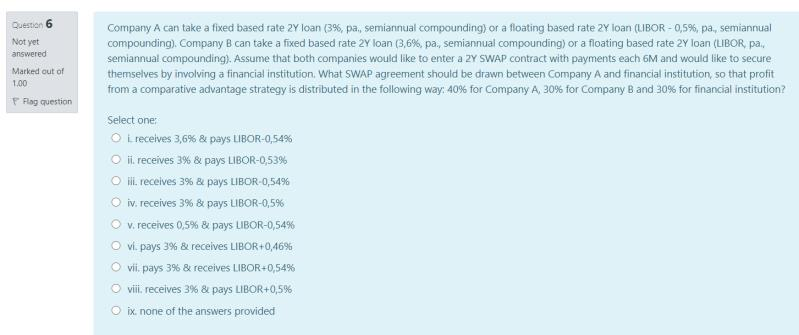

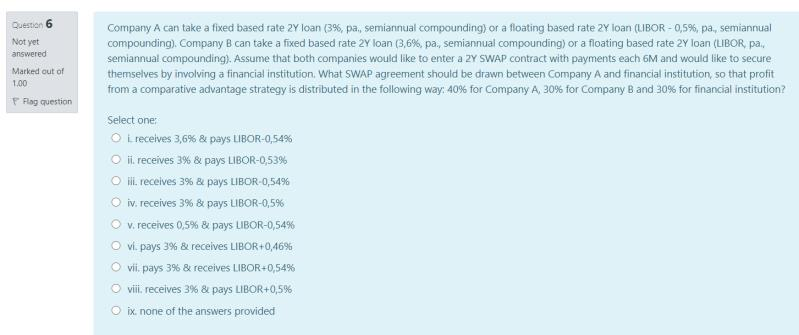

Question 6 Not yet answered Company A can take a fixed based rate 2Y loan (3%, pa, semiannual compounding) or a floating based rate Y loan (UBOR -0,5%, pa, semiannual compounding). Company B can take a fixed based rate 2 loan (3,6%, pa, semiannual compounding) or a floating based rate 2 loan (LIBOR, pa, semiannual compounding). Assume that both companies would like to enter a 2Y SWAP contract with payments each 6M and would like to secure themselves by involving a financial institution. What SWAP agreement should be drawn between Company A and financial institution so that profit from a comparative advantage strategy is distributed in the following way: 40% for company A, 30% for Company B and 30% for financial institution? Marked out of 1.00 F Fag question Select one: O receives 3,6% & pays LIBOR-0,54% O ii, receives 3% & pays LIBOR-0,53% Oli, receives 3% & pays LIBOR-0,54% Oiv, receives 3% & pays LIBOR-0,5% v. receives 0,5% & pays LIBOR-0,54% Ovi pays 3% & receives LIBOR+0,46% vii, pays 3% & receives LIBOR+0,54% viii. receives 3% & pays LIBOR+0,5% Oix none of the answers provided Question 6 Not yet answered Company A can take a fixed based rate 2Y loan (3%, pa, semiannual compounding) or a floating based rate Y loan (UBOR -0,5%, pa, semiannual compounding). Company B can take a fixed based rate 2 loan (3,6%, pa, semiannual compounding) or a floating based rate 2 loan (LIBOR, pa, semiannual compounding). Assume that both companies would like to enter a 2Y SWAP contract with payments each 6M and would like to secure themselves by involving a financial institution. What SWAP agreement should be drawn between Company A and financial institution so that profit from a comparative advantage strategy is distributed in the following way: 40% for company A, 30% for Company B and 30% for financial institution? Marked out of 1.00 F Fag question Select one: O receives 3,6% & pays LIBOR-0,54% O ii, receives 3% & pays LIBOR-0,53% Oli, receives 3% & pays LIBOR-0,54% Oiv, receives 3% & pays LIBOR-0,5% v. receives 0,5% & pays LIBOR-0,54% Ovi pays 3% & receives LIBOR+0,46% vii, pays 3% & receives LIBOR+0,54% viii. receives 3% & pays LIBOR+0,5% Oix none of the answers provided