Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question #6 Suppose your property is expected to generate the net operating income of $80,000. You currently have a $700,000, 25-year, fully-amortizing, 7% mortgage loan.

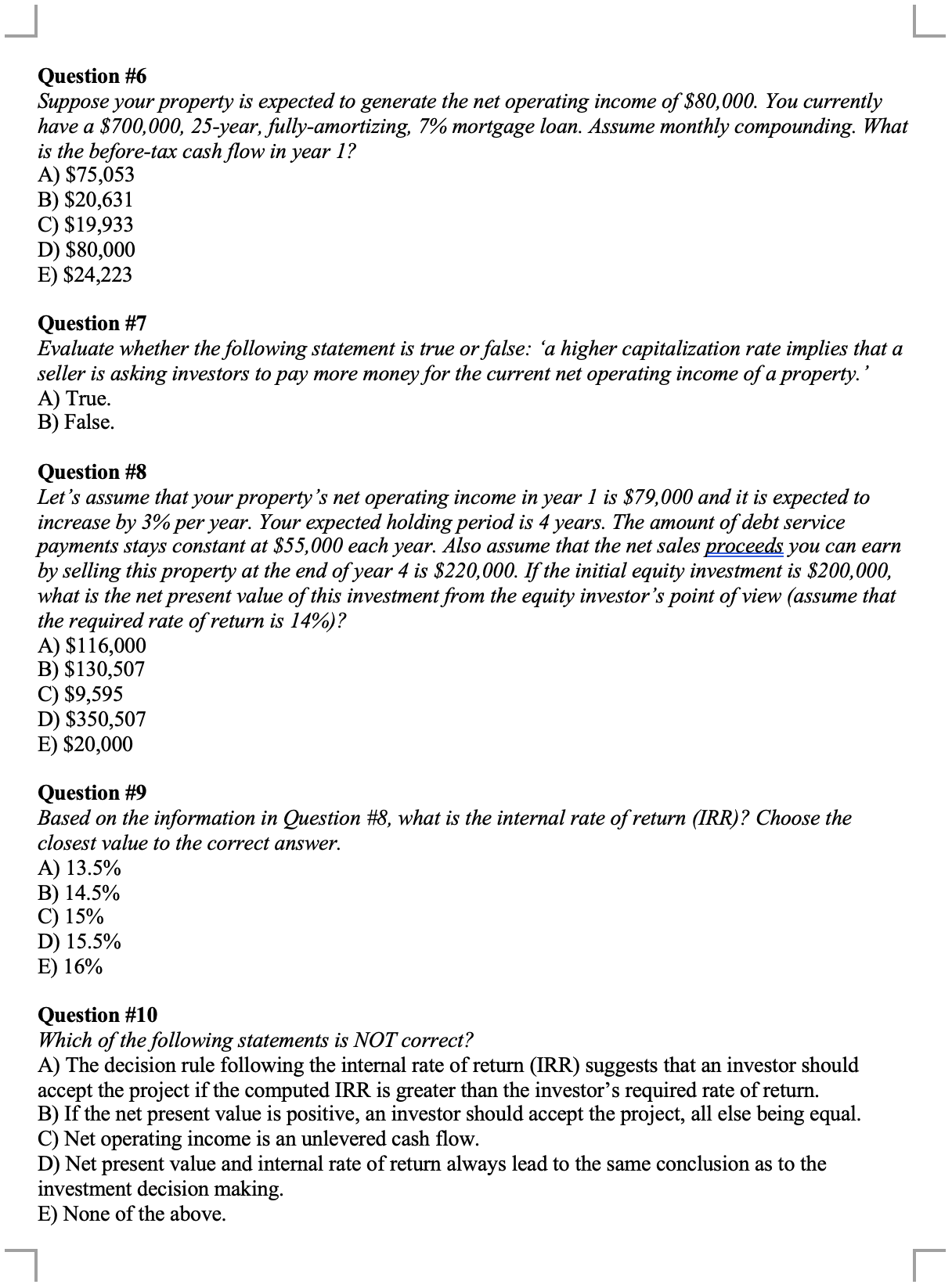

Question \#6 Suppose your property is expected to generate the net operating income of $80,000. You currently have a \$700,000, 25-year, fully-amortizing, 7\% mortgage loan. Assume monthly compounding. What is the before-tax cash flow in year 1 ? A) $75,053 B) $20,631 C) $19,933 D) $80,000 E) $24,223 Question \#7 Evaluate whether the following statement is true or false: 'a higher capitalization rate implies that a seller is asking investors to pay more money for the current net operating income of a property.' A) True. B) False. Question \#8 Let's assume that your property's net operating income in year 1 is $79,000 and it is expected to increase by 3\% per year. Your expected holding period is 4 years. The amount of debt service payments stays constant at $55,000 each year. Also assume that the net sales proceeds you can earn by selling this property at the end of year 4 is $220,000. If the initial equity investment is $200,000, what is the net present value of this investment from the equity investor's point of view (assume that the required rate of return is 14%) ? A) $116,000 B) $130,507 C) $9,595 D) $350,507 E) $20,000 Question \#9 Based on the information in Question \#8, what is the internal rate of return (IRR)? Choose the closest value to the correct answer. A) 13.5% B) 14.5% C) 15% D) 15.5% E) 16% Question \#10 Which of the following statements is NOT correct? A) The decision rule following the internal rate of return (IRR) suggests that an investor should accept the project if the computed IRR is greater than the investor's required rate of return. B) If the net present value is positive, an investor should accept the project, all else being equal. C) Net operating income is an unlevered cash flow. D) Net present value and internal rate of return always lead to the same conclusion as to the investment decision making. E) None of the above

Question \#6 Suppose your property is expected to generate the net operating income of $80,000. You currently have a \$700,000, 25-year, fully-amortizing, 7\% mortgage loan. Assume monthly compounding. What is the before-tax cash flow in year 1 ? A) $75,053 B) $20,631 C) $19,933 D) $80,000 E) $24,223 Question \#7 Evaluate whether the following statement is true or false: 'a higher capitalization rate implies that a seller is asking investors to pay more money for the current net operating income of a property.' A) True. B) False. Question \#8 Let's assume that your property's net operating income in year 1 is $79,000 and it is expected to increase by 3\% per year. Your expected holding period is 4 years. The amount of debt service payments stays constant at $55,000 each year. Also assume that the net sales proceeds you can earn by selling this property at the end of year 4 is $220,000. If the initial equity investment is $200,000, what is the net present value of this investment from the equity investor's point of view (assume that the required rate of return is 14%) ? A) $116,000 B) $130,507 C) $9,595 D) $350,507 E) $20,000 Question \#9 Based on the information in Question \#8, what is the internal rate of return (IRR)? Choose the closest value to the correct answer. A) 13.5% B) 14.5% C) 15% D) 15.5% E) 16% Question \#10 Which of the following statements is NOT correct? A) The decision rule following the internal rate of return (IRR) suggests that an investor should accept the project if the computed IRR is greater than the investor's required rate of return. B) If the net present value is positive, an investor should accept the project, all else being equal. C) Net operating income is an unlevered cash flow. D) Net present value and internal rate of return always lead to the same conclusion as to the investment decision making. E) None of the above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started