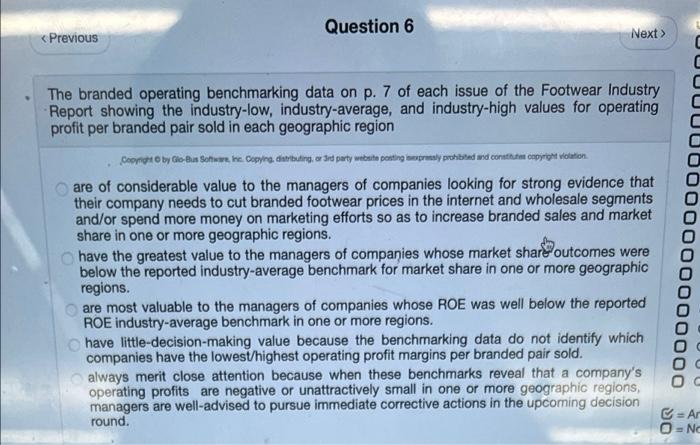

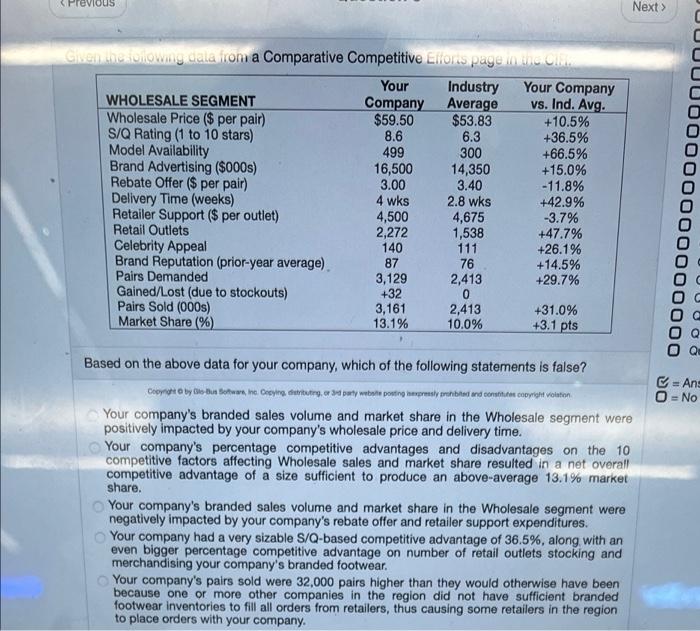

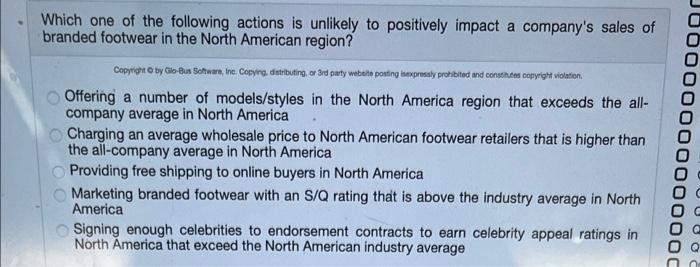

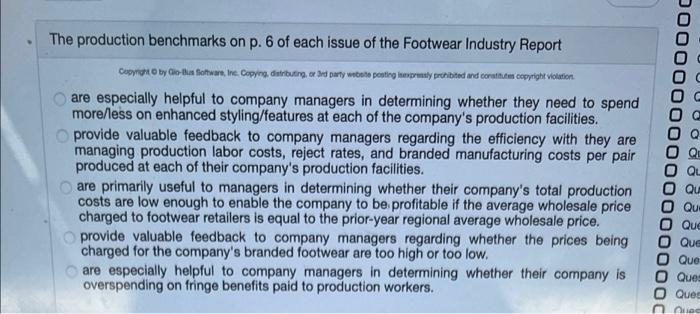

Question 6 UUU The branded operating benchmarking data on p. 7 of each issue of the Footwear Industry Report showing the industry-low, industry-average, and industry-high values for operating profit per branded pair sold in each geographic region Coomoto by Gio Bas Sow, Inc. Copying, darbuting, or 3rd party website penting reply prohibited and constant opyright violation are of considerable value to the managers of companies looking for strong evidence that their company needs to cut branded footwear prices in the internet and wholesale segments and/or spend more money on marketing efforts so as to increase branded sales and market share in one or more geographic regions. have the greatest value to the managers of companies whose market share outcomes were below the reported industry-average benchmark for market share in one or more geographic regions. are most valuable to the managers of companies whose ROE was well below the reported ROE industry-average benchmark in one or more regions. have little-decision-making value because the benchmarking data do not identify which companies have the lowest/highest operating profit margins per branded pair sold. always merit close attention because when these benchmarks reveal that a company's operating profits are negative or unattractively small in one or more geographic regions, managers are well-advised to pursue immediate corrective actions in the upcoming decision round. 000000 = Ar =Nc If a company spends $20 million to install new footwear-making equipment with capacity to produce 1 million pairs of athletic footwear at its North American production facility, then its annual depreciation costs at that facility will rise by Copyright by Glo-Bun Softwwe, Inc. Copying, distributing, or Sud pety wetere pesting expressly prohibited and continues copyright violation 4% or $800,000 10% or $2,000,000 15% or $3,000,000 8% or $1,600,000 5% or $1,000,000 JUUUUOOC Previous Next > C Clienthelowing delle from a Comparative Competitive Efforis page who Your Industry Your Company WHOLESALE SEGMENT Company Average vs. Ind. Avg. Wholesale Price ($ per pair) $59.50 $53.83 +10.5% S/Q Rating (1 to 10 stars) 8.6 6.3 +36.5% Model Availability 499 300 +66.5% Brand Advertising ($000s) 16,500 14,350 +15.0% Rebate Offer ($ per pair) 3.00 3.40 -11.8% Delivery Time (weeks) 4 wks 2.8 wks +42.9% Retailer Support ($ per outlet) 4,500 4,675 -3.7% Retail Outlets 2,272 1,538 +47.7% Celebrity Appeal 140 111 +26.1% Brand Reputation (prior-year average). 87 76 +14.5% Pairs Demanded 3,129 2,413 +29.7% Gained/Lost (due to stockouts) +32 Pairs Sold (000) 3,161 2,413 +31.0% Market Share (%) 13.1% 10.0% 00000000 +3.1 pts Oo Based on the above data for your company, which of the following statements is false? = Ang 0 = No Copyright by Bus Bows, Inc. Deying during 3d party website posting sy band constituts convolution Your company's branded sales volume and market share in the Wholesale segment were positively impacted by your company's wholesale price and delivery time. Your company's percentage competitive advantages and disadvantages on the 10 competitive factors affecting Wholesale sales and market share resulted in a net overall competitive advantage of a size sufficient to produce an above-average 13.1% market share. Your company's branded sales volume and market share in the Wholesale segment were negatively impacted by your company's rebate offer and retailer support expenditures. Your company had a very sizable S/Q-based competitive advantage of 36.5%, along with an even bigger percentage competitive advantage on number of retail outlets stocking and merchandising your company's branded footwear. Your company's pairs sold were 32,000 pairs higher than they would otherwise have been because one or more other companies in the region did not have sufficient branded footwear inventories to fill all orders from retailers, thus causing some retailers in the region to place orders with your company. Which one of the following actions is unlikely to positively impact a company's sales of branded footwear in the North American region? Copyright by Glo-Bus Software Int. Copying distributing, or 3rd party weberte porting expressly prohibited and contes copyright violation Offering a number of models/styles in the North America region that exceeds the all- company average in North America Charging an average wholesale price to North American footwear retailers that is higher than the all-company average in North America Providing free shipping to online buyers in North America Marketing branded footwear with an S/Q rating that is above the industry average in North America Signing enough celebrities to endorsement contracts to earn celebrity appeal ratings in North America that exceed the North American industry average 00000000 The production benchmarks on p. 6 of each issue of the Footwear Industry Report Copyright by Gio-lus Software, Inc. Copying, distributing, or rd party website posting by prohibited and consum copyright violation are especially helpful to company managers in determining whether they need to spend more/less on enhanced styling/features at each of the company's production facilities. provide valuable feedback to company managers regarding the efficiency with they are managing production labor costs, reject rates, and branded manufacturing costs per pair produced at each of their company's production facilities. are primarily useful to managers in determining whether their company's total production costs are low enough to enable the company to be profitable if the average wholesale price charged to footwear retailers is equal to the prior-year regional average wholesale price. provide valuable feedback to company managers regarding whether the prices being charged for the company's branded footwear are too high or too low. are especially helpful to company managers in determining whether their company is overspending on fringe benefits paid to production workers. Q QU 0 Qu: Que O Que Que O Ques Ques Question 6 UUU The branded operating benchmarking data on p. 7 of each issue of the Footwear Industry Report showing the industry-low, industry-average, and industry-high values for operating profit per branded pair sold in each geographic region Coomoto by Gio Bas Sow, Inc. Copying, darbuting, or 3rd party website penting reply prohibited and constant opyright violation are of considerable value to the managers of companies looking for strong evidence that their company needs to cut branded footwear prices in the internet and wholesale segments and/or spend more money on marketing efforts so as to increase branded sales and market share in one or more geographic regions. have the greatest value to the managers of companies whose market share outcomes were below the reported industry-average benchmark for market share in one or more geographic regions. are most valuable to the managers of companies whose ROE was well below the reported ROE industry-average benchmark in one or more regions. have little-decision-making value because the benchmarking data do not identify which companies have the lowest/highest operating profit margins per branded pair sold. always merit close attention because when these benchmarks reveal that a company's operating profits are negative or unattractively small in one or more geographic regions, managers are well-advised to pursue immediate corrective actions in the upcoming decision round. 000000 = Ar =Nc If a company spends $20 million to install new footwear-making equipment with capacity to produce 1 million pairs of athletic footwear at its North American production facility, then its annual depreciation costs at that facility will rise by Copyright by Glo-Bun Softwwe, Inc. Copying, distributing, or Sud pety wetere pesting expressly prohibited and continues copyright violation 4% or $800,000 10% or $2,000,000 15% or $3,000,000 8% or $1,600,000 5% or $1,000,000 JUUUUOOC Previous Next > C Clienthelowing delle from a Comparative Competitive Efforis page who Your Industry Your Company WHOLESALE SEGMENT Company Average vs. Ind. Avg. Wholesale Price ($ per pair) $59.50 $53.83 +10.5% S/Q Rating (1 to 10 stars) 8.6 6.3 +36.5% Model Availability 499 300 +66.5% Brand Advertising ($000s) 16,500 14,350 +15.0% Rebate Offer ($ per pair) 3.00 3.40 -11.8% Delivery Time (weeks) 4 wks 2.8 wks +42.9% Retailer Support ($ per outlet) 4,500 4,675 -3.7% Retail Outlets 2,272 1,538 +47.7% Celebrity Appeal 140 111 +26.1% Brand Reputation (prior-year average). 87 76 +14.5% Pairs Demanded 3,129 2,413 +29.7% Gained/Lost (due to stockouts) +32 Pairs Sold (000) 3,161 2,413 +31.0% Market Share (%) 13.1% 10.0% 00000000 +3.1 pts Oo Based on the above data for your company, which of the following statements is false? = Ang 0 = No Copyright by Bus Bows, Inc. Deying during 3d party website posting sy band constituts convolution Your company's branded sales volume and market share in the Wholesale segment were positively impacted by your company's wholesale price and delivery time. Your company's percentage competitive advantages and disadvantages on the 10 competitive factors affecting Wholesale sales and market share resulted in a net overall competitive advantage of a size sufficient to produce an above-average 13.1% market share. Your company's branded sales volume and market share in the Wholesale segment were negatively impacted by your company's rebate offer and retailer support expenditures. Your company had a very sizable S/Q-based competitive advantage of 36.5%, along with an even bigger percentage competitive advantage on number of retail outlets stocking and merchandising your company's branded footwear. Your company's pairs sold were 32,000 pairs higher than they would otherwise have been because one or more other companies in the region did not have sufficient branded footwear inventories to fill all orders from retailers, thus causing some retailers in the region to place orders with your company. Which one of the following actions is unlikely to positively impact a company's sales of branded footwear in the North American region? Copyright by Glo-Bus Software Int. Copying distributing, or 3rd party weberte porting expressly prohibited and contes copyright violation Offering a number of models/styles in the North America region that exceeds the all- company average in North America Charging an average wholesale price to North American footwear retailers that is higher than the all-company average in North America Providing free shipping to online buyers in North America Marketing branded footwear with an S/Q rating that is above the industry average in North America Signing enough celebrities to endorsement contracts to earn celebrity appeal ratings in North America that exceed the North American industry average 00000000 The production benchmarks on p. 6 of each issue of the Footwear Industry Report Copyright by Gio-lus Software, Inc. Copying, distributing, or rd party website posting by prohibited and consum copyright violation are especially helpful to company managers in determining whether they need to spend more/less on enhanced styling/features at each of the company's production facilities. provide valuable feedback to company managers regarding the efficiency with they are managing production labor costs, reject rates, and branded manufacturing costs per pair produced at each of their company's production facilities. are primarily useful to managers in determining whether their company's total production costs are low enough to enable the company to be profitable if the average wholesale price charged to footwear retailers is equal to the prior-year regional average wholesale price. provide valuable feedback to company managers regarding whether the prices being charged for the company's branded footwear are too high or too low. are especially helpful to company managers in determining whether their company is overspending on fringe benefits paid to production workers. Q QU 0 Qu: Que O Que Que O Ques Ques