Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 69 of 75. What is Essie's basis in the Weeping Willow property? O $50,000 O $84,226 $300,000 O $350,000 3. Like-Kind Exchange Early this

Question 69 of 75. What is Essie's basis in the Weeping Willow property? O $50,000 O $84,226 $300,000 O $350,000

Question 69 of 75. What is Essie's basis in the Weeping Willow property? O $50,000 O $84,226 $300,000 O $350,000

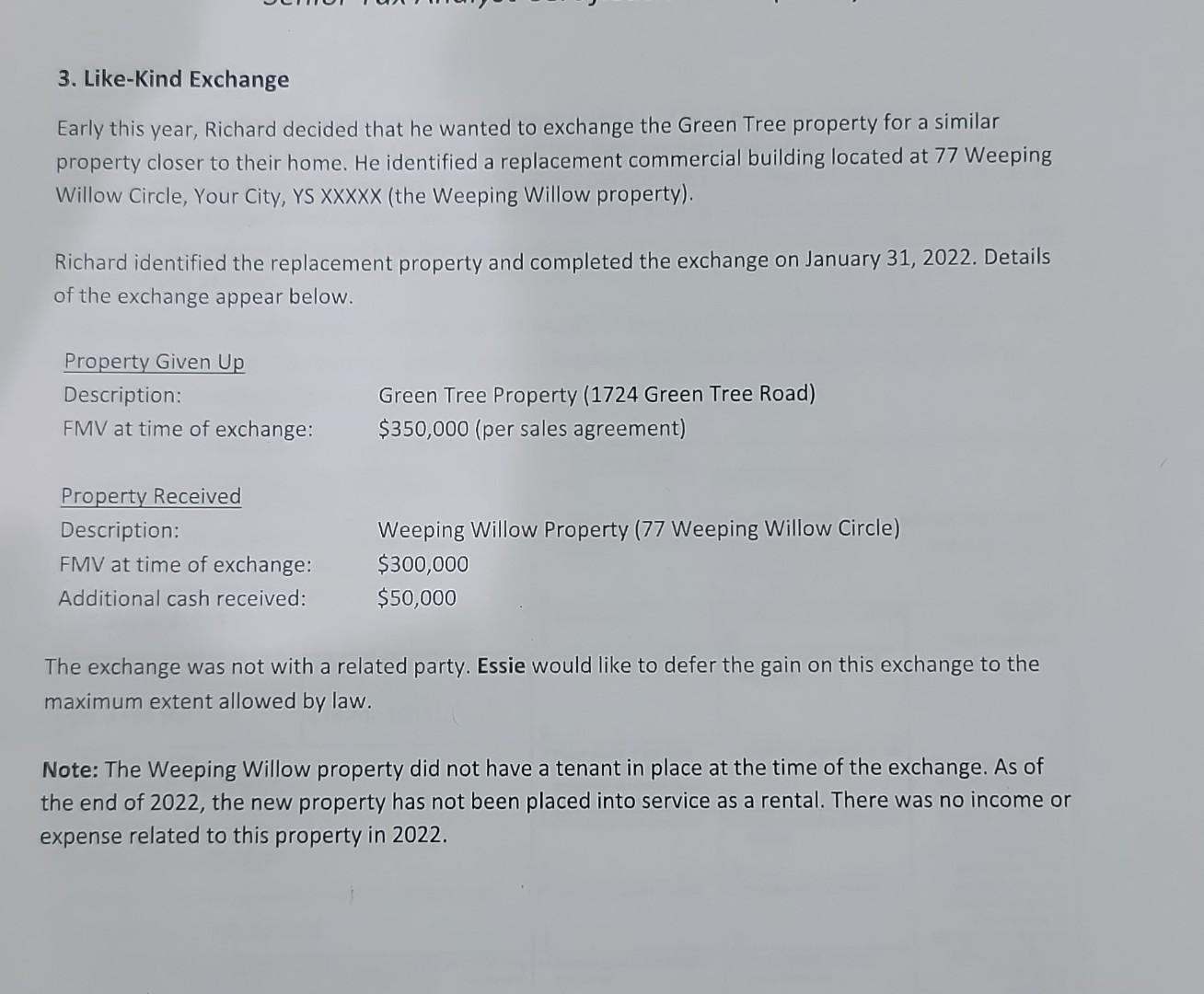

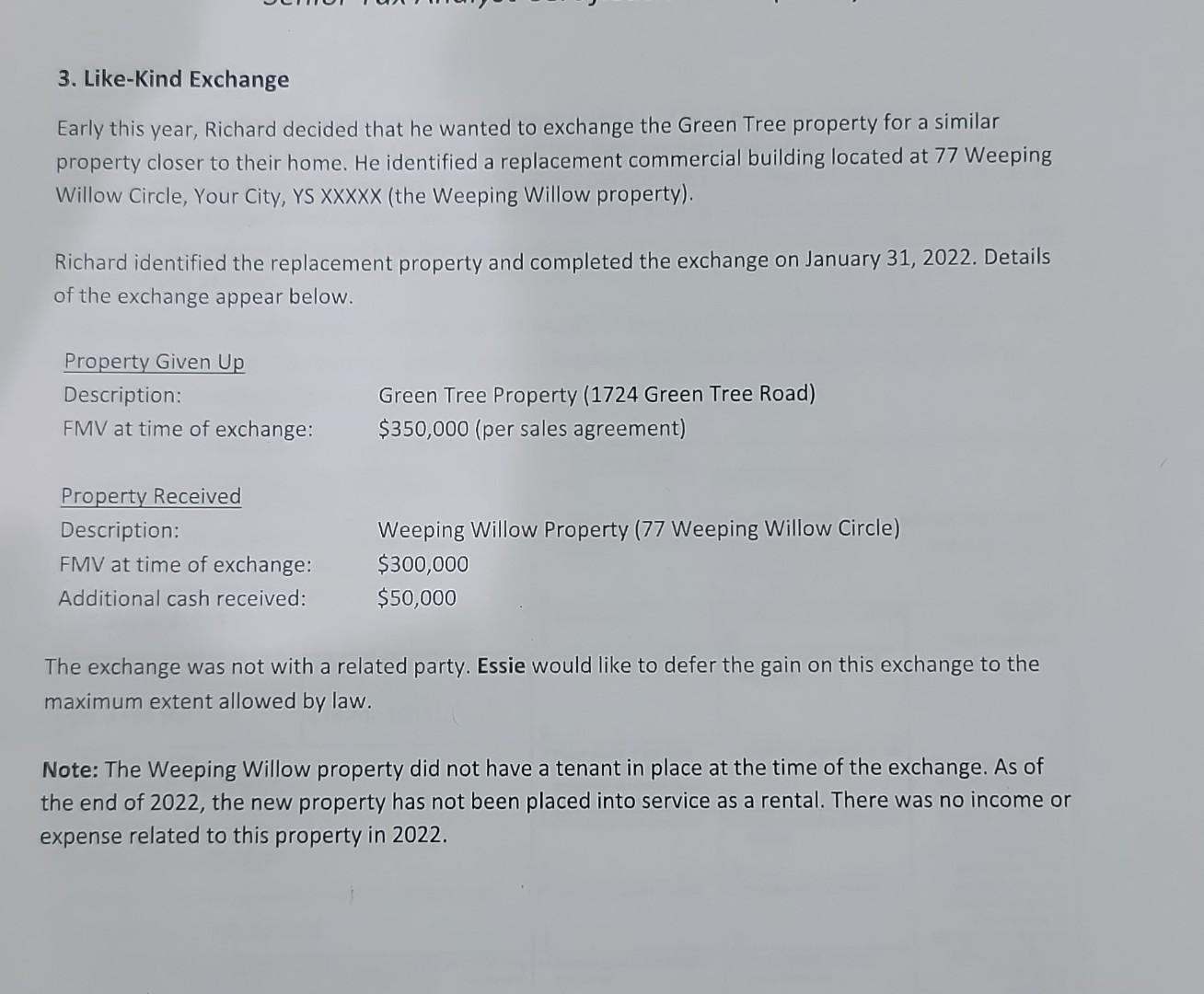

3. Like-Kind Exchange Early this year, Richard decided that he wanted to exchange the Green Tree property for a similar property closer to their home. He identified a replacement commercial building located at 77 Weeping Willow Circle, Your City, YS XXXXX (the Weeping Willow property). Richard identified the replacement property and completed the exchange on January 31, 2022. Details of the exchange appear below. The exchange was not with a related party. Essie would like to defer the gain on this exchange to the maximum extent allowed by law. Note: The Weeping Willow property did not have a tenant in place at the time of the exchange. As of the end of 2022, the new property has not been placed into service as a rental. There was no income or expense related to this property in 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started