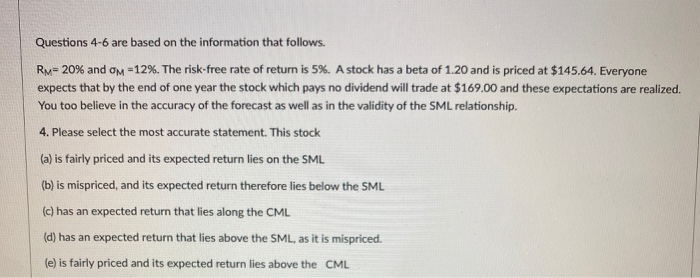

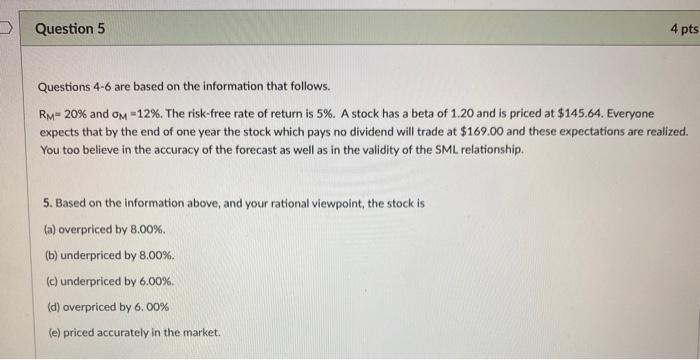

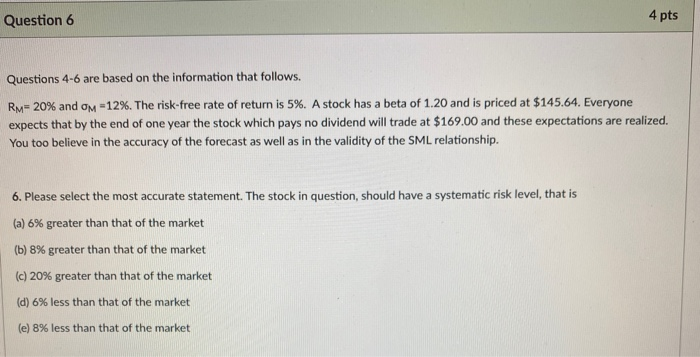

Questions 4-6 are based on the information that follows. RM= 20% and om =12%. The risk-free rate of return is 5%. A stock has a beta of 1.20 and is priced at $145.64. Everyone expects that by the end of one year the stock which pays no dividend will trade at $169.00 and these expectations are realized. You too believe in the accuracy of the forecast as well as in the validity of the SML relationship. 4. Please select the most accurate statement. This stock (a) is fairly priced and its expected return lies on the SML (b) is mispriced, and its expected return therefore lies below the SML (c) has an expected return that lies along the CML (d) has an expected return that lies above the SML, as it is mispriced. (e) is fairly priced and its expected return lies above the CML Question 5 4 pts Questions 4-6 are based on the information that follows. RM= 20% and OM =12%. The risk-free rate of return is 5%. A stock has a beta of 1.20 and is priced at $145.64. Everyone expects that by the end of one year the stock which pays no dividend will trade at $169.00 and these expectations are realized. You too believe in the accuracy of the forecast as well as in the validity of the SML relationship. 5. Based on the information above, and your rational viewpoint, the stock is (a) overpriced by 8.00%. (b) underpriced by 8.00% (c) underpriced by 6.00%. (d) overpriced by 6.00% (e) priced accurately in the market. Question 6 4 pts Questions 4-6 are based on the information that follows. Rm=20% and Om =12%. The risk-free rate of return is 5%. A stock has a beta of 1.20 and is priced at $145.64. Everyone expects that by the end of one year the stock which pays no dividend will trade at $169.00 and these expectations are realized. You too believe in the accuracy of the forecast as well as in the validity of the SML relationship. 6. Please select the most accurate statement. The stock in question, should have a systematic risk level, that is (a) 6% greater than that of the market (b) 8% greater than that of the market (c) 20% greater than that of the market (d) 6% less than that of the market (e) 8% less than that of the market