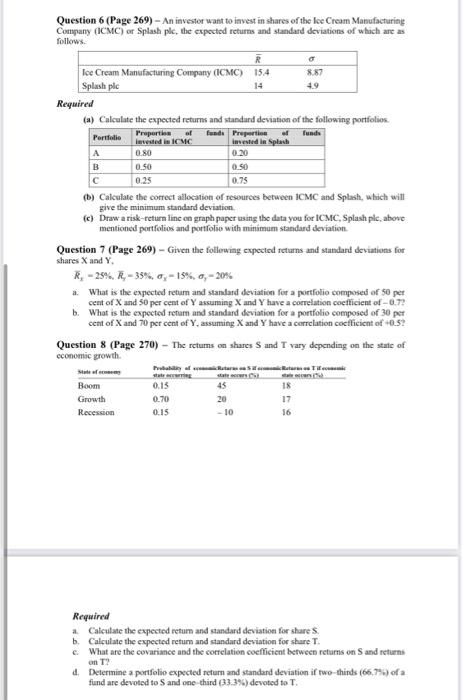

Question 6 (Page 269) - An investor want to invest in shares of the loc Cream Manufacturing Company (ICMC) or Splash ple, the expected returns and standard deviations of which are as follows R Ice Cream Manufacturing Company (ICMC) 15.4 8.87 Splash plc 14 4.9 Required (a) Calculate the expected returns and standard deviation of the following portfolios Portfolio Proportion of fundo rur of funds invested in ICMC invested in Splash A 0.80 0_20 B 0.50 0.50 0.25 0.75 () Calculate the correct allocation of resources between ICMC and Splash, which will give the minimum standard deviation (c) Draw a risk-return line en graph paper using the data you for ICMC, Splash ple, above mentioned portfolios and portfolio with minimum standard deviation Question 7 (Page 269) - Given the following expected returns and standard deviations for shares X and Y. R, -25%. R-35%, 0, -15%, -20% a What is the expected return and standard deviation for a portfolio composed of 50 per cent of X and 50 per cent of Y assuming X and Y have a correlation coefficient of -0.72 b. What is the expected retum and standard deviation for a portfolio composed of 30 per cent of X and 70 per cent of Y, assuming X and Y have a correlation coefficient of 0.5 Question 8 (Page 270) - The retums on shares S and T vary depending on the state of economic growth Balatasara Boom 0.15 18 Growth 0.70 20 17 Recession 0.15 - 10 Required a Calculate the expected return and standard deviation for share S. b. Calculate the expected return and standard deviation for share T. c. What are the covariance and the correlation coefficient between retums on S and return d. Determine a portfolio expected return and standard deviation if two-thirds (66.7%) of a fund are devoted to S and one third (33.3%) devoted to T. Question 6 (Page 269) - An investor want to invest in shares of the loc Cream Manufacturing Company (ICMC) or Splash ple, the expected returns and standard deviations of which are as follows R Ice Cream Manufacturing Company (ICMC) 15.4 8.87 Splash plc 14 4.9 Required (a) Calculate the expected returns and standard deviation of the following portfolios Portfolio Proportion of fundo rur of funds invested in ICMC invested in Splash A 0.80 0_20 B 0.50 0.50 0.25 0.75 () Calculate the correct allocation of resources between ICMC and Splash, which will give the minimum standard deviation (c) Draw a risk-return line en graph paper using the data you for ICMC, Splash ple, above mentioned portfolios and portfolio with minimum standard deviation Question 7 (Page 269) - Given the following expected returns and standard deviations for shares X and Y. R, -25%. R-35%, 0, -15%, -20% a What is the expected return and standard deviation for a portfolio composed of 50 per cent of X and 50 per cent of Y assuming X and Y have a correlation coefficient of -0.72 b. What is the expected retum and standard deviation for a portfolio composed of 30 per cent of X and 70 per cent of Y, assuming X and Y have a correlation coefficient of 0.5 Question 8 (Page 270) - The retums on shares S and T vary depending on the state of economic growth Balatasara Boom 0.15 18 Growth 0.70 20 17 Recession 0.15 - 10 Required a Calculate the expected return and standard deviation for share S. b. Calculate the expected return and standard deviation for share T. c. What are the covariance and the correlation coefficient between retums on S and return d. Determine a portfolio expected return and standard deviation if two-thirds (66.7%) of a fund are devoted to S and one third (33.3%) devoted to T