Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 7 6. Consider the following performance data for two port- folio managers (A and B) and a common benchmark portfolio: they manage, along with

Question 7

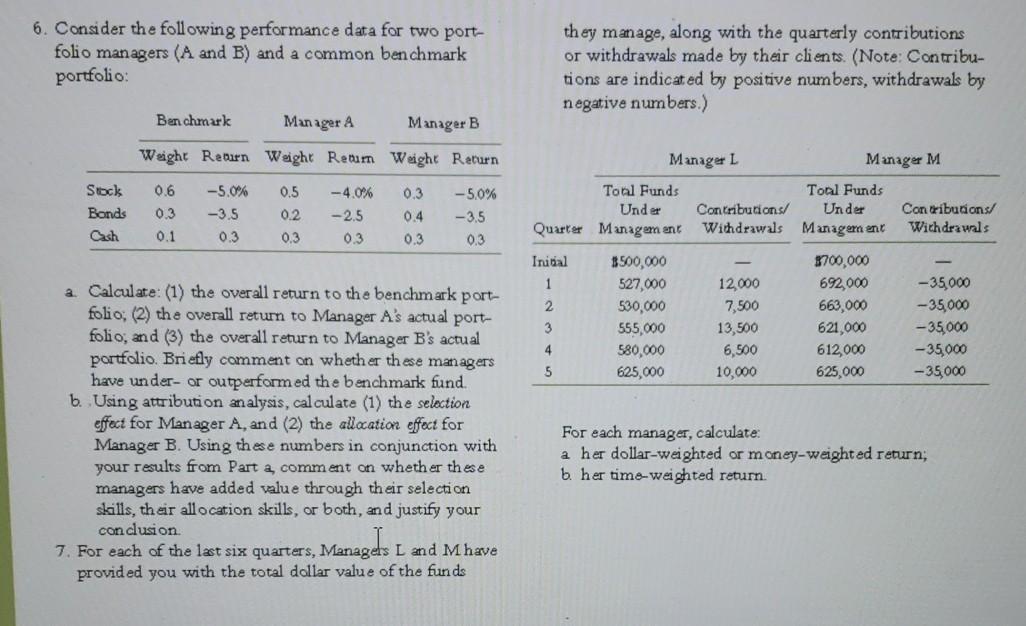

6. Consider the following performance data for two port- folio managers (A and B) and a common benchmark portfolio: they manage, along with the quarterly contributions or withdrawals made by their clients. (Note: Contribu- tions are indicated by positive numbers, withdrawals by negative numbers.) Benchmark Manager A Manager B Weight Return Weight Retum Weight Return 0.6 Stock Bonds Cash -5.0% -3.5 0.5 0.2 0.3 0.3 -4.0% -2.5 0.3 0.3 0.4 0.3 -5,0% -3.5 0.3 Manager L Manager M Tool Funds Toal Funds Under Contribution/ Under Contributions/ Quarter Management Withdrawals Management Withdrawals 0.1 0.3 Initial 1 2 3 4 5 $500,000 527,000 530,000 555.000 580,000 625,000 12,000 7,500 13,500 6,500 10,000 3700,000 692,000 663,000 621,000 612,000 625,000 -35,000 -35,000 - 35.000 -35,000 -35,000 a. Calculate: (1) the overall return to the benchmark port- folio; (2) the overall return to Manager A's actual port- folio, and (3) the overall return to Manager B's actual portfolio. Briefly comment on whether these managers have under- or outperformed the benchmark fund. 6. Using attribution analysis, calculate (1) the seloction effect for Manager A, and (2) the allocation effect for Manager B. Using these numbers in conjunction with your results from Part a comment on whether these managers have added value through their selection skills, their allocation skills, or both, and justify your conclusion 7. For each of the last six quarters, Managels L and Mhave provided you with the total dollar value of the funds For each manager, calculate: a her dollar-weighted or money-weighted return; b her time-weighted returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started