Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 6-30 6-30 social security benefits. X who is single and retired has the following income for the current year: taxable interent....................$12000 dividend income.... ........................$10000

question 6-30

6-30 social security benefits. X who is single and retired has the following income for the current year:

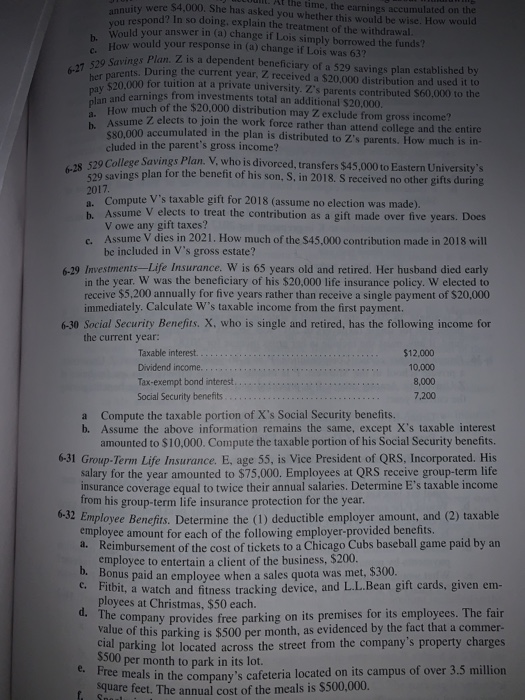

Ar the time, the earnings accumulated on the annuity were $4,000. She has asked you whether this would be wise. How would you respond? In so doing, explain the treatment of the withdrawal. b. Would your answer in (a) change if Lois simply borrowed the funds? How would your response in (a) change if Lois was 63? C. 6-27 529 Savings Plan. Z is a dependent beneficiary of a 529 savings plan established by arents. During the current year, Z received a $20,000 distribution and used it to het 20.000 for tuition at a private university. Z's parents contributed S60,000 to the plan and earnings from investments total an additional $20,000. How much of the $20,000 distribution may Z exclude from gross income? a. Assume Z elects to join the work force rather than attend college and the entire S80.000 accumulated in the plan is distributed to Z's parents, How much is in- cluded in the parent's gross income? 20 Callege Savings Plan. V, who is divorced, transfers $45,000 to Eastern University's 529 savings plan for the benefit of his son, S, in 2018. S received no other gifts during 2017. . Compute V's taxable gift for 2018 (assume no election was made). h Assume V elects to treat the contribution as a gift made over five years. Does V owe any gift taxes? G. Assume V dies in 2021. How much of the $45,000 contribution made in 2018 will be included in V's gross estate? 6-29 Investments-Life Insurance. W is 65 years old and retired. Her husband died early in the year. W was the beneficiary of his $20,000 life insurance policy. W elected to receive $5,200 annually for five years rather than receive a single payment of $20,000 immediately. Calculate W's taxable income from the first payment. 6-30 Social Security Benefits. X, who is single and retired, has the following income for the current year: Taxable interest. $12,000 Dividend income. 10,000 Tax-exempt bond interest. Social Security benefits. 8,000 7,200 a Compute the taxable portion of X's Social Security benefits. b. Assume the above information remains the same, except X's taxable interest amounted to $10,000. Compute the taxable portion of his Social Security benefits. 6-31 Group-Term Life Insurance. E, age 55, is Vice President of QRS, Incorporated. His salary for the year amounted to $75,000. Employees at QRS receive group-term life insurance coverage equal to twice their annual salaries. Determine E's taxable income from his group-term life insurance protection for the year. 0-32 Employee Benefits. Determine the (1) deductible employer amount, and (2) taxable employee amount for each of the following employer-provided benefits. Reimbursement of the cost of tickets to a Chicago Cubs baseball game paid by an employee to entertain a client of the business, $200. b. Bonus paid an emplovee when a sales quota was met, $300. . Fitbit, a watch and fitness tracking device, and L.L.Bean gift cards, given em- ployees at Christmas, $50 each. d. The company provides free parking on its premises for its employees. The fair Value of this parking is $500 per month, as evidenced by the fact that a commer- a. Cial parking lot located across the street from the company's property charges per month to park in its lot. $500 e. Fice meals in the company's cafeteria located on its campus of over 3.5 million square feet. The annual cost of the meals is $500,000. Speal taxable interent....................$12000

dividend income.... ........................$10000

tax exempt bond interest...............$8000

social sec. benefits ....................$7200

a. compute taxable portion of X's Social Security benefits.

b. assume the above info remains the same, except X's taxable interest amounted to $10'000. Compute the taxable portion of his social security benefits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started