Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 6 Please assist urgently, thank you X C V B 1 N Er M Alt Shift Alt re SUMMATIVE ASSESSMENT (ASSIGNMENT) - 2020 FIRST

Question 6 Please assist urgently, thank you

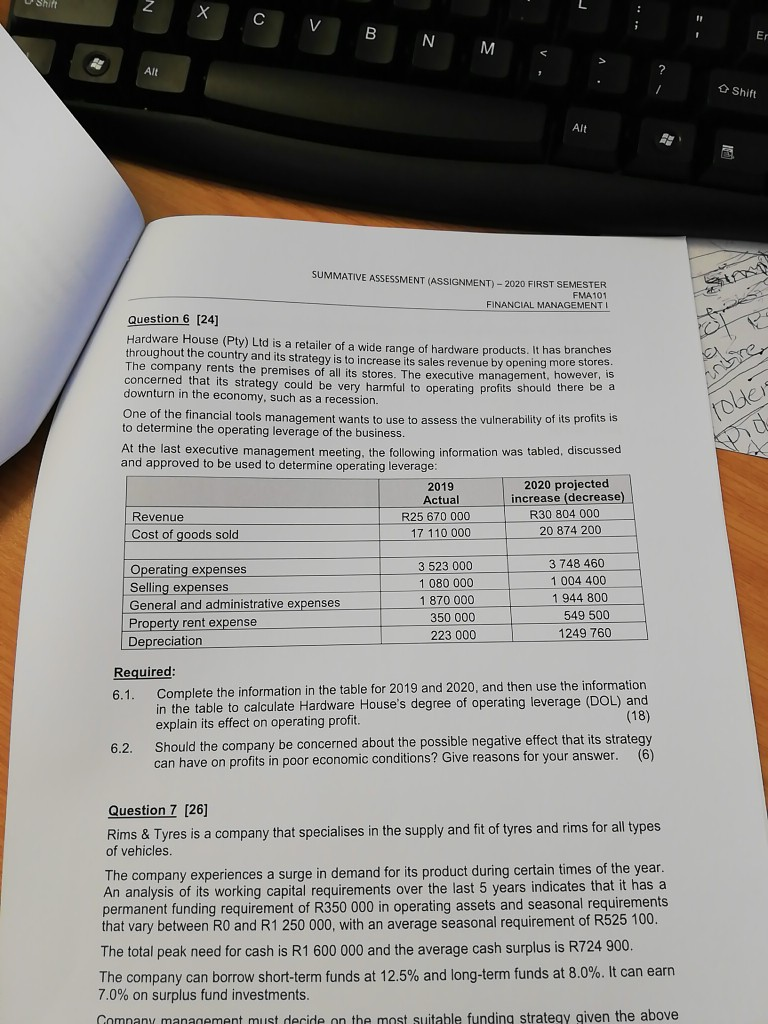

X C V B 1 N Er M Alt Shift Alt re SUMMATIVE ASSESSMENT (ASSIGNMENT) - 2020 FIRST SEMESTER FMA 101 FINANCIAL MANAGEMENT I Question 6 [24] Hardware House (Pty) Ltd is a retailer of a wide range of hardware products. It has branches throughout the country and its strategy is to increase its sales revenue by opening more stores. The company rents the premises of all its stores. The executive management, however, is concerned that its strategy could be very harmful to operating profits should there be a downturn in the economy, such as a recession. One of the financial tools management wants to use to assess the vulnerability of its profits is to determine the operating leverage the business At the last executive management meeting, the following information was tabled, discussed and approved to be used to determine operating leverage: 2019 2020 projected Actual increase (decrease) Revenue R25 670 000 R30 804 000 Cost of goods sold 17 110 000 20 874 200 toller Operating expenses Selling expenses General and administrative expenses Property rent expense Depreciation 3 523 000 1 080 000 1 870 000 350 000 223 000 3 748 460 1 004 400 1 944 800 549 500 1249 760 Required: 6.1. Complete the information in the table for 2019 and 2020, and then use the information in the table to calculate Hardware House's degree of operating leverage (DOL) and explain its effect on operating profit. (18) 6.2. Should the company be concerned about the possible negative effect that its strategy can have on profits in poor economic conditions? Give reasons for your answer. (6) Question 7 [26] Rims & Tyres is a company that specialises in the supply and fit of tyres and rims for all types of vehicles. The company experiences a surge in demand for its product during certain times of the year. An analysis of its working capital requirements over the last 5 years indicates that it has a permanent funding requirement of R350 000 in operating assets and seasonal requirements that vary between RO and R1 250 000, with an average seasonal requirement of R525 100. The total peak need for cash is R1 600 000 and the average cash surplus is R724 900. The company can borrow short-term funds at 12.5% and long-term funds at 8.0%. It can earn 7.0% on surplus fund investments. Company management must decide on the most suitable funding strategy given the above X C V B 1 N Er M Alt Shift Alt re SUMMATIVE ASSESSMENT (ASSIGNMENT) - 2020 FIRST SEMESTER FMA 101 FINANCIAL MANAGEMENT I Question 6 [24] Hardware House (Pty) Ltd is a retailer of a wide range of hardware products. It has branches throughout the country and its strategy is to increase its sales revenue by opening more stores. The company rents the premises of all its stores. The executive management, however, is concerned that its strategy could be very harmful to operating profits should there be a downturn in the economy, such as a recession. One of the financial tools management wants to use to assess the vulnerability of its profits is to determine the operating leverage the business At the last executive management meeting, the following information was tabled, discussed and approved to be used to determine operating leverage: 2019 2020 projected Actual increase (decrease) Revenue R25 670 000 R30 804 000 Cost of goods sold 17 110 000 20 874 200 toller Operating expenses Selling expenses General and administrative expenses Property rent expense Depreciation 3 523 000 1 080 000 1 870 000 350 000 223 000 3 748 460 1 004 400 1 944 800 549 500 1249 760 Required: 6.1. Complete the information in the table for 2019 and 2020, and then use the information in the table to calculate Hardware House's degree of operating leverage (DOL) and explain its effect on operating profit. (18) 6.2. Should the company be concerned about the possible negative effect that its strategy can have on profits in poor economic conditions? Give reasons for your answer. (6) Question 7 [26] Rims & Tyres is a company that specialises in the supply and fit of tyres and rims for all types of vehicles. The company experiences a surge in demand for its product during certain times of the year. An analysis of its working capital requirements over the last 5 years indicates that it has a permanent funding requirement of R350 000 in operating assets and seasonal requirements that vary between RO and R1 250 000, with an average seasonal requirement of R525 100. The total peak need for cash is R1 600 000 and the average cash surplus is R724 900. The company can borrow short-term funds at 12.5% and long-term funds at 8.0%. It can earn 7.0% on surplus fund investments. Company management must decide on the most suitable funding strategy given the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started