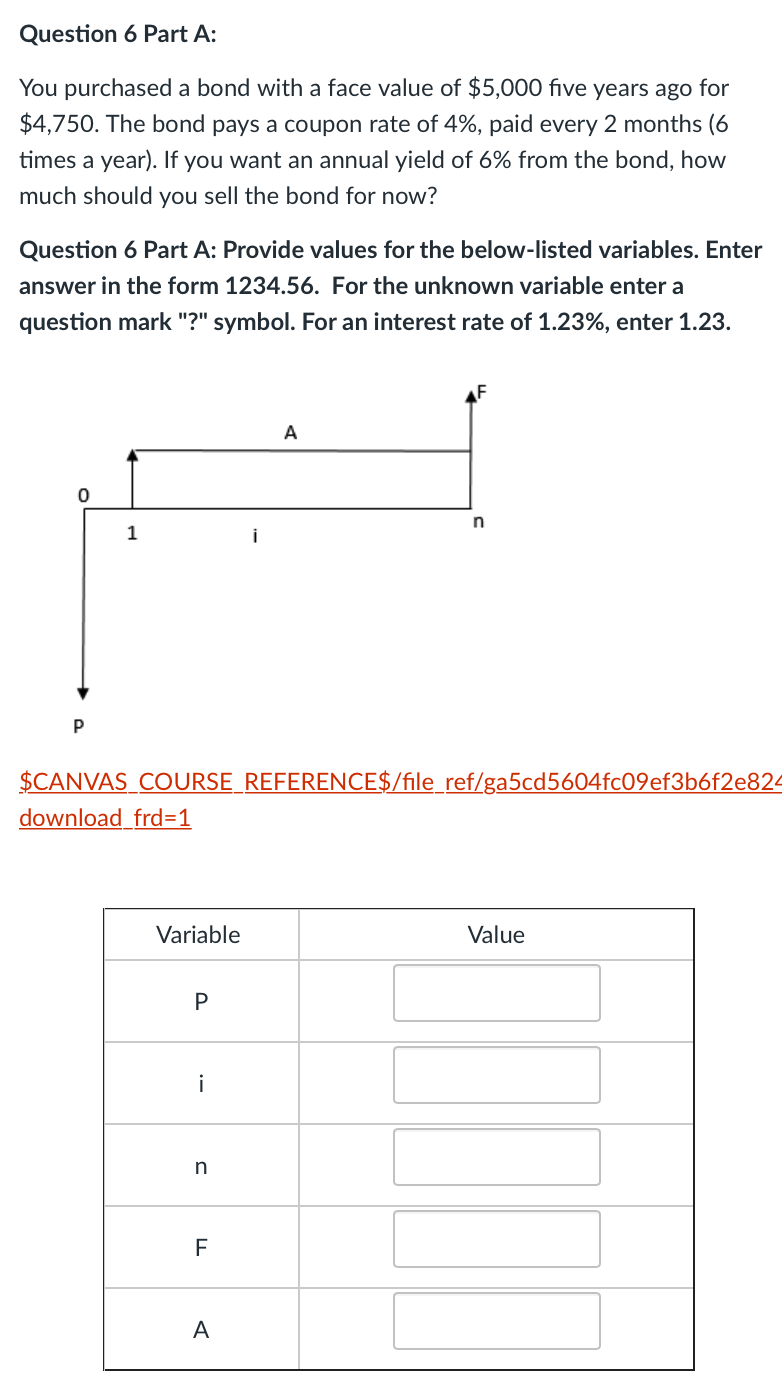

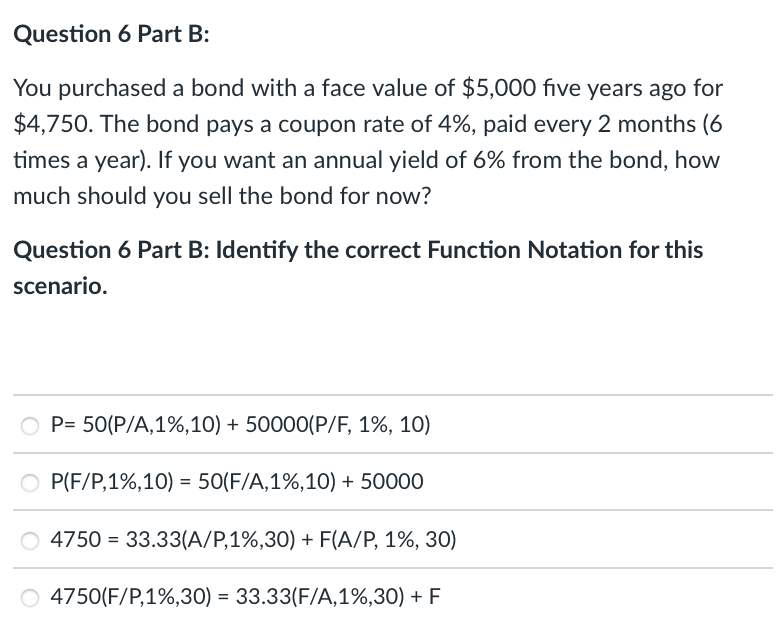

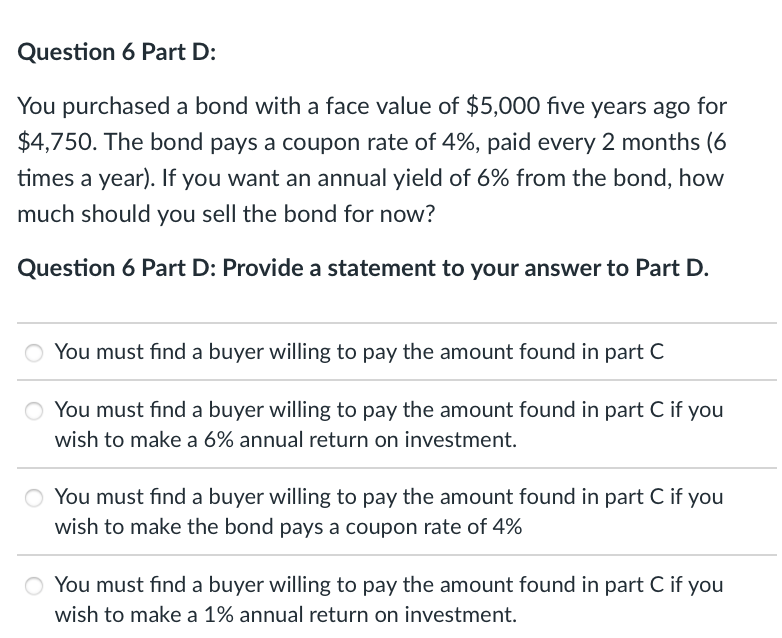

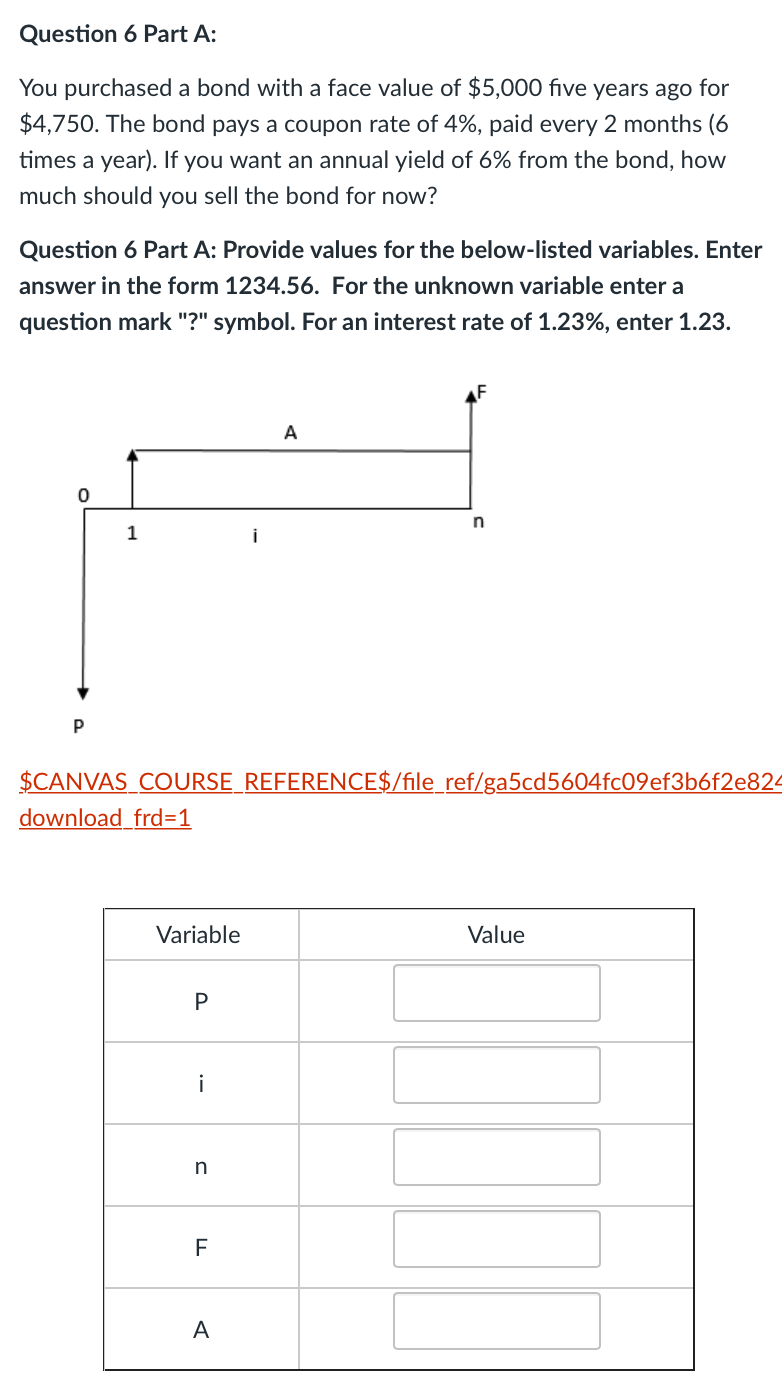

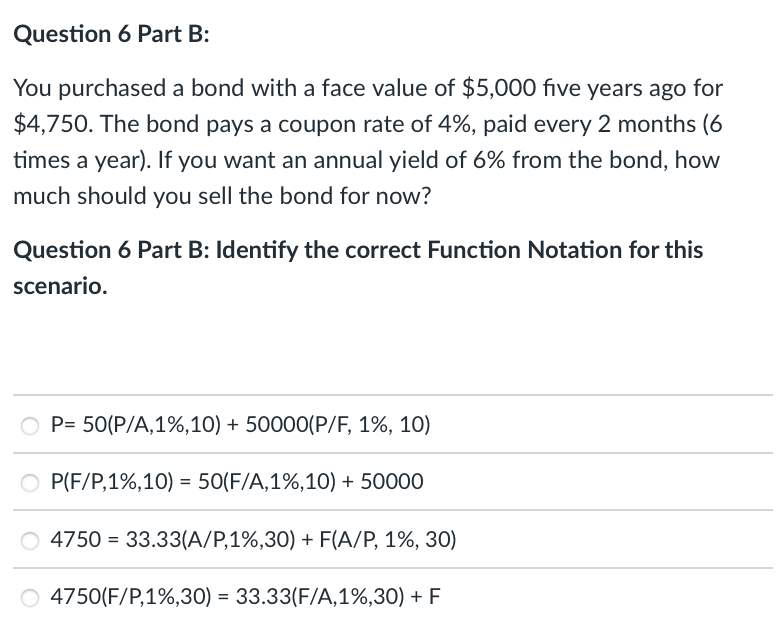

Question 6 Part A: You purchased a bond with a face value of $5,000 five years ago for $4,750. The bond pays a coupon rate of 4%, paid every 2 months (6 times a year). If you want an annual yield of 6% from the bond, how much should you sell the bond for now? Question 6 Part A: Provide values for the below-listed variables. Enter answer in the form 1234.56. For the unknown variable enter a question mark "?" symbol. For an interest rate of 1.23%, enter 1.23. A 0 n 1 P $CANVAS COURSE REFERENCE$/file_ref/ga5cd5604fc09ef3b6f2e824 download frd=1 Variable Value i n F F A Question 6 Part B: You purchased a bond with a face value of $5,000 five years ago for $4,750. The bond pays a coupon rate of 4%, paid every 2 months (6 times a year). If you want an annual yield of 6% from the bond, how much should you sell the bond for now? Question 6 Part B: Identify the correct Function Notation for this scenario. P= 50(P/A,1%,10) + 50000(P/F, 1%, 10) O P(F/P,1%, 10) = 50(F/A,1%, 10) + 50000 4750 = 33.33(A/P,1%,30) + F(A/P, 1%, 30) 4750(F/P,1%,30) = 33.33(F/A,1%,30) + F = Question 6 Part C: You purchased a bond with a face value of $5,000 five years ago for $4,750. The bond pays a coupon rate of 4%, paid every 2 months (6 times a year). If you want an annual yield of 6% from the bond, how much should you sell the bond for now? Question 6 Part C: Provide the selling value of the bond. Enter your answer in the form: 12345.67 Question 6 Part D: You purchased a bond with a face value of $5,000 five years ago for $4,750. The bond pays a coupon rate of 4%, paid every 2 months (6 times a year). If you want an annual yield of 6% from the bond, how much should you sell the bond for now? Question 6 Part D: Provide a statement to your answer to Part D. You must find a buyer willing to pay the amount found in part C You must find a buyer willing to pay the amount found in part C if you wish to make a 6% annual return on investment. You must find a buyer willing to pay the amount found in part C if you wish to make the bond pays a coupon rate of 4% You must find a buyer willing to pay the amount found in part C if you wish to make a 1% annual return on investment