Answered step by step

Verified Expert Solution

Question

1 Approved Answer

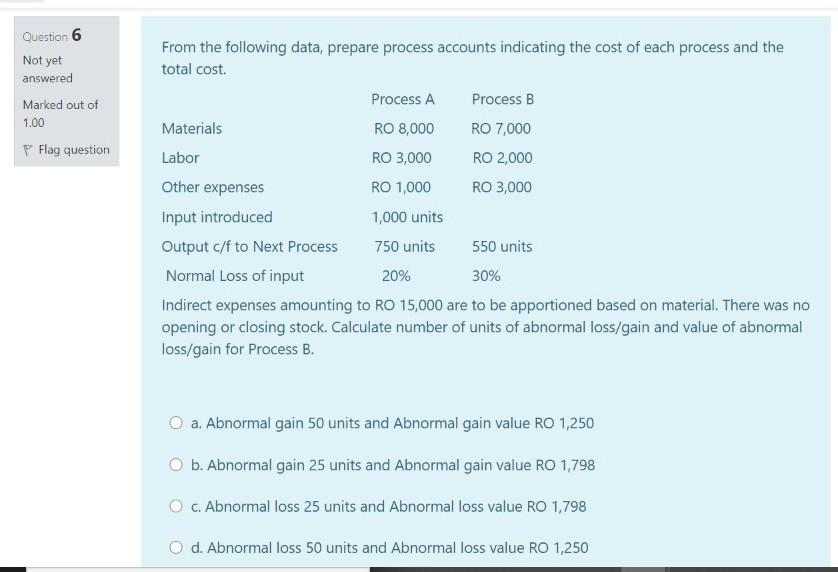

Question 6 Not yet answered Marked out of 1.00 P Flag question From the following data, prepare process accounts indicating the cost of each process

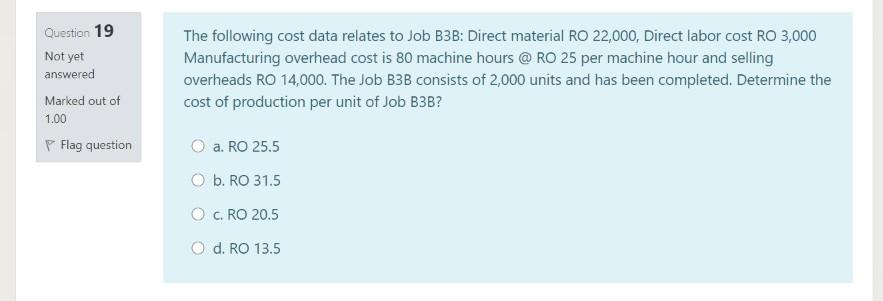

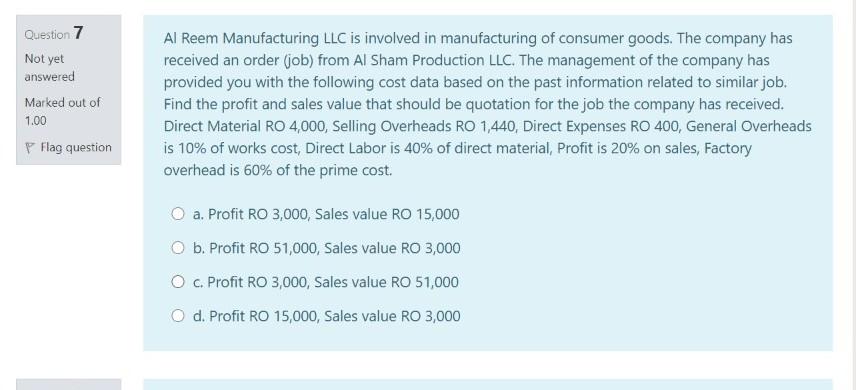

Question 6 Not yet answered Marked out of 1.00 P Flag question From the following data, prepare process accounts indicating the cost of each process and the total cost. Process A Process B Materials RO 8,000 RO 7,000 Labor RO 3,000 RO 2,000 Other expenses RO 1,000 RO 3,000 Input introduced 1,000 units Output c/f to Next Process 750 units 550 units Normal Loss of input 20% 30% Indirect expenses amounting to RO 15,000 are to be apportioned based on material. There was no opening or closing stock. Calculate number of units of abnormal loss/gain and value of abnormal loss/gain for Process B. O a. Abnormal gain 50 units and Abnormal gain value RO 1,250 O b. Abnormal gain 25 units and Abnormal gain value RO 1,798 O c. Abnormal loss 25 units and Abnormal loss value RO 1,798 O d. Abnormal loss 50 units and Abnormal loss value RO 1,250 Question 19 Not yet answered Marked out of 1.00 P Flag question The following cost data relates to Job B3B: Direct material RO 22,000, Direct labor cost RO 3,000 Manufacturing overhead cost is 80 machine hours @ RO 25 per machine hour and selling overheads RO 14,000. The Job B3B consists of 2,000 units and has been completed. Determine the cost of production per unit of Job B3B? O a. RO 25.5 O b. RO 31.5 C.RO 20.5 O d. RO 13.5 Question 7 Not yet answered Marked out of 1.00 P Flag question Al Reem Manufacturing LLC is involved in manufacturing of consumer goods. The company has received an order (job) from Al Sham Production LLC. The management of the company has provided you with the following cost data based on the past information related to similar job. Find the profit and sales value that should be quotation for the job the company has received. Direct Material RO 4,000, Selling Overheads RO 1,440, Direct Expenses RO 400, General Overheads is 10% of works cost, Direct Labor is 40% of direct material, Profit is 20% on sales, Factory overhead is 60% of the prime cost. O a. Profit RO 3,000, Sales value RO 15,000 O b. Profit RO 51,000, Sales value RO 3,000 O c. Profit RO 3,000, Sales value RO 51,000 O d. Profit RO 15,000, Sales value RO 3,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started