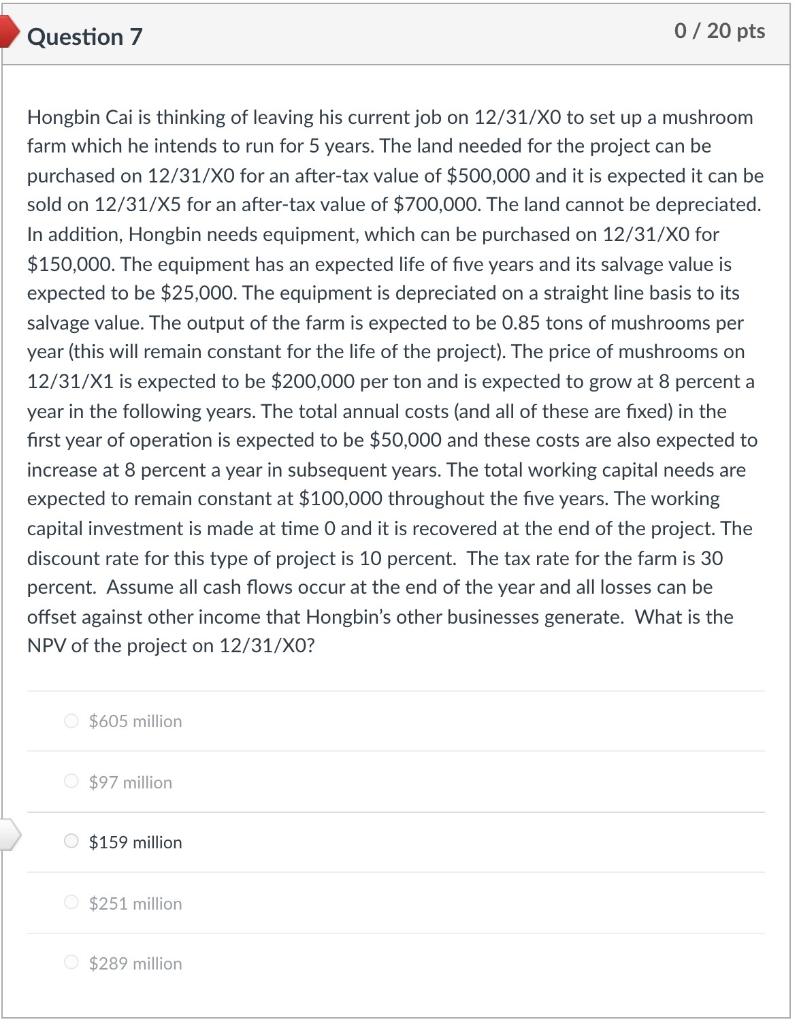

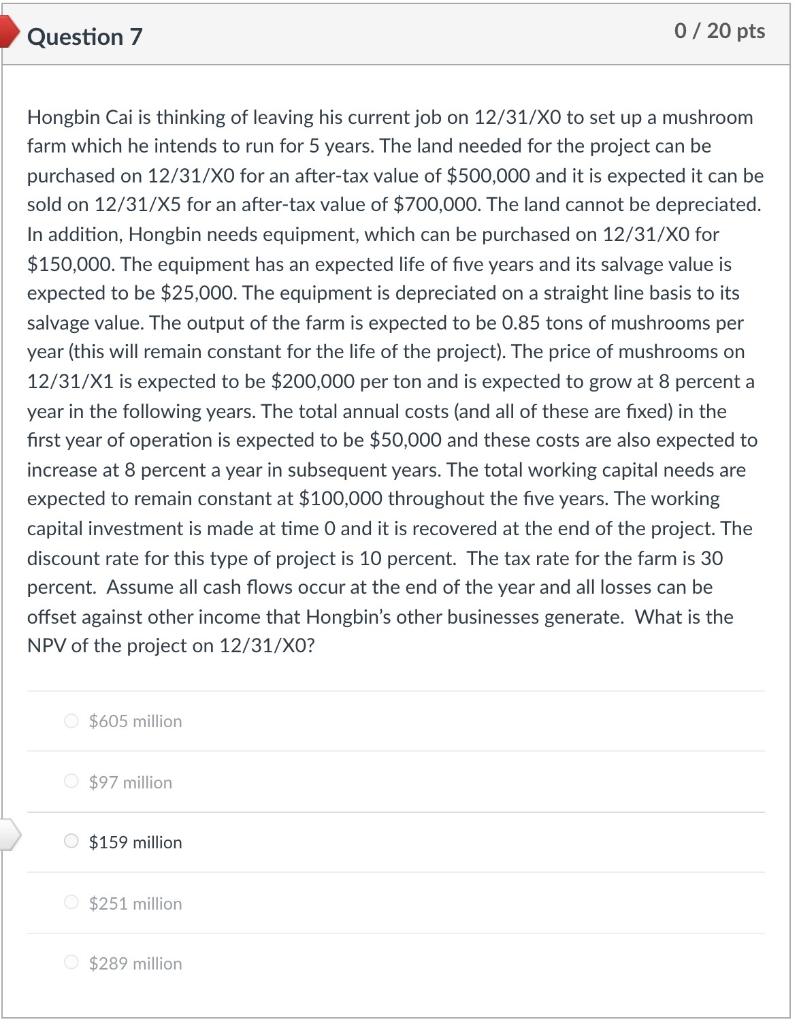

Question 7 0 / 20 pts Hongbin Cai is thinking of leaving his current job on 12/31/XO to set up a mushroom farm which he intends to run for 5 years. The land needed for the project can be purchased on 12/31/XO for an after-tax value of $500,000 and it is expected it can be sold on 12/31/X5 for an after-tax value of $700,000. The land cannot be depreciated. In addition, Hongbin needs equipment, which can be purchased on 12/31/XO for $150,000. The equipment has an expected life of five years and its salvage value is expected to be $25,000. The equipment is depreciated on a straight line basis to its salvage value. The output of the farm is expected to be 0.85 tons of mushrooms per year (this will remain constant for the life of the project). The price of mushrooms on 12/31/X1 is expected to be $200,000 per ton and is expected to grow at 8 percent a year in the following years. The total annual costs (and all of these are fixed) in the first year of operation is expected to be $50,000 and these costs are also expected to increase at 8 percent a year in subsequent years. The total working capital needs are expected to remain constant at $100,000 throughout the five years. The working capital investment is made at time 0 and it is recovered at the end of the project. The discount rate for this type of project is 10 percent. The tax rate for the farm is 30 percent. Assume all cash flows occur at the end of the year and all losses can be offset against other income that Hongbin's other businesses generate. What is the NPV of the project on 12/31/XO? $605 million $97 million $159 million $251 million $289 million Question 7 0 / 20 pts Hongbin Cai is thinking of leaving his current job on 12/31/XO to set up a mushroom farm which he intends to run for 5 years. The land needed for the project can be purchased on 12/31/XO for an after-tax value of $500,000 and it is expected it can be sold on 12/31/X5 for an after-tax value of $700,000. The land cannot be depreciated. In addition, Hongbin needs equipment, which can be purchased on 12/31/XO for $150,000. The equipment has an expected life of five years and its salvage value is expected to be $25,000. The equipment is depreciated on a straight line basis to its salvage value. The output of the farm is expected to be 0.85 tons of mushrooms per year (this will remain constant for the life of the project). The price of mushrooms on 12/31/X1 is expected to be $200,000 per ton and is expected to grow at 8 percent a year in the following years. The total annual costs (and all of these are fixed) in the first year of operation is expected to be $50,000 and these costs are also expected to increase at 8 percent a year in subsequent years. The total working capital needs are expected to remain constant at $100,000 throughout the five years. The working capital investment is made at time 0 and it is recovered at the end of the project. The discount rate for this type of project is 10 percent. The tax rate for the farm is 30 percent. Assume all cash flows occur at the end of the year and all losses can be offset against other income that Hongbin's other businesses generate. What is the NPV of the project on 12/31/XO? $605 million $97 million $159 million $251 million $289 million