 June 2022 at cost $ 75,400 NOTE 3 - ENTERTAINMENT Staff Christmas Party Meals & Golf Day with customers NOTE 4 - RENT $ 29,200 $ 37,300 $ 96,200 $ 84,300 At Market Value $ 2,100 $ 16,300 $ 976,000 440,000 10,000 216,000 55,000 850 600 400 118,000 12,000 19,000 35,000 26,000 17,000 18,000 46,600 2,400 16,400 156,000 79,500 2,100 NOTE 4 - RENT Includes $12,000 paid in advance for the period 15 July to 15 August 2022. NOTE 5 - DECLINE IN VALUE Leisel purchased a new computer for $1,500(Effective Life 3 Years) on 1/8/21 She also purchased a printer for $600(Effective Life 3 Years) on 1/9/21. Leisel also maintained a low value pool which had an opening balance of $2,200 Decline in value deductions on the remaining assets totalled $ 39,600 NOTE 6-OTHER Leisel received Wine and Champagne to the value of $500 after completing a job for a customer Required Calculate Leisel's taxable income for the year ended 30 June 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Leisels Taxable Income for the Year Ended 30 June 2022 Income Sales 976000 Subsidy received from sup...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started