Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 6 of 10 1 Point The net sales of Grand Manufacturing Co. in 2019 is total, P580,600. The cost of goods manufactured is P480,000.

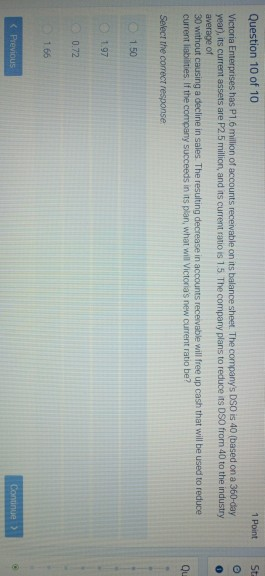

Question 6 of 10 1 Point The net sales of Grand Manufacturing Co. in 2019 is total, P580,600. The cost of goods manufactured is P480,000. The beginning inventories of goods in process and finished goods are P82,000 and P65,000, respectively. The ending inventories are goods in process, P75,000, finished goods, P55,000. The selling expenses is 5%, general and administrative expenses 25% of cost of sales, respectively The net profit in the year 2019 is Select the correct response P45,725 p90,000 P53,850 PB3,000 Question 7 of 10 1 Point Statu Barr Co has total debt of $420,000 and shareholders equity of S700,000. Barr is seeking capital to fund an expansion Barris planning to issue an additional $300,000 in common stock, and is negotiating with a bank to borrow additional funds. The bank is requiring a debt-to-equity rate of 0.75 What is the maximum additional amount Bart will be able to borrow? 0 Pe Select the correct response P750,000 Quest OU OU OL P330,000 P525,000 Cu P225,000 . Que Question 9 of 10 1 Point Alumbat Corporation has P800,000 of debt outstanding, and it pays an interest rate of 10 percent annually on its bank loon Alumbat's annual sales are P3,200,000, its average tax rate is 40 percent, and its ner profit margin on sales is 6 percent. If the company does not maintain a TIE ratio of at least 4 times, its bank will refuse to renew its loan, and bankruptcy will result What is Alumbat's current TIE ratio? Select the correct response: 3.6 5.0 0 24 0 3.4 Question 10 of 10 1 Point St : Victoria Enterprises has P1.6 million of accounts receivable on its balance sheet. The company's DSO is 40 (based on a 360-day year), its current assets are P25 million, and its current ratio is 15 The company plans to reduce its DSO from 40 to the industry average of 30 without causing a decline in sales. The resulting decrease in accounts receivable will free up cash that will be used to reduce current liabilities. If the company succeeds in its plan, what will Victoria's new current ratio be? Ou Select the correct response 1.50 1.97 0.72 166

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started