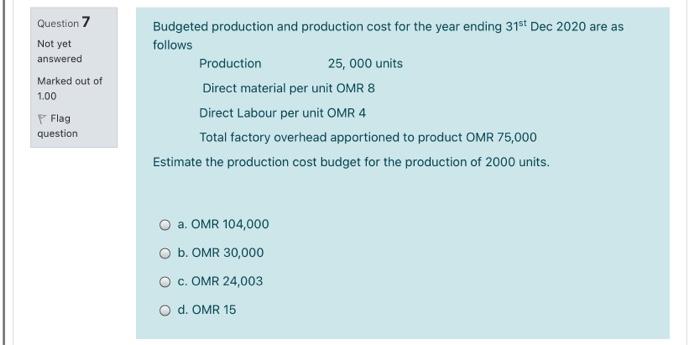

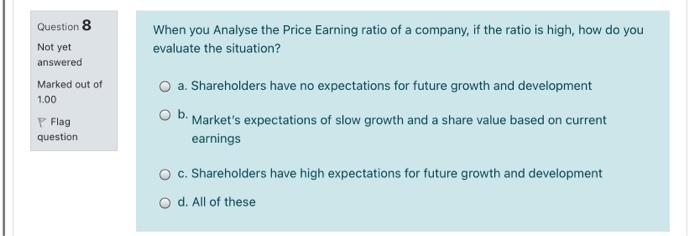

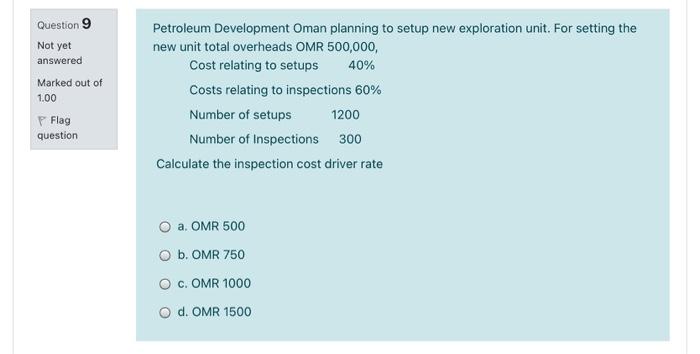

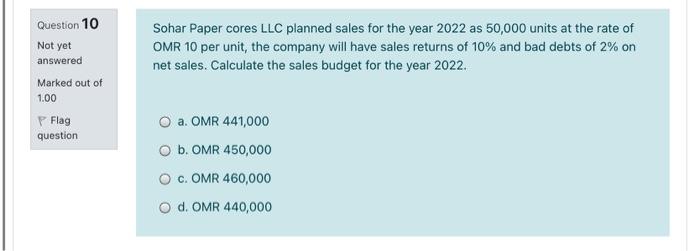

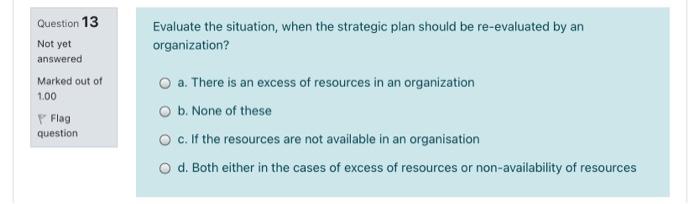

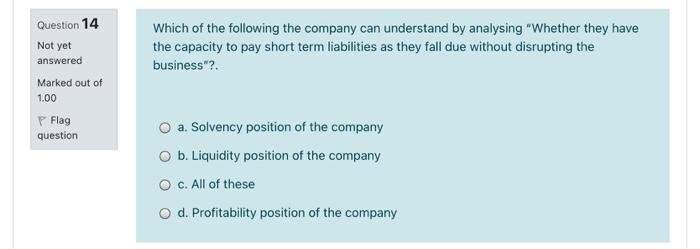

Question 7 Not yet answered Marked out of 1.00 P Flag question Budgeted production and production cost for the year ending 31st Dec 2020 are as follows Production 25,000 units Direct material per unit OMR 8 Direct Labour per unit OMR 4 Total factory overhead apportioned to product OMR 75,000 Estimate the production cost budget for the production of 2000 units. a. OMR 104,000 O b. OMR 30,000 O c. OMR 24,003 d. OMR 15 When you Analyse the Price Earning ratio of a company, if the ratio is high, how do you evaluate the situation? Question 8 Not yet answered Marked out of 1.00 Flag question O a. Shareholders have no expectations for future growth and development O b. Market's expectations of slow growth and a share value based on current earnings O c. Shareholders have high expectations for future growth and development d. All of these Question 8 When you Analyse the Price Earning ratio of a company, if the ratio is high, how do you evaluate the situation? Not yet answered Marked out of 1.00 a. Shareholders have no expectations for future growth and development O b. Market's expectations of slow growth and a share value based on current earnings Flag question OC. Shareholders have high expectations for future growth and development d. All of these Question 9 Not yet answered Marked out of 1.00 P Flag question Petroleum Development Oman planning to setup new exploration unit. For setting the new unit total overheads OMR 500,000, Cost relating to setups 40% Costs relating to inspections 60% Number of setups 1200 Number of Inspections 300 Calculate the inspection cost driver rate O a OMR 500 b. OMR 750 O c. OMR 1000 d. OMR 1500 Question 10 Not yet Sohar Paper cores LLC planned sales for the year 2022 as 50,000 units at the rate of OMR 10 per unit, the company will have sales returns of 10% and bad debts of 2% on net sales. Calculate the sales budget for the year 2022. answered Marked out of 1.00 P Flag question a. OMR 441,000 O b. OMR 450,000 O c. OMR 460,000 O d. OMR 440,000 Evaluate the situation, when the strategic plan should be re-evaluated by an organization? Question 13 Not yet answered Marked out of 1.00 Flag question a. There is an excess of resources in an organization b. None of these c. If the resources are not available in an organisation Od. Both either in the cases of excess of resources or non-availability of resources Which of the following the company can understand by analysing "Whether they have the capacity to pay short term liabilities as they fall due without disrupting the business"? Question 14 Not yet answered Marked out of 1.00 P Flag question a. Solvency position of the company O b. Liquidity position of the company c. All of these d. Profitability position of the company