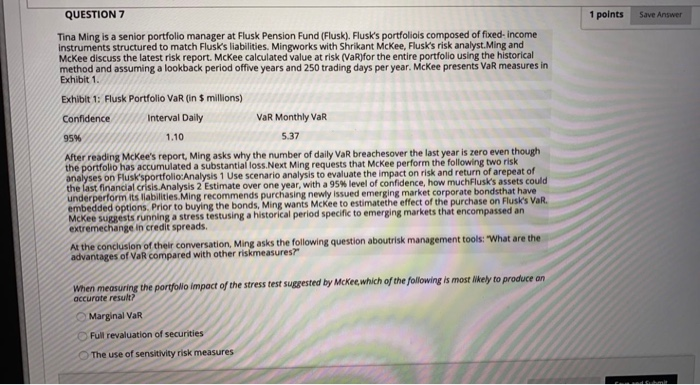

QUESTION 7 1 points Save Answer Tina Ming is a senior portfolio Manager at Flusk Pension Fund (Flusk). Flusk's portfoliois composed of fixed Income Instruments structured to match Flusk's liabilities. Mingworks with Shrikant Mckee, Flusk's risk analyst.Ming and McKee discuss the latest risk report. McKee calculated value at risk VaR for the entire portfolio using the historical method and assuming a lookback period offive years and 250 trading days per year. McKee presents VaR measures in Exhibit 1. Exhibit 1: Flusk Portfolio VaR (in $ millions) Confidence Interval Daily VaR Monthly VaR 95% 1.10 5.37 After reading McKee's report, Ming asks why the number of daily VaR breachesover the last year is zero even though the portfolio las accumulated a substantial loss. Next Ming requests that McKee perform the following two risk analyses on Flusk'sportfolio:Analysis 1 Use scenario analysis to evaluate the impact on risk and return of arepeat of the last financial crisis.Analysis 2 Estimate over one year, with a 95% level of confidence, how muchFlusk's assets could underperform its liabilities. Ming recommends purchasing newly issued emerging market corporate bondsthat have embedded options. Prior to buying the bonds, Ming wants McKee to estimatethe effect of the purchase on Flusk's VaR. McKee suggests running a stress testusing a historical period specific to emerging markets that encompassed an extremechange in credit spreads At the conclusion of their conversation, Ming asks the following question aboutrisk management tools: What are the advantages of VaR compared with other riskmeasures?" When measuring the portfolio impact of the stress test suggested by McKee, which of the following is most likely to produce on accurate result? Marginal VaR Full revaluation of securities The use of sensitivity risk measures QUESTION 7 1 points Save Answer Tina Ming is a senior portfolio Manager at Flusk Pension Fund (Flusk). Flusk's portfoliois composed of fixed Income Instruments structured to match Flusk's liabilities. Mingworks with Shrikant Mckee, Flusk's risk analyst.Ming and McKee discuss the latest risk report. McKee calculated value at risk VaR for the entire portfolio using the historical method and assuming a lookback period offive years and 250 trading days per year. McKee presents VaR measures in Exhibit 1. Exhibit 1: Flusk Portfolio VaR (in $ millions) Confidence Interval Daily VaR Monthly VaR 95% 1.10 5.37 After reading McKee's report, Ming asks why the number of daily VaR breachesover the last year is zero even though the portfolio las accumulated a substantial loss. Next Ming requests that McKee perform the following two risk analyses on Flusk'sportfolio:Analysis 1 Use scenario analysis to evaluate the impact on risk and return of arepeat of the last financial crisis.Analysis 2 Estimate over one year, with a 95% level of confidence, how muchFlusk's assets could underperform its liabilities. Ming recommends purchasing newly issued emerging market corporate bondsthat have embedded options. Prior to buying the bonds, Ming wants McKee to estimatethe effect of the purchase on Flusk's VaR. McKee suggests running a stress testusing a historical period specific to emerging markets that encompassed an extremechange in credit spreads At the conclusion of their conversation, Ming asks the following question aboutrisk management tools: What are the advantages of VaR compared with other riskmeasures?" When measuring the portfolio impact of the stress test suggested by McKee, which of the following is most likely to produce on accurate result? Marginal VaR Full revaluation of securities The use of sensitivity risk measures