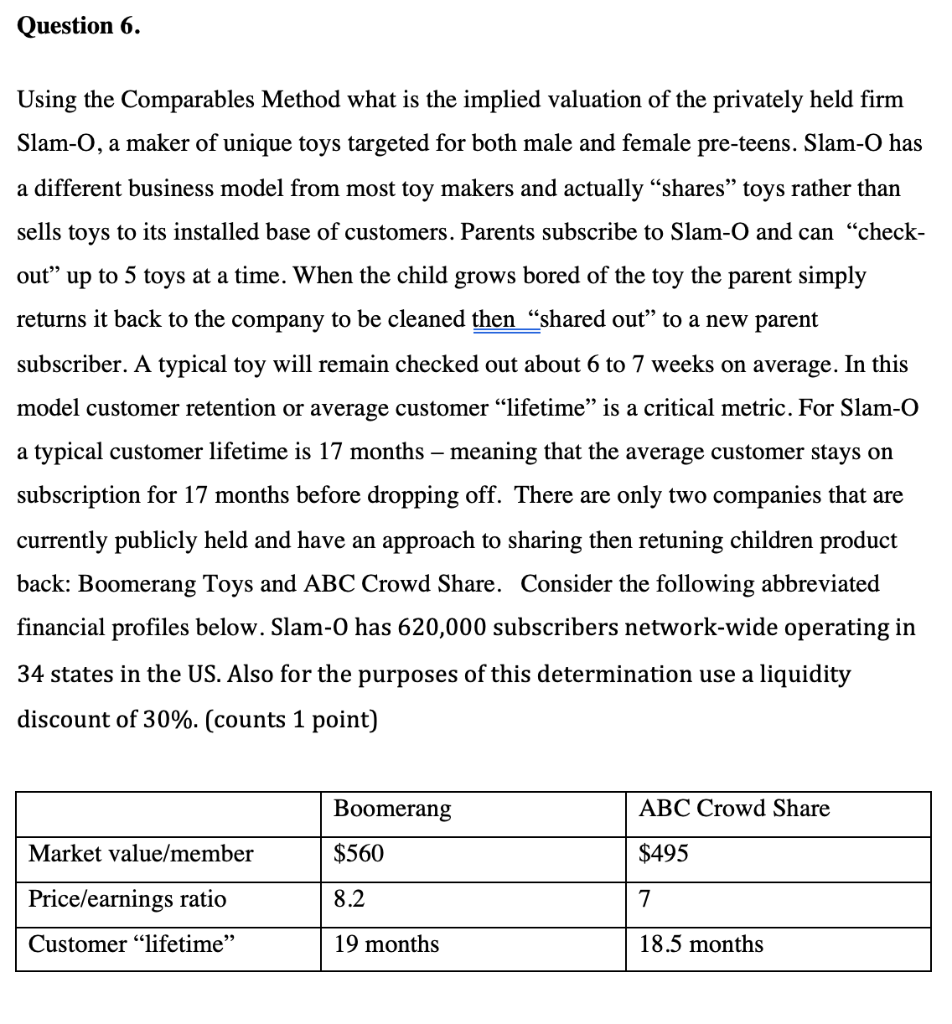

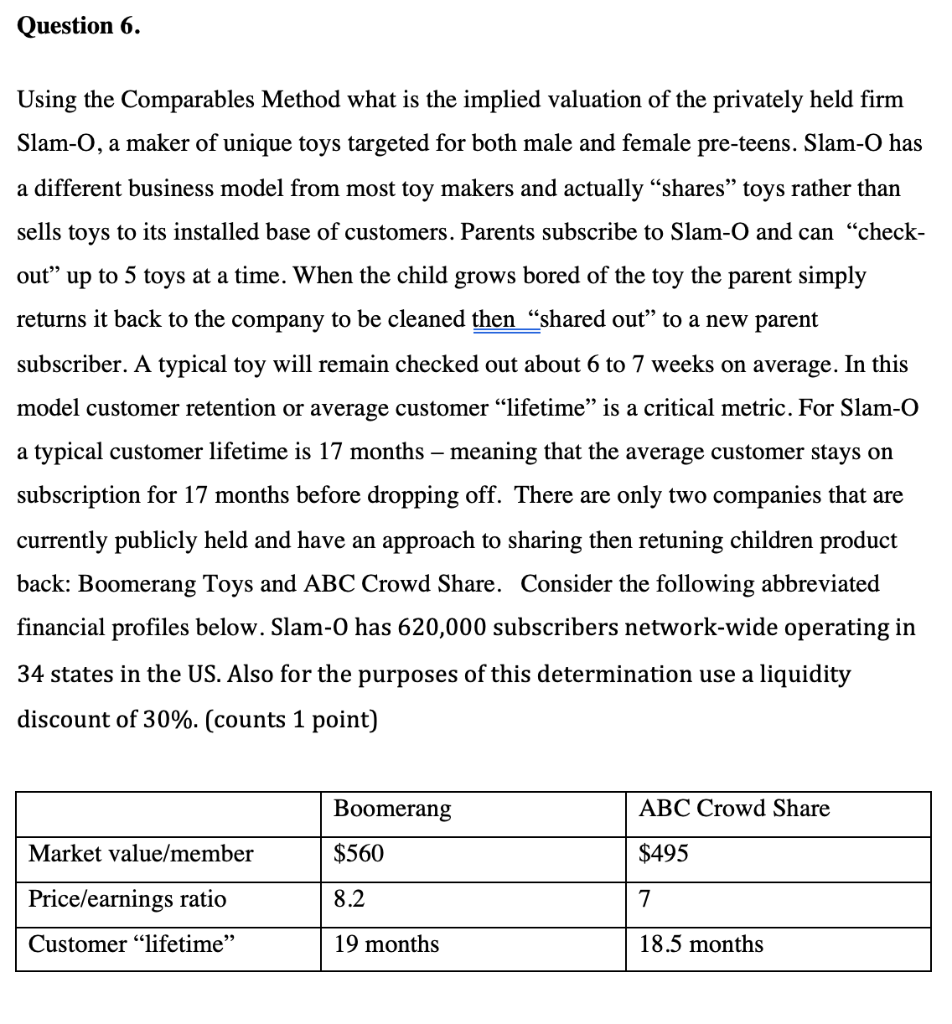

Question 6. Using the Comparables Method what is the implied valuation of the privately held firm Slam-O, a maker of unique toys targeted for both male and female pre-teens. Slam-O has a different business model from most toy makers and actually shares toys rather than sells toys to its installed base of customers. Parents subscribe to Slam-O and can check- out up to 5 toys at a time. When the child grows bored of the toy the parent simply returns it back to the company to be cleaned then shared out to a new parent subscriber. A typical toy will remain checked out about 6 to 7 weeks on average. In this model customer retention or average customer lifetime is a critical metric. For Slam-0 a typical customer lifetime is 17 months meaning that the average customer stays on subscription for 17 months before dropping off. There are only two companies that are currently publicly held and have an approach to sharing then retuning children product back: Boomerang Toys and ABC Crowd Share. Consider the following abbreviated financial profiles below. Slam-O has 620,000 subscribers network-wide operating in 34 states in the US. Also for the purposes of this determination use a liquidity discount of 30%. (counts 1 point) Boomerang ABC Crowd Share Market value/member $560 $495 Price/earnings ratio 8.2 Customer lifetime 19 months 18.5 months Question 6. Using the Comparables Method what is the implied valuation of the privately held firm Slam-O, a maker of unique toys targeted for both male and female pre-teens. Slam-O has a different business model from most toy makers and actually shares toys rather than sells toys to its installed base of customers. Parents subscribe to Slam-O and can check- out up to 5 toys at a time. When the child grows bored of the toy the parent simply returns it back to the company to be cleaned then shared out to a new parent subscriber. A typical toy will remain checked out about 6 to 7 weeks on average. In this model customer retention or average customer lifetime is a critical metric. For Slam-0 a typical customer lifetime is 17 months meaning that the average customer stays on subscription for 17 months before dropping off. There are only two companies that are currently publicly held and have an approach to sharing then retuning children product back: Boomerang Toys and ABC Crowd Share. Consider the following abbreviated financial profiles below. Slam-O has 620,000 subscribers network-wide operating in 34 states in the US. Also for the purposes of this determination use a liquidity discount of 30%. (counts 1 point) Boomerang ABC Crowd Share Market value/member $560 $495 Price/earnings ratio 8.2 Customer lifetime 19 months 18.5 months