Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 7 (10 marks) a. Total risk can be decomposed into systematic risk and unsystematic risk. Explain each of these components of risk and how

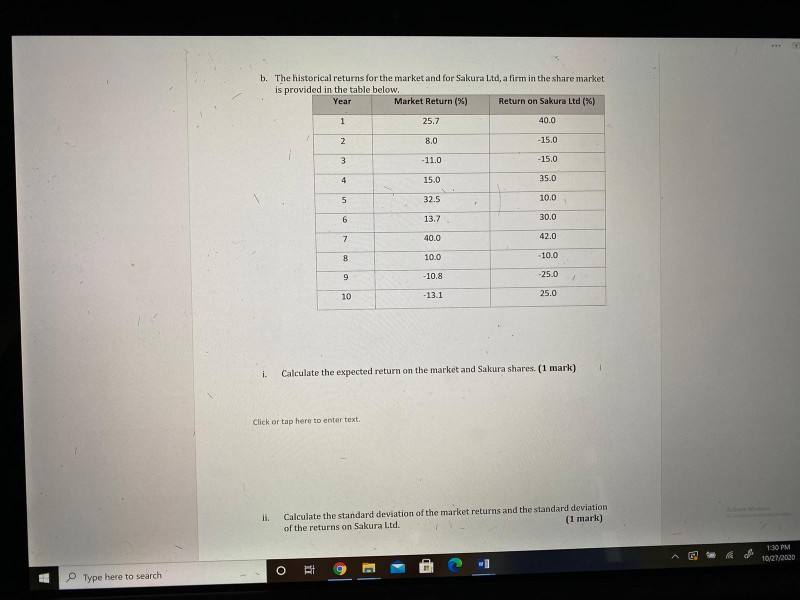

Question 7 (10 marks) a. Total risk can be decomposed into systematic risk and unsystematic risk. Explain each of these components of risk and how they are affected by increasing the number of securities in the portfolio. (2 marks) Click or tap here to enter text. fou Salora td a firm in the share market b. The historical returns for the market and for Sakura Ltd, a firm in the share market is provided in the table below. Year Market Return (%) Return on Sakura Ltd (%) 1 25.7 40.0 2 8.0 - 15.0 3 - 11.0 - 15.0 4 15.0 35.0 5 32.5 10.0 6 13.7 30.0 7 40.0 42.0 8 10.0 -10.0 9 - 10.8 -25.0 10 -13.1 25.0 i. Calculate the expected return on the market and Sakura shares. (1 mark) Click or tap here to enter text. 1. Calculate the standard deviation of the market returns and the standard deviation of the returns on Sakura Ltd. (1 mark) 1:30 PM 10/27/2000 O 9 Type here to search is. Determine the correlation coefficient between the market return and the return on Sakura shares and hence calculate the Beta coefficient for Sakura Ltd. (2 marks) Click or tap here to enter text (2 mark) iv. What is the compensation for bearing systematic risk? Click or tap here to enter text. V If the risk free rate is 5 percent would you consider the shares of Sakura Ltd as a good buy? (2 marks) Click or tap here to enter text. 9 131 PM 10/27/2020 Otom 21. O BI E Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started