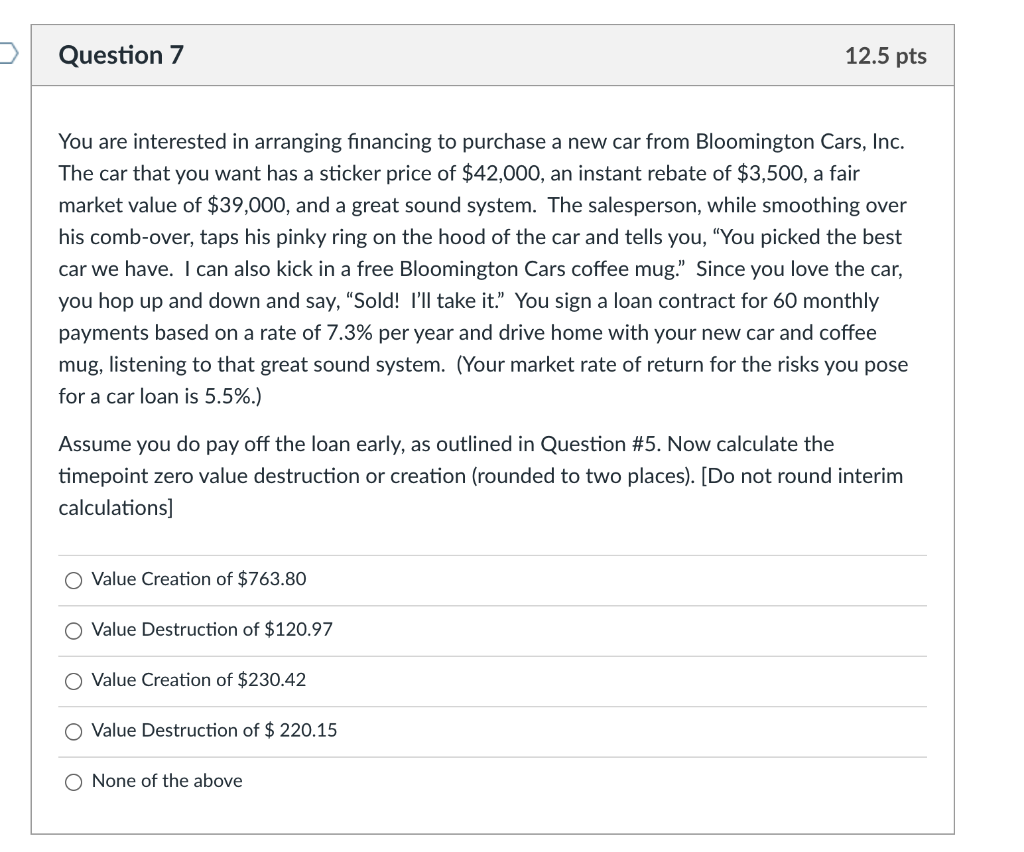

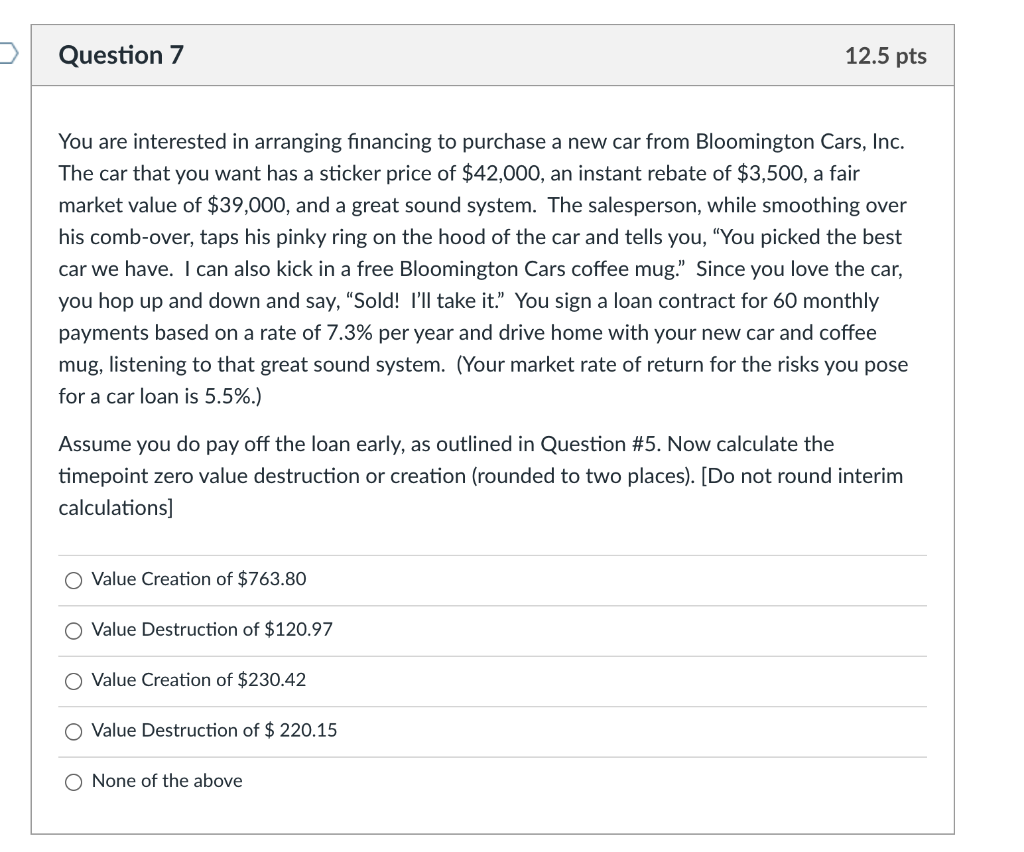

Question 7 12.5 pts You are interested in arranging financing to purchase a new car from Bloomington Cars, Inc. The car that you want has a sticker price of $42,000, an instant rebate of $3,500, a fair market value of $39,000, and a great sound system. The salesperson, while smoothing over his comb-over, taps his pinky ring on the hood of the car and tells you, You picked the best car we have. I can also kick in a free Bloomington Cars coffee mug. Since you love the car, you hop up and down and say, Sold! I'll take it." You sign a loan contract for 60 monthly payments based on a rate of 7.3% per year and drive home with your new car and coffee mug, listening to that great sound system. (Your market rate of return for the risks you pose for a car loan is 5.5%.) Assume you do pay off the loan early, as outlined in Question #5. Now calculate the timepoint zero value destruction or creation (rounded to two places). [Do not round interim calculations] Value Creation of $763.80 O Value Destruction of $120.97 O Value Creation of $230.42 O Value Destruction of $ 220.15 O None of the above Question 7 12.5 pts You are interested in arranging financing to purchase a new car from Bloomington Cars, Inc. The car that you want has a sticker price of $42,000, an instant rebate of $3,500, a fair market value of $39,000, and a great sound system. The salesperson, while smoothing over his comb-over, taps his pinky ring on the hood of the car and tells you, You picked the best car we have. I can also kick in a free Bloomington Cars coffee mug. Since you love the car, you hop up and down and say, Sold! I'll take it." You sign a loan contract for 60 monthly payments based on a rate of 7.3% per year and drive home with your new car and coffee mug, listening to that great sound system. (Your market rate of return for the risks you pose for a car loan is 5.5%.) Assume you do pay off the loan early, as outlined in Question #5. Now calculate the timepoint zero value destruction or creation (rounded to two places). [Do not round interim calculations] Value Creation of $763.80 O Value Destruction of $120.97 O Value Creation of $230.42 O Value Destruction of $ 220.15 O None of the above