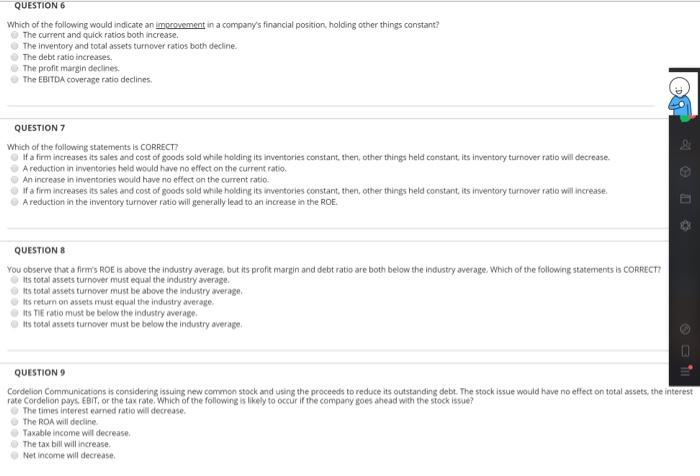

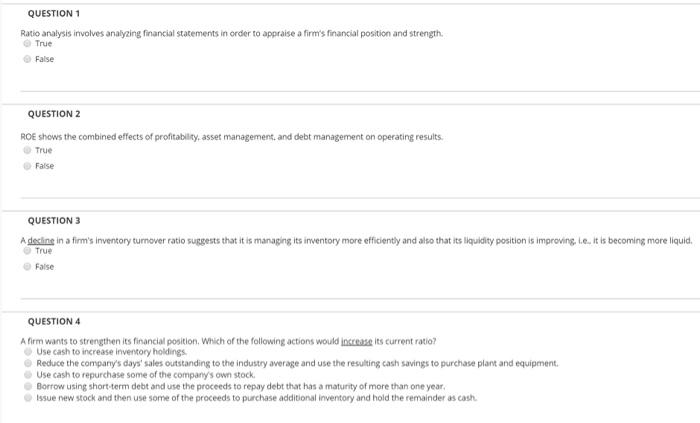

QUESTION 6 Which of the following would indicate an improvement in a company's financial position, holding other things constant? The current and quick ratios both increase The inventory and total assets turnover ratios both decline. The debt ratio increases. The profit margin declines. The EBITDA coverage ratio declines, QUESTION 7 Which of the following statements is CORRECT? # a firm increases its sales and cost of goods sold while holding its inventories constant, then, other things held constant, its inventory turnover ratio will decrease. A reduction in inventories held would have no effect on the current ratio An increase in inventories would have no effect on the current ratio. if a firm increases its sales and cost of goods sold while holding its inventores constant, then, other things held constant, its inventory turnover ratio will increase. A reduction in the inventory turnover ratio will generally lead to an increase in the ROE QUESTIONS You observe that a firm's ROE is above the industry average, but its profit margin and debt ratio are both below the industry average. Which of the following statements is CORRECT? its total assets turnover must equal the industry average Its total assets turnover must be above the industry average Its return on assets must equal the industry average Its TIE ratio must be below the industry average Its total assets turnover must be below the industry average QUESTION 9 Cordelion Communications is considering issuing new common stock and using the proceeds to reduce its outstanding debt. The stock issue would have no effect on total assets, the interest rate Cordelion pays. EBIT, or the tax rate. Which of the following is likely to occur if the company goes ahead with the stock issue? The times interest eamed ratio will decrease The ROA will decline Taxable income will decrease The tax bill will increase Net Income will decrease QUESTION 1 Ratio analysis involves analyzing financial statements in order to appraise a firm's financial position and strength: True False QUESTION 2 ROE shows the combined effects of profitability, asset management and debt management on operating results. True False QUESTION 3 A decline in a firm's inventory turnover ratio suggests that it is managing its inventory more efficiently and also that its liquidity position is improving te. It is becoming more liquid. True False QUESTION 4 A firm wants to strengthen les financial position. Which of the following actions would increase its current ratio? Use cash to increase inventory holdings Reduce the company's days' sales outstanding to the industry average and use the resulting cash savings to purchase plant and equipment Use cash to repurchase some of the company's own stock Borrow using short term debt and use the proceeds to repay debt that has a maturity of more than one year, Issue new stock and then use some of the proceeds to purchase additional inventory and hold the remainder as cash