Answered step by step

Verified Expert Solution

Question

1 Approved Answer

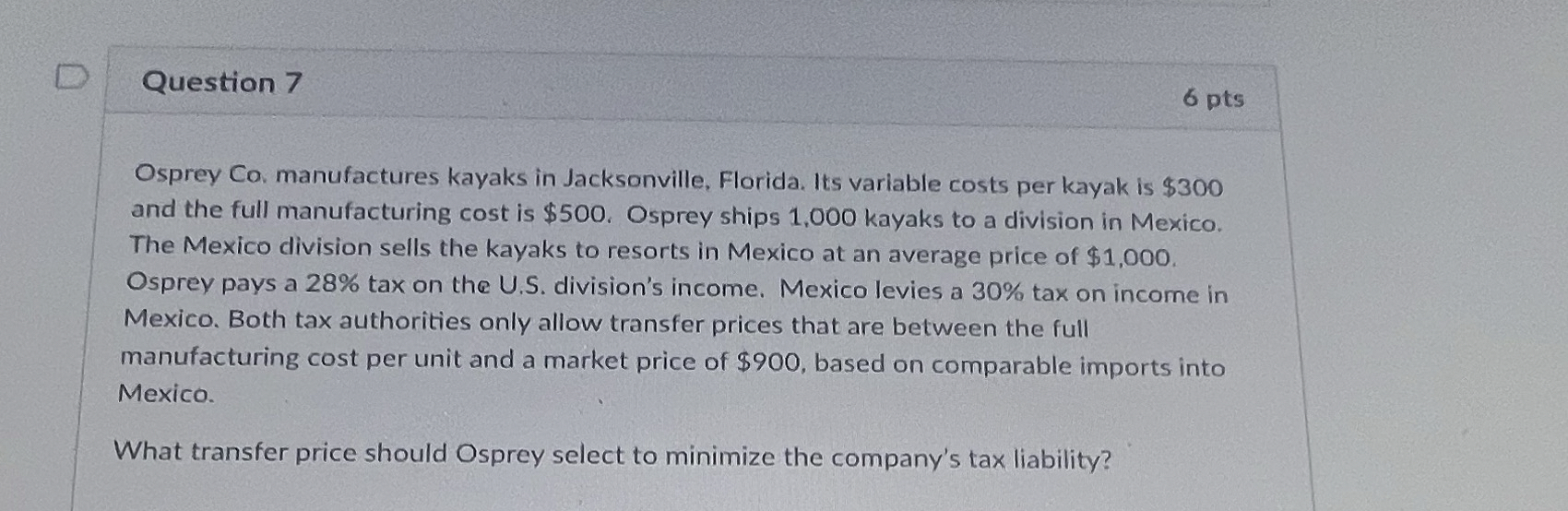

Question 7 6 pts Osprey Co , manufactures kayaks in Jacksonville, Florida. Its variable costs per kayak is $ 3 0 0 and the full

Question

pts

Osprey Co manufactures kayaks in Jacksonville, Florida. Its variable costs per kayak is $ and the full manufacturing cost is $ Osprey ships kayaks to a division in Mexico. The Mexico division sells the kayaks to resorts in Mexico at an average price of $ Osprey pays a tax on the US division's income. Mexico levies a tax on income in Mexico. Both tax authorities only allow transfer prices that are between the full manufacturing cost per unit and a market price of $ based on comparable imports into Mexico.

What transfer price should Osprey select to minimize the company's tax liability?

Edit View Insert Format Tools Table

pt Paragra

Question

pts

Osprey Co manufactures kayaks in Jacksonville, Florida. Its variable costs per kayak is $ and the full manufacturing cost is $ Osprey ships kayaks to a division in Mexico. The Mexico division sells the kayaks to resorts in Mexico at an average price of $ Osprey pays a tax on the US division's income. Mexico levies a tax on income in Mexico. Both tax authorities only allow transfer prices that are between the full manufacturing cost per unit and a market price of $ based on comparable imports into Mexico.

What transfer price should Osprey select to minimize the company's tax liability?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started