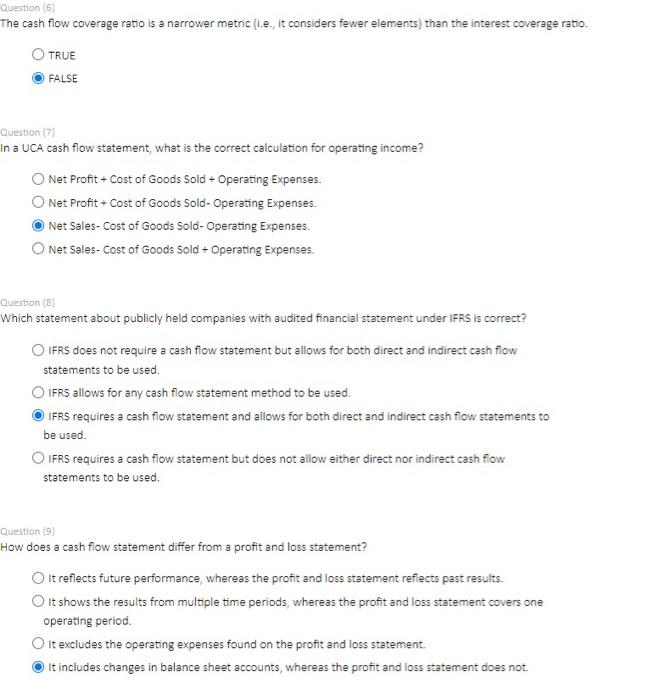

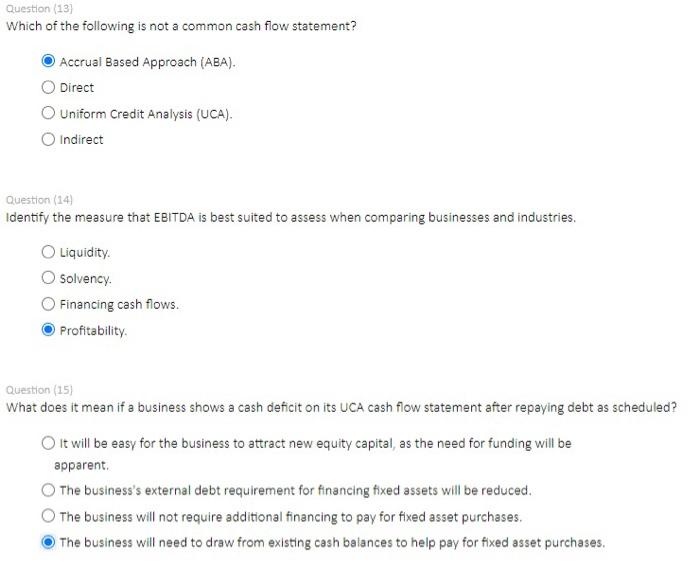

Question (6) The cash flow coverage ratio is a narrower metric (i.e., it considers fewer elements) than the interest coverage ratio. TRUE FALSE In a UCA cash flow statement, what is the correct calculation for operating income? Net Profit + Cost of Goods Sold + Operating Expenses. Net Profit + Cost of Goods Sold- Operating Expenses. Net Sales- Cost of Goods Sold- Operating Expenses. Net Sales- Cost of Goods Sold + Operating Expenses. Question (8) Which statement about publicly held companies with audited financial statement under IFRS is correct? IFRS does not require a cash flow statement but allows for both direct and indirect cash flow statements to be used. IFRS allows for any cash flow statement method to be used. IFRS requires a cash flow statement and allows for both direct and indirect cash flow statements to be used. IFRS requires a cash flow statement but does not allow either direct nor indirect cash flow statements to be used. Question (9) How does a cash flow statement differ from a profit and loss statement? It reflects future performance, whereas the profit and loss statement reflects past results. It shows the results from multiple time periods, whereas the profit and loss statement covers one operating period. It excludes the operating expenses found on the profit and loss statement. It includes changes in balance sheet accounts, whereas the profit and loss statement does not. Question (13) Which of the following is not a common cash flow statement? Accrual Based Approach (ABA). Direct Uniform Credit Analysis (UCA). Indirect Question (14) Identify the measure that EBITDA is best suited to assess when comparing businesses and industries. Liquidity. Solvency. Financing cash flows. Profitability. Question (15) What does it mean if a business shows a cash deficit on its UCA cash flow statement after repaying debt as scheduled? It will be easy for the business to attract new equity capital, as the need for funding will be apparent. The business's external debt requirement for financing fixed assets will be reduced. The business will not require additional financing to pay for fixed asset purchases. The business will need to draw from existing cash balances to help pay for fixed asset purchases