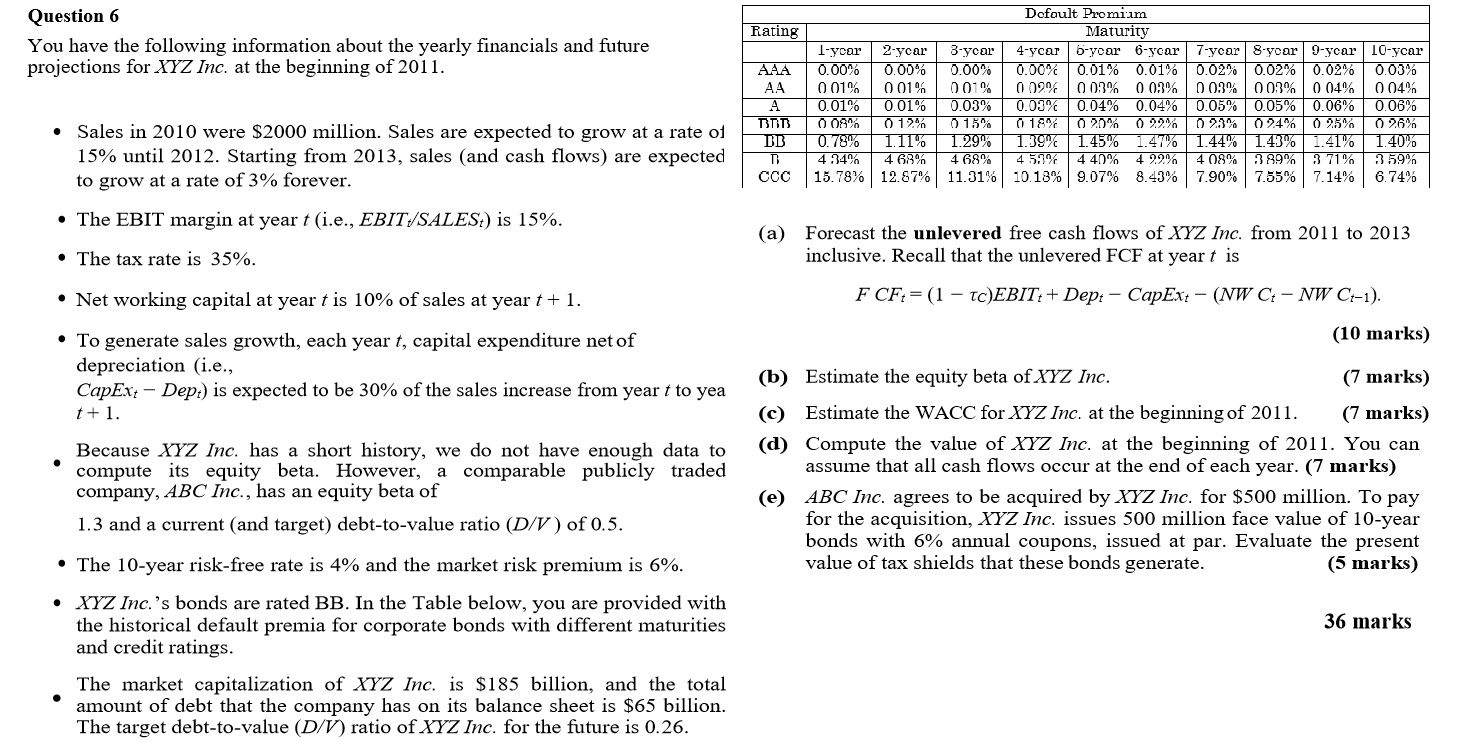

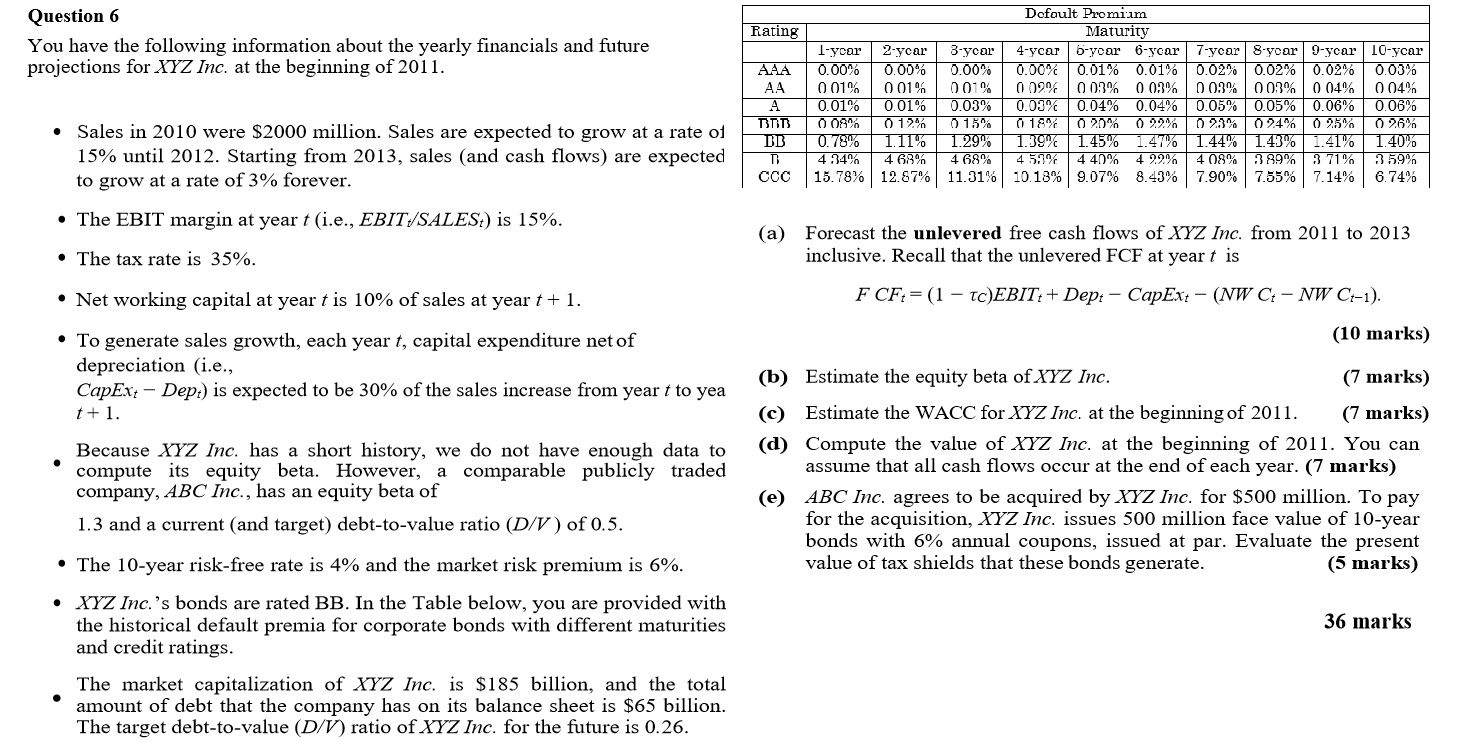

Question 6 You have the following information about the yearly financials and future projections for XYZ Inc. at the beginning of 2011. Rating | 1-year 2-year AAA 0.00% 0.00% AA 001% 0.01% A 0.01% 0.01% BOB 0 08% 12% DB 0.78% | 111% 4 34% 4 68% 15.78% 12.87% Dofault Promium Maturity 3-ycar 4-ycar 6-year 6-year 0.00% 0.00% 0.01% 0.01% 0.01% 0.00% 0 0.3% 0.03% 0.03% 0.03% 0.04% 0.04% 15% 18% 0 20% 0 0.9% 1.29% | 1.39% | 1.45% 1.47% 4 68% 4 59% 4 40% 42.91% 11.31% 10.13% 9.07% 8.43% 7-year 8-year 9-year | 10-year 0.02% 0.02% 0.02% 0.03% 0.03% 003% 0.04% 004% 0.05% 0.05% 0.06% 0.06% 0.25% 0.24% 0 95% 0 26% 1.44% 1.43% 1.41% 1.40% 4 08% 3 89% 3 71% 3 59% 7.90% 7.55% 7.14% 6.74% Sales in 2010 were $2000 million. Sales are expected to grow at a rate of 15% until 2012. Starting from 2013, sales and cash flows) are expected to grow at a rate of 3% forever. CCC 15 7912 The EBIT margin at year t (i.e., EBIT/SALES:) is 15%. (a) Forecast the unlevered free cash flows of XYZ Inc. from 2011 to 2013 inclusive. Recall that the unlevered FCF at year t is The tax rate is 35%. Net working capital at year t is 10% of sales at year t + 1. F CF:= (1 TC)EBIT: + Dep: - Cap Ex: - (NW C: - NW C-1). (10 marks) To generate sales growth, each year t, capital expenditure net of depreciation (i.e., CapEx: Dept) is expected to be 30% of the sales increase from year t to yea t+1. Because XYZ Inc. has a short history, we do not have enough data to compute its equity beta. However, a comparable publicly traded company, ABC Inc., has an equity beta of 1.3 and a current (and target) debt-to-value ratio (D/V) of 0.5. (b) Estimate the equity beta of XYZ Inc. (7 marks) (c) Estimate the WACC for XYZ Inc. at the beginning of 2011. (7 marks) Compute the value of XYZ Inc. at the beginning of 2011. You can assume that all cash flows occur at the end of each year. (7 marks) ABC Inc. agrees to be acquired by XYZ Inc. for $500 million. To pay for the acquisition, XYZ Inc. issues 500 million face value of 10-year bonds with 6% annual coupons, issued at par. Evaluate the present value of tax shields that these bonds generate. (5 marks) The 10-year risk-free rate is 4% and the market risk premium is 6%. XYZ Inc.'s bonds are rated BB. In the Table below, you are provided with the historical default premia for corporate bonds with different maturities and credit ratings. 36 marks The market capitalization of XYZ Inc. is $185 billion, and the total amount of debt that the company has on its balance sheet is $65 billion. The target debt-to-value (D/V) ratio of XYZ Inc. for the future is 0.26. Question 6 You have the following information about the yearly financials and future projections for XYZ Inc. at the beginning of 2011. Rating | 1-year 2-year AAA 0.00% 0.00% AA 001% 0.01% A 0.01% 0.01% BOB 0 08% 12% DB 0.78% | 111% 4 34% 4 68% 15.78% 12.87% Dofault Promium Maturity 3-ycar 4-ycar 6-year 6-year 0.00% 0.00% 0.01% 0.01% 0.01% 0.00% 0 0.3% 0.03% 0.03% 0.03% 0.04% 0.04% 15% 18% 0 20% 0 0.9% 1.29% | 1.39% | 1.45% 1.47% 4 68% 4 59% 4 40% 42.91% 11.31% 10.13% 9.07% 8.43% 7-year 8-year 9-year | 10-year 0.02% 0.02% 0.02% 0.03% 0.03% 003% 0.04% 004% 0.05% 0.05% 0.06% 0.06% 0.25% 0.24% 0 95% 0 26% 1.44% 1.43% 1.41% 1.40% 4 08% 3 89% 3 71% 3 59% 7.90% 7.55% 7.14% 6.74% Sales in 2010 were $2000 million. Sales are expected to grow at a rate of 15% until 2012. Starting from 2013, sales and cash flows) are expected to grow at a rate of 3% forever. CCC 15 7912 The EBIT margin at year t (i.e., EBIT/SALES:) is 15%. (a) Forecast the unlevered free cash flows of XYZ Inc. from 2011 to 2013 inclusive. Recall that the unlevered FCF at year t is The tax rate is 35%. Net working capital at year t is 10% of sales at year t + 1. F CF:= (1 TC)EBIT: + Dep: - Cap Ex: - (NW C: - NW C-1). (10 marks) To generate sales growth, each year t, capital expenditure net of depreciation (i.e., CapEx: Dept) is expected to be 30% of the sales increase from year t to yea t+1. Because XYZ Inc. has a short history, we do not have enough data to compute its equity beta. However, a comparable publicly traded company, ABC Inc., has an equity beta of 1.3 and a current (and target) debt-to-value ratio (D/V) of 0.5. (b) Estimate the equity beta of XYZ Inc. (7 marks) (c) Estimate the WACC for XYZ Inc. at the beginning of 2011. (7 marks) Compute the value of XYZ Inc. at the beginning of 2011. You can assume that all cash flows occur at the end of each year. (7 marks) ABC Inc. agrees to be acquired by XYZ Inc. for $500 million. To pay for the acquisition, XYZ Inc. issues 500 million face value of 10-year bonds with 6% annual coupons, issued at par. Evaluate the present value of tax shields that these bonds generate. (5 marks) The 10-year risk-free rate is 4% and the market risk premium is 6%. XYZ Inc.'s bonds are rated BB. In the Table below, you are provided with the historical default premia for corporate bonds with different maturities and credit ratings. 36 marks The market capitalization of XYZ Inc. is $185 billion, and the total amount of debt that the company has on its balance sheet is $65 billion. The target debt-to-value (D/V) ratio of XYZ Inc. for the future is 0.26