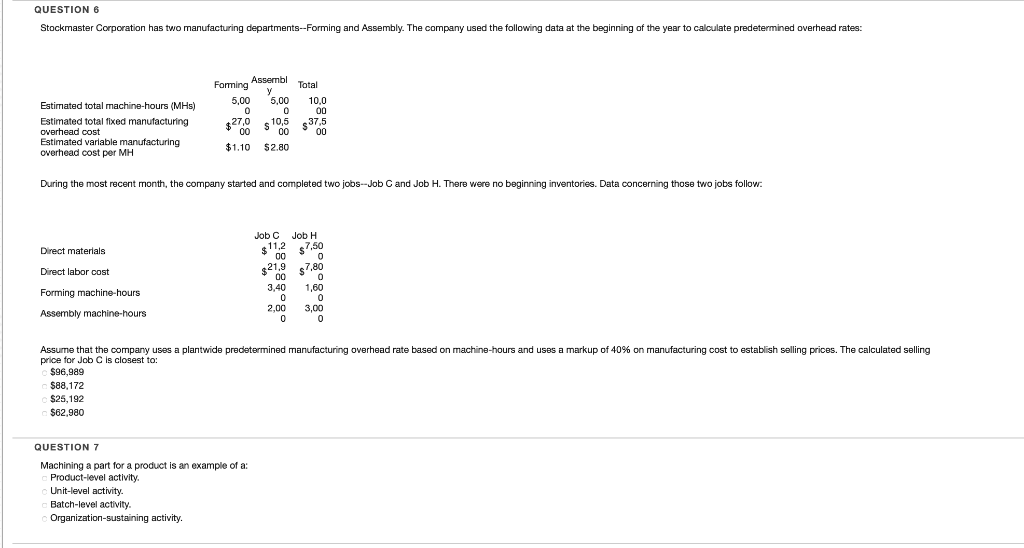

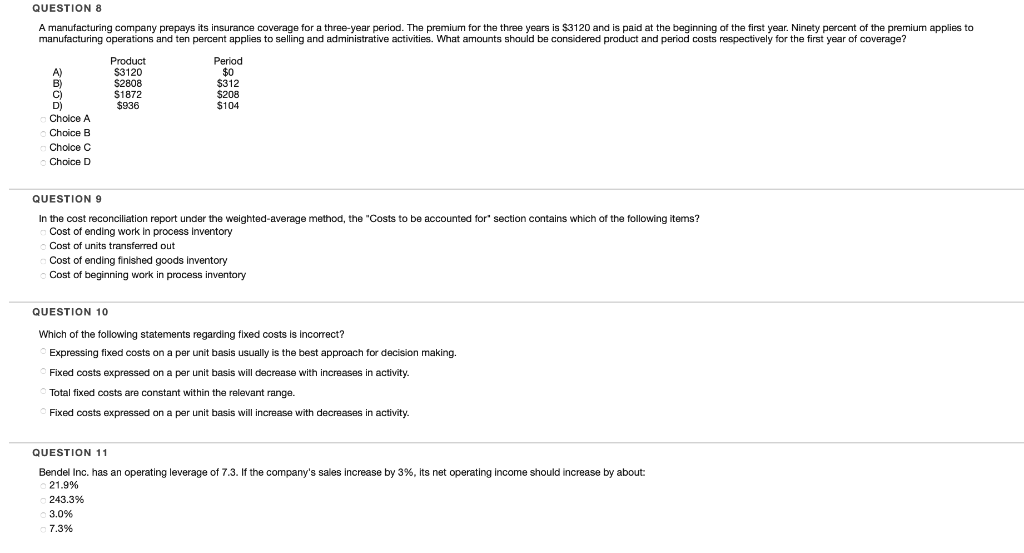

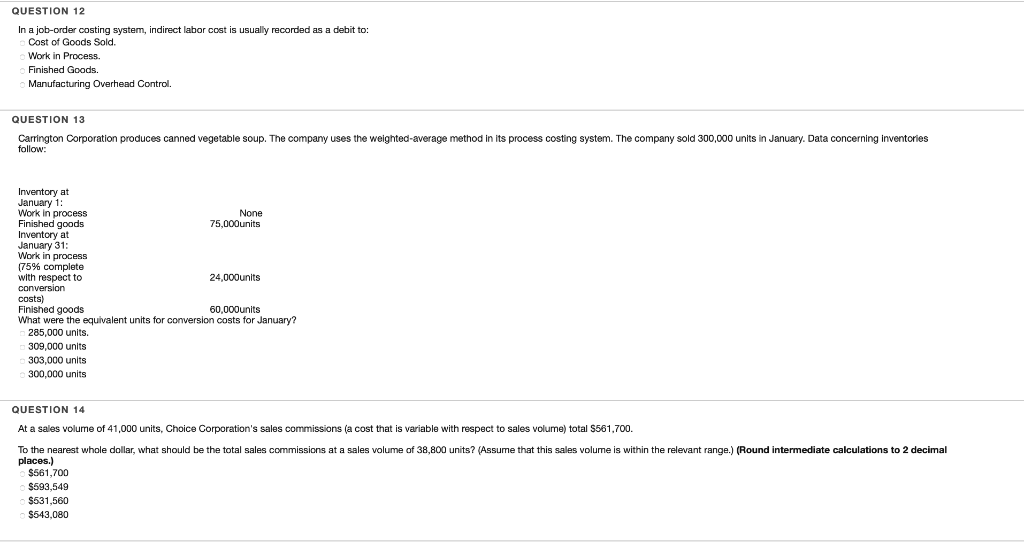

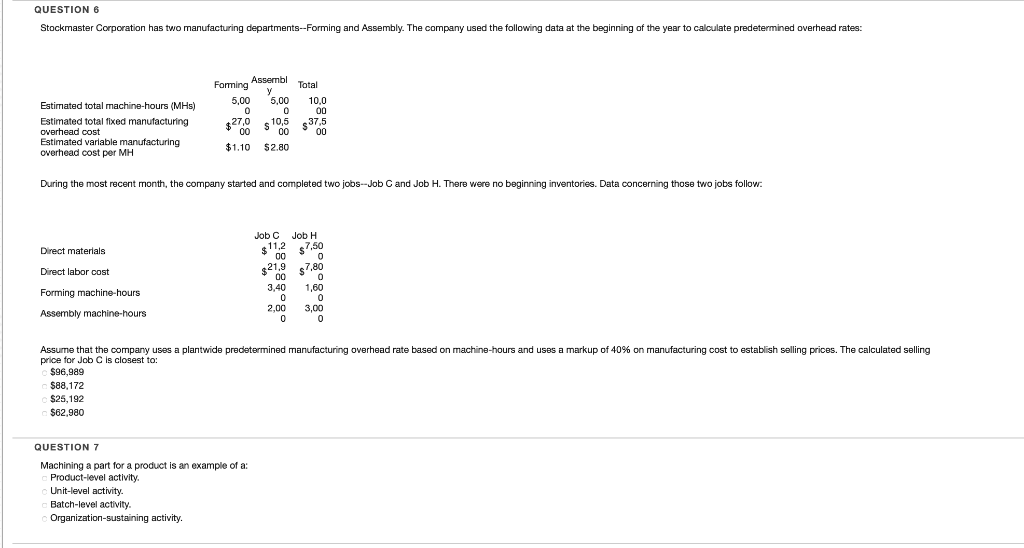

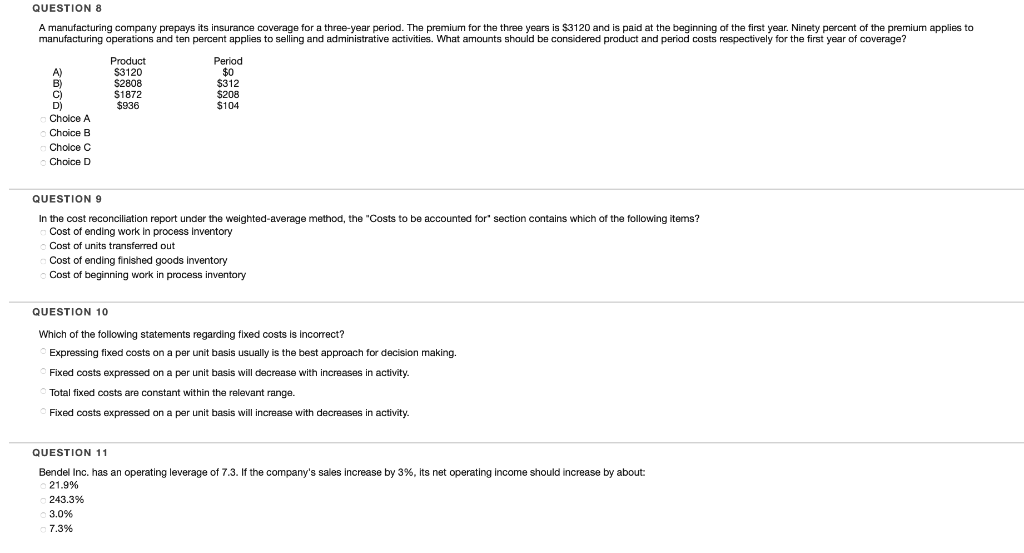

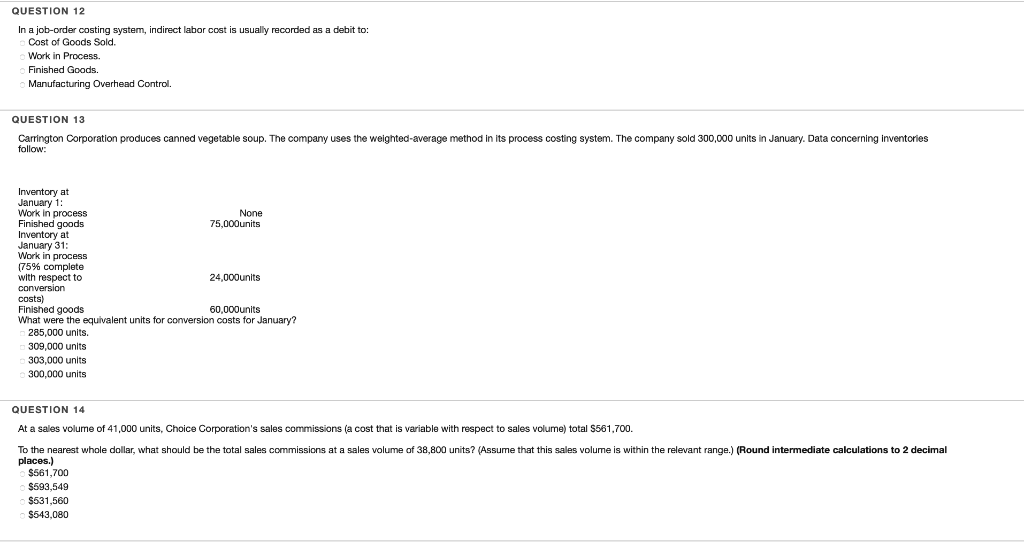

QUESTION 6 Stockmaster Corporation has two manufacturing departments--Forming and Assembly. The company used the following data at the beginning of the year to calculate predetermined overhead rates: Forming Assembl 5,00 5,00 10,0 Estimated total machine-hours (MHs) Estimated total fixed manufacturing overhead cost Estimated varlable manufacturing overhead cost per MH 27,0 10,5 37,5 $1.10 2.80 During the most recent month, the company started and completed two jobs-Job C and Job H. There were no beginning inventories. Data concerning those two jobs follow JobC Job H Direct materials Direct labor cost Forming machine-hours e11,2 7,50 21,9 7,80 3,40 1,60 2,00 3,00 Assume that the company uses a plantwide predetermined price for Job C is closest to: anufacturing overhead rate based on machine hours and uses a markup of 40% on manufacturing cost to establish selling prices. The calculated selling S96,989 $88,172 $25,192 $62,980 QUESTION 7 Machining a part for a product is an example of a: Product-level activity. Unit-level activity. Batch-level activity. Organization-sustaining activity. QUESTION 8 A manufacturing company prepays its insurance coverage for a three-year period. The premium for the three years is $3120 and is paid at the beginning of the first year. Ninety percent of the premium applies to manufacturing operations and ten percent applies to selling and administrative activities. What amounts should be considered praduct and periad costs respectively for the first year of coverage? Product S3120 S2808 S1872 $936 Period $0 $312 $208 $104 A) B) C) D) Choice A Choice B Cholce C Choice D QUESTION 9 In the cost reconciliation report under the weighted-average method, the "Costs to be accounted for" section contains which of the following items? Cost of ending work in process inventory Cost of units transferred out Cost of ending finished goods inventory Cost of beginning work in process inventory QUESTION 10 Which of the following statements regarding fixed costs is incorrect? Expressing fixed costs on a per unit basis usually is the best approach for decision making. Fixed costs expressed on a par unit basis will decrease with increases in activity Total fixed costs are constant within the relevant range. Fixed costs expressed on a par unit basis will increase with decreases in activity QUESTION 11 Bendel Inc. has an operating leverage of 7.3. If the company's sales increase by 3%, its net operating income should increase by about 21.9% 243.3% 3.0% 7.3% QUESTION 12 In a job-order costing system, indirect labor cost is usually recorded as a debit to: Cost of Goods Sold. Work in Process. Finished Goods Manufacturing Overhead Control. QUESTION 13 Carrington Corporation produces canned vegetable soup. The company uses the weighted-average method in its process costing system. The company sold 300,000 units in January. Data concerning inventories follow: Inventory at January 1: Work in process Finished goods Inventory at January 31: Work in process (75% complete with respect to None 75,000units costs) Finished goods What were the equivalent units for conversion costs for January? 60,000units 285,000 units. 309,000 units 303,000 units 300,000 units QUESTION 14 At a sales volume of 41,000 units, Choice Corporation's sales commissions (a cost that is variable with respect to sales volume) total S561,700. To the nearest whole dollar, what should be the total sales commissions at a sales volume of 38,800 units? (Assume that this sales volume is within the relevant range.) (Round intermediate calculations to 2 decimal places.) S561,700 $593,549 $531,560 $543,080