Answered step by step

Verified Expert Solution

Question

1 Approved Answer

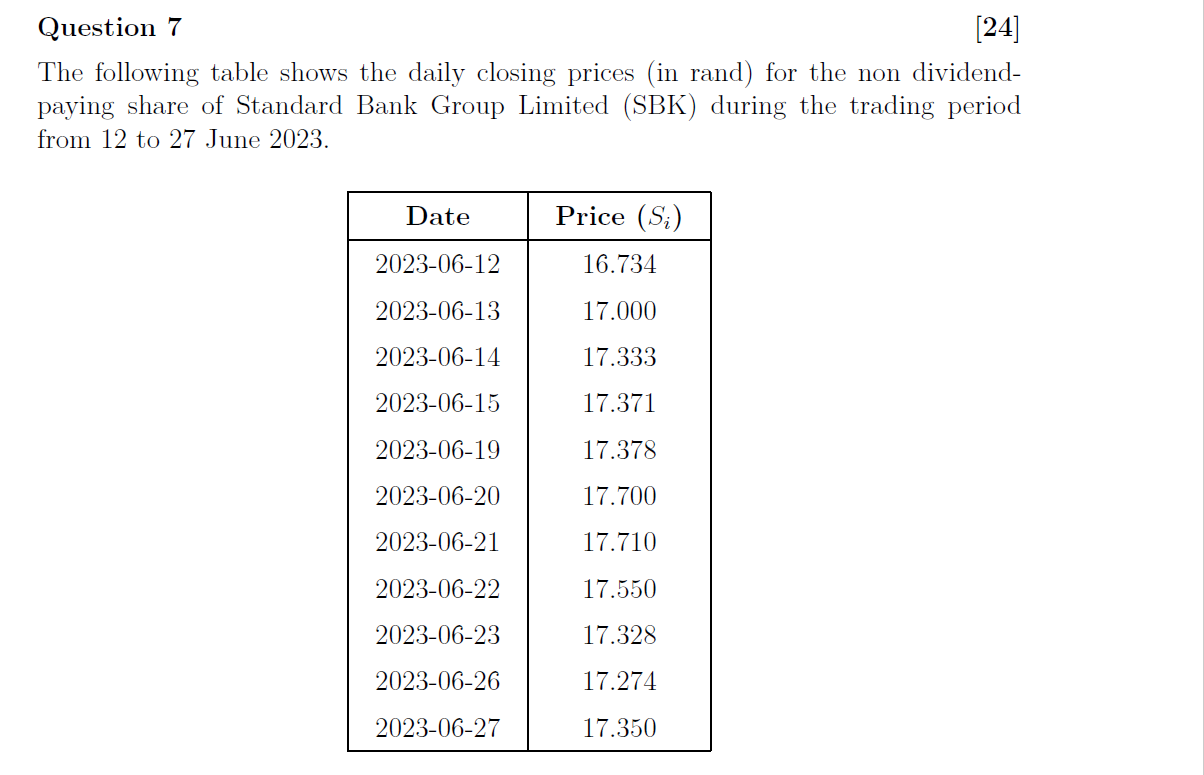

Question 7 ( [24] ) The following table shows the daily closing prices (in rand) for the non dividendpaying share of Standard Bank Group Limited

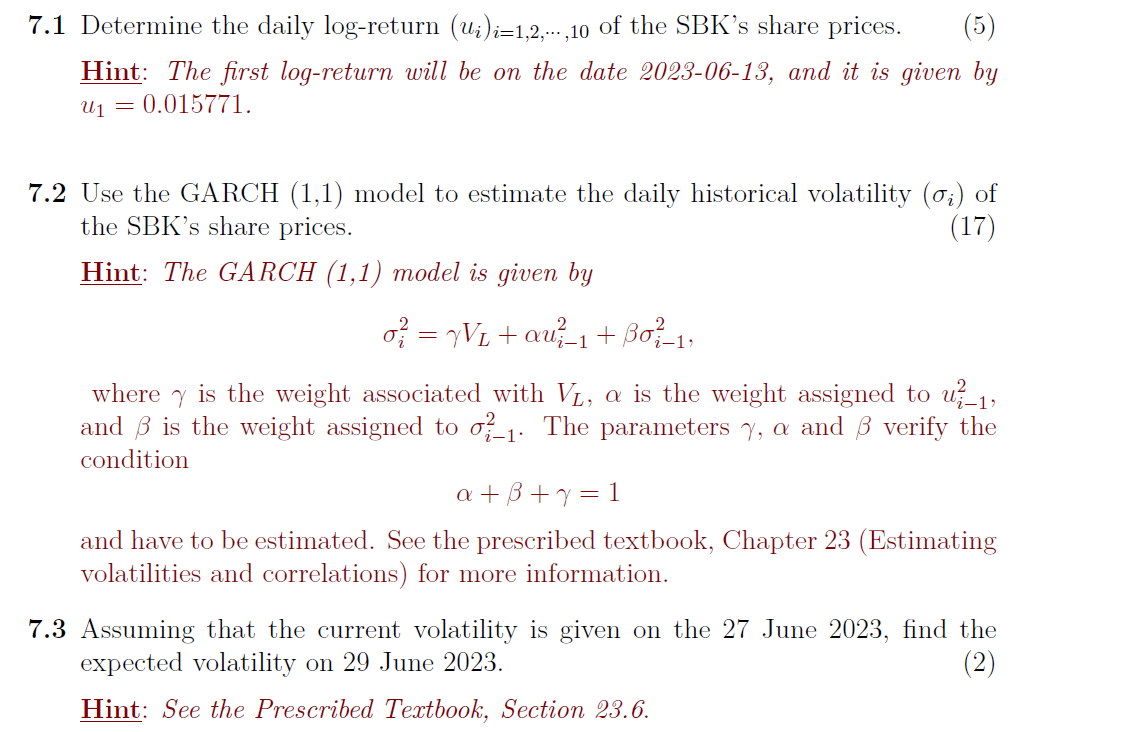

Question 7 \\( [24] \\) The following table shows the daily closing prices (in rand) for the non dividendpaying share of Standard Bank Group Limited (SBK) during the trading period from 12 to 27 June 2023 . .1 Determine the daily log-return \\( \\left(u_{i}\ ight)_{i=1,2, \\cdots, 10} \\) of the SBK's share prices. Hint: The first log-return will be on the date 2023-06-13, and it is given by \\( u_{1}=0.015771 \\). .2 Use the GARCH \\( (1,1) \\) model to estimate the daily historical volatility \\( \\left(\\sigma_{i}\ ight) \\) of the SBK's share prices. Hint: The GARCH \\( (1,1) \\) model is given by \\[ \\sigma_{i}^{2}=\\gamma V_{L}+\\alpha u_{i-1}^{2}+\\beta \\sigma_{i-1}^{2}, \\] where \\( \\gamma \\) is the weight associated with \\( V_{L}, \\alpha \\) is the weight assigned to \\( u_{i-1}^{2} \\), and \\( \\beta \\) is the weight assigned to \\( \\sigma_{i-1}^{2} \\). The parameters \\( \\gamma, \\alpha \\) and \\( \\beta \\) verify the condition \\[ \\alpha+\\beta+\\gamma=1 \\] and have to be estimated. See the prescribed textbook, Chapter 23 (Estimating volatilities and correlations) for more information. .3 Assuming that the current volatility is given on the 27 June 2023, find the expected volatility on 29 June 2023. Hint: See the Prescribed Textbook, Section 23.6. Question 7 \\( [24] \\) The following table shows the daily closing prices (in rand) for the non dividendpaying share of Standard Bank Group Limited (SBK) during the trading period from 12 to 27 June 2023 . .1 Determine the daily log-return \\( \\left(u_{i}\ ight)_{i=1,2, \\cdots, 10} \\) of the SBK's share prices. Hint: The first log-return will be on the date 2023-06-13, and it is given by \\( u_{1}=0.015771 \\). .2 Use the GARCH \\( (1,1) \\) model to estimate the daily historical volatility \\( \\left(\\sigma_{i}\ ight) \\) of the SBK's share prices. Hint: The GARCH \\( (1,1) \\) model is given by \\[ \\sigma_{i}^{2}=\\gamma V_{L}+\\alpha u_{i-1}^{2}+\\beta \\sigma_{i-1}^{2}, \\] where \\( \\gamma \\) is the weight associated with \\( V_{L}, \\alpha \\) is the weight assigned to \\( u_{i-1}^{2} \\), and \\( \\beta \\) is the weight assigned to \\( \\sigma_{i-1}^{2} \\). The parameters \\( \\gamma, \\alpha \\) and \\( \\beta \\) verify the condition \\[ \\alpha+\\beta+\\gamma=1 \\] and have to be estimated. See the prescribed textbook, Chapter 23 (Estimating volatilities and correlations) for more information. .3 Assuming that the current volatility is given on the 27 June 2023, find the expected volatility on 29 June 2023. Hint: See the Prescribed Textbook, Section 23.6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started