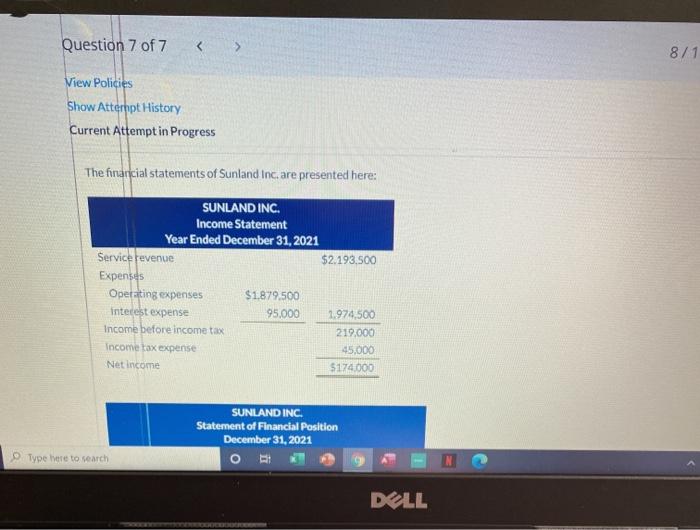

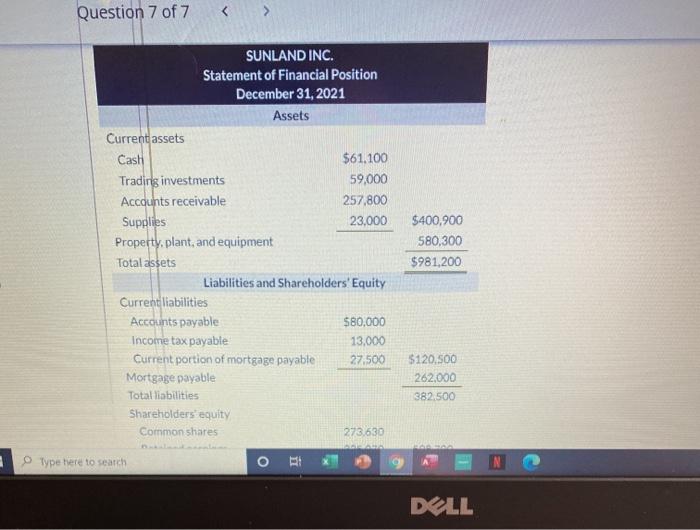

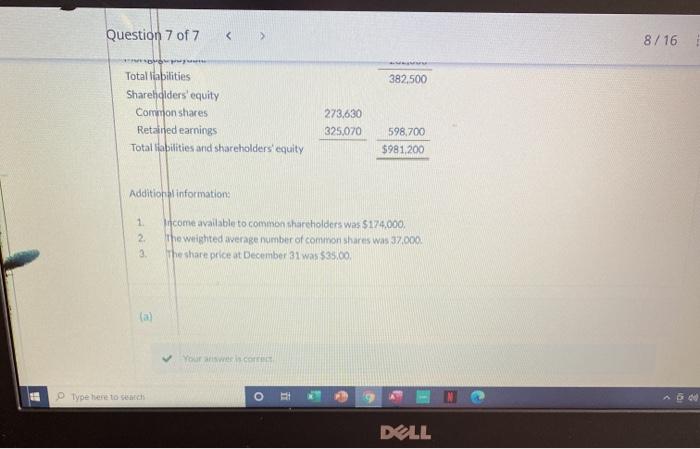

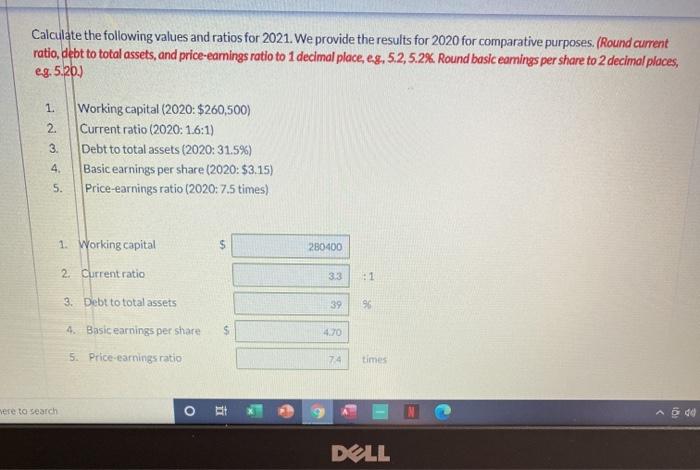

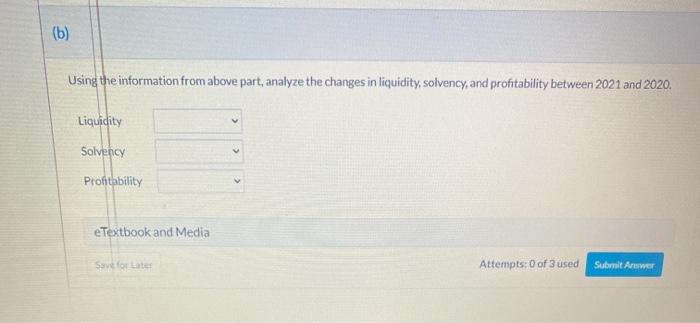

Question 7 of 7 8/1 View Policies Show Attempt History Current Attempt in Progress The financial statements of Sunland Inc. are presented here: SUNLAND INC. Income Statement Year Ended December 31, 2021 Service revenue $2.193.500 Expenses Operating expenses $1.879.500 interest expense 95.000 1.974,500 Income before income tax 219.000 Income tax expense 45,000 Net Income $174.000 SUNLAND INC. Statement of Financial Position December 31, 2021 Type here to search DELL Question 7 of 7 SUNLAND INC. Statement of Financial Position December 31, 2021 Assets Current assets Cash $61,100 Trading investments 59,000 Accounts receivable 257,800 Supplies 23.000 Property, plant, and equipment Total assets Liabilities and Shareholders' Equity Current liabilities Accounts payable $80,000 Income tax payable 13.000 Current portion of mortgage payable 27,500 Mortgage payable Total liabilities Shareholders equity Common shares 273.630 $400,900 580,300 $981,200 $120.500 262.000 382.500 Type here to search DELL Question 7 of 7 8/16 382,500 Total liabilities Shareholders' equity Common shares Retailed earnings Total abilities and shareholders equity 273.630 325,070 598,700 $981,200 Addition blinformation 1 2 3 N Income available to common shareholders was 174.000, the weighted average number of common shares was 37.000 the share price at December 31 was $35.00 (a) Your answers Type here to death IN DELL Calculate the following values and ratios for 2021. We provide the results for 2020 for comparative purposes. (Round current ratio, debt to total assets, and price-earnings ratio to 1 decimal place, e., 5.2, 5.2%. Round basic earnings per share to 2 decimal places, eg. 5.26.) 1. 2. 3. 4. 5. Working capital (2020: $260,500) Current ratio (2020: 1.6:1) Debt to total assets (2020: 31.5%) Basic earnings per share (2020: $3.15) Price-earnings ratio (2020:7.5 times) 1. Working capital A 280400 2 Current ratio 3.3 :1 39 90 3. Debt to total assets A Basic earnings per share 5. Price-earnings ratio S 4.70 74 times ere to search O i Add DELL (b) Using the information from above part, analyze the changes in liquidity, solvency, and prohtability between 2021 and 2020. Liquidity Solvency Profitability e Textbook and Media Savefonater Attempts:0 of 3 used Submit