Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 6 Pacific Basin Bank ( PBB ) has outstanding a $ 1 0 0 , 0 0 0 face value, adjustable rate loan to

Question

Pacific Basin Bank PBB has outstanding a $ face value, adjustable rate loan to a

company that has a leverage ratio of per cent defined as Current market value of debt

Market Value of assets The current riskfree rate is per cent, and the time to maturity on

the loan is exactly year. The asset risk of the borrower, as measured by the standard

deviation of the rate of change in the value of the underlying assets, is per cent. Use the

KMV Merton model and the normal density function.

Do not round intermediate calculations.

d

to six decimal places. No commas

Nd

to six decimal places. No commas

d

to six decimal places. No commas

to six decimal places. No commas

MV Debt

to two decimal places. No commas

credit spread interest rate on debt over risk free rate

to four

decimal places. No commasQuestion

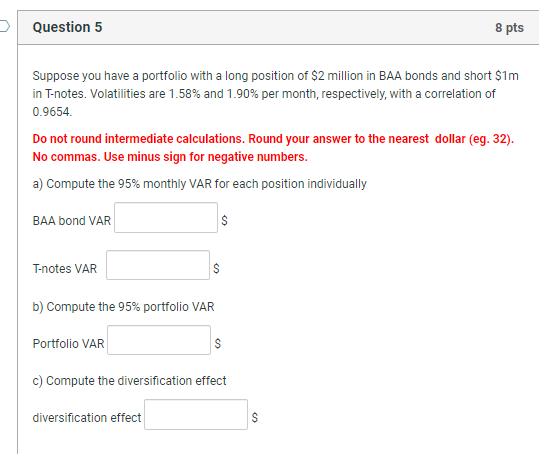

Suppose you have a portfolio with a long position of $ million in BAA bonds and short $

in Tnotes. Volatilities are and per month, respectively, with a correlation of

Do not round intermediate calculations. Round your answer to the nearest dollar eg

No commas. Use minus sign for negative numbers.

a Compute the monthly VAR for each position individually

BAA bond VAR

$

Tnotes VAR

$

b Compute the portfolio VAR

Portfolio VAR

$

c Compute the diversification effect

diversification effect

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started