Answered step by step

Verified Expert Solution

Question

1 Approved Answer

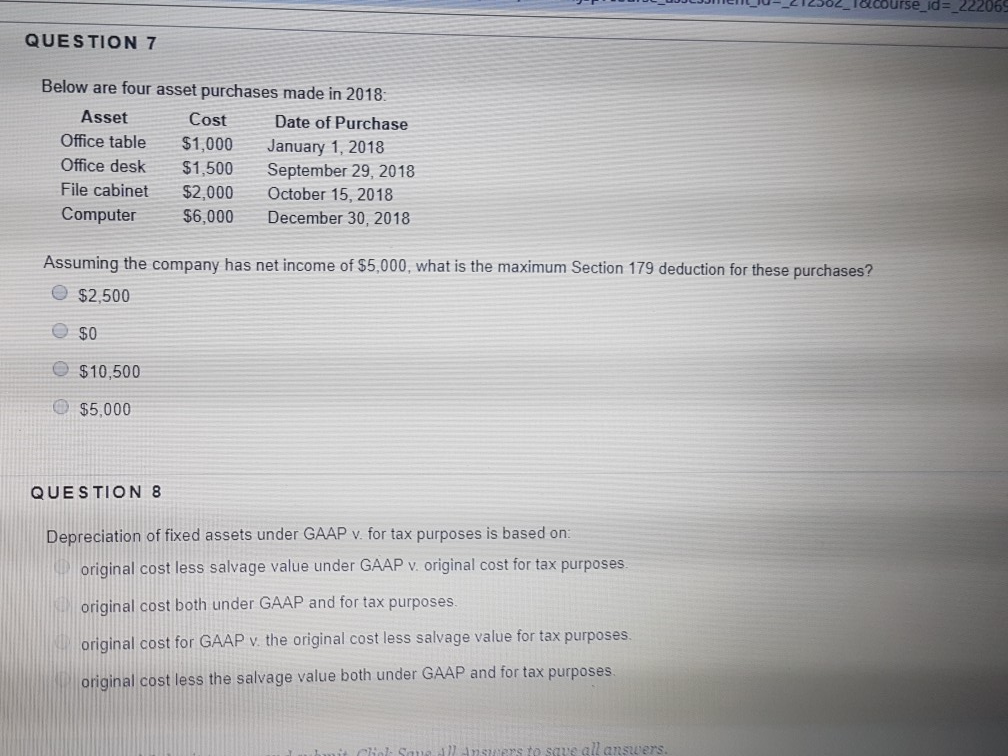

QUESTION 7 Below are four asset purchases made in 2018 Asset Ofice table $1,000 January 1, 2018 Office desk $1,500 September 29, 2018 File cabinet

QUESTION 7 Below are four asset purchases made in 2018 Asset Ofice table $1,000 January 1, 2018 Office desk $1,500 September 29, 2018 File cabinet $2,000 October 15, 2018 Computer$6,000 December 30, 2018 Cost Date of Purchase Assuming the company has net income of $5,000, what is the maximum Section 179 deduction fo these purchases? $2,500 $0 $10,500 $5,000 QUESTION 8 Depreciation of fixed assets under GAAP v. for tax purposes is based on original cost less salvage value under GAAP v. original cost for tax purposes original cost both under GAAP and for tax purposes original cost for GAAP v the original cost less salvage value for tax purposes original cost less the salvage value both under GAAP and for tax purposes mhn el S al insirers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started