Answered step by step

Verified Expert Solution

Question

1 Approved Answer

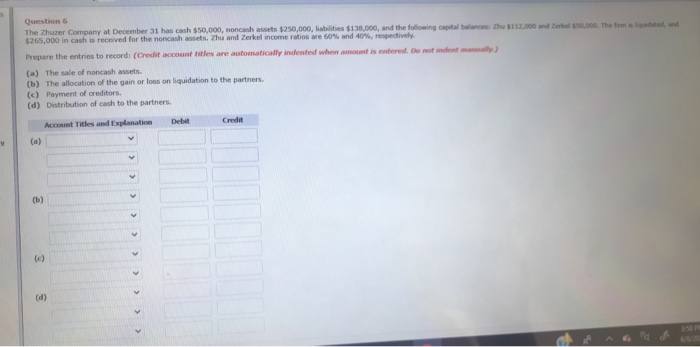

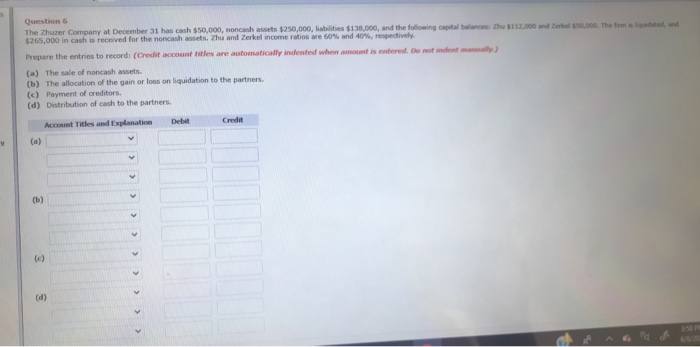

Question 6 The Zhurer Company at December 31 has cash $50,000, noncash assets $250,000, liabilities $130,000, and the following capital balances $112.000 and 150,000. The

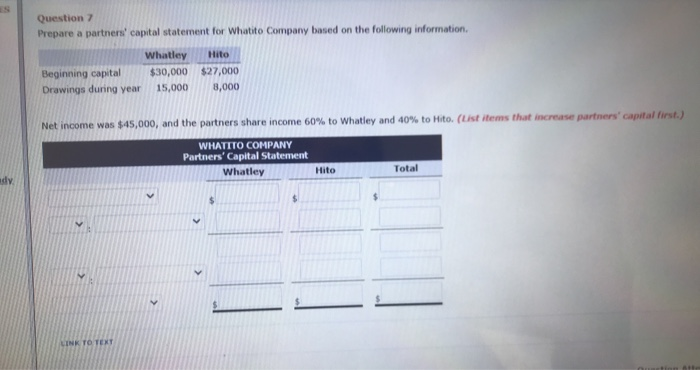

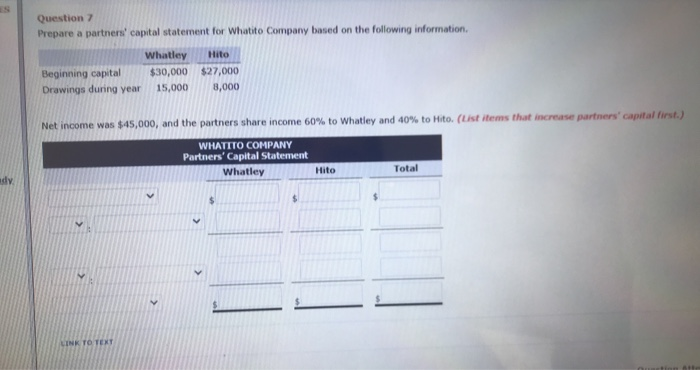

Question 6 The Zhurer Company at December 31 has cash $50,000, noncash assets $250,000, liabilities $130,000, and the following capital balances $112.000 and 150,000. The firm bed and $265,000 in cash is received for the noncash assets. Zhu and Zerkel income ratios we 60% and 40%, respectively Prepare the entries to records (Credit account titles are automatically indented when amount is entered. Do not identy (a) The sale of noncash assets. (b) The allocation of the gain or loss on liquidation to the partners (c) Payment of creditors (d) Distribution of cash to the partners. De Credit Account Titles and Explanation (a) (6) (0) (d) Question 7 Prepare a partners' capital statement for whatito Company based on the following information Whatley Beginning capital $30,000 Drawings during year 15,000 Hito $27,000 8,000 Net income was $45,000, and the partners share income 60% to Whatley and 40% to Hito. (List items that increase partners' capital first.) WHATITO COMPANY Partners' Capital Statement Whatley Hito Total dy LINK TO TEXT

Question 6 The Zhurer Company at December 31 has cash $50,000, noncash assets $250,000, liabilities $130,000, and the following capital balances $112.000 and 150,000. The firm bed and $265,000 in cash is received for the noncash assets. Zhu and Zerkel income ratios we 60% and 40%, respectively Prepare the entries to records (Credit account titles are automatically indented when amount is entered. Do not identy (a) The sale of noncash assets. (b) The allocation of the gain or loss on liquidation to the partners (c) Payment of creditors (d) Distribution of cash to the partners. De Credit Account Titles and Explanation (a) (6) (0) (d) Question 7 Prepare a partners' capital statement for whatito Company based on the following information Whatley Beginning capital $30,000 Drawings during year 15,000 Hito $27,000 8,000 Net income was $45,000, and the partners share income 60% to Whatley and 40% to Hito. (List items that increase partners' capital first.) WHATITO COMPANY Partners' Capital Statement Whatley Hito Total dy LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started