Answered step by step

Verified Expert Solution

Question

1 Approved Answer

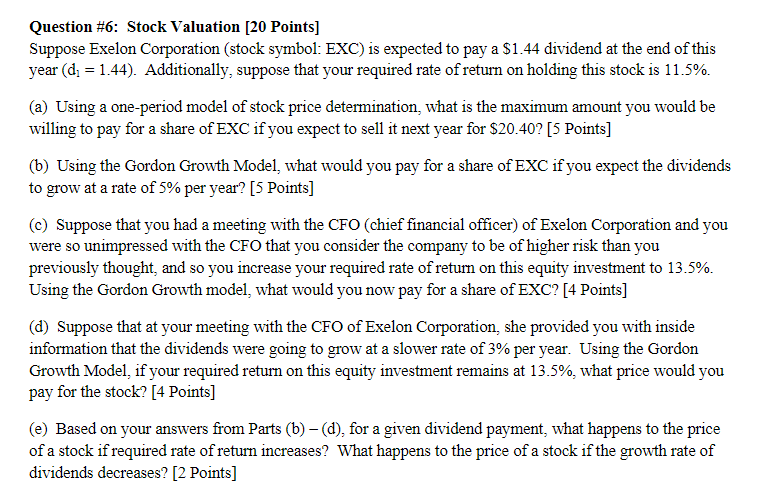

Question # 6 : Stock Valuation [ 2 0 Points ] Suppose Exelon Corporation ( stock symbol: EXC ) is expected to pay a $

Question #: Stock Valuation Points

Suppose Exelon Corporation stock symbol: EXC is expected to pay a $ dividend at the end of this

year Additionally, suppose that your required rate of return on holding this stock is

a Using a oneperiod model of stock price determination, what is the maximum amount you would be

willing to pay for a share of EXC if you expect to sell it next year for $ Points

b Using the Gordon Growth Model, what would you pay for a share of EXC if you expect the dividends

to grow at a rate of per year? Points

c Suppose that you had a meeting with the CFO chief financial officer of Exelon Corporation and you

were so unimpressed with the CFO that you consider the company to be of higher risk than you

previously thought, and so you increase your required rate of return on this equity investment to

Using the Gordon Growth model, what would you now pay for a share of EXC? Points

d Suppose that at your meeting with the CFO of Exelon Corporation, she provided you with inside

information that the dividends were going to grow at a slower rate of per year. Using the Gordon

Growth Model, if your required return on this equity investment remains at what price would you

pay for the stock? Points

e Based on your answers from Parts bd for a given dividend payment, what happens to the price

of a stock if required rate of return increases? What happens to the price of a stock if the growth rate of

dividends decreases? Points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started