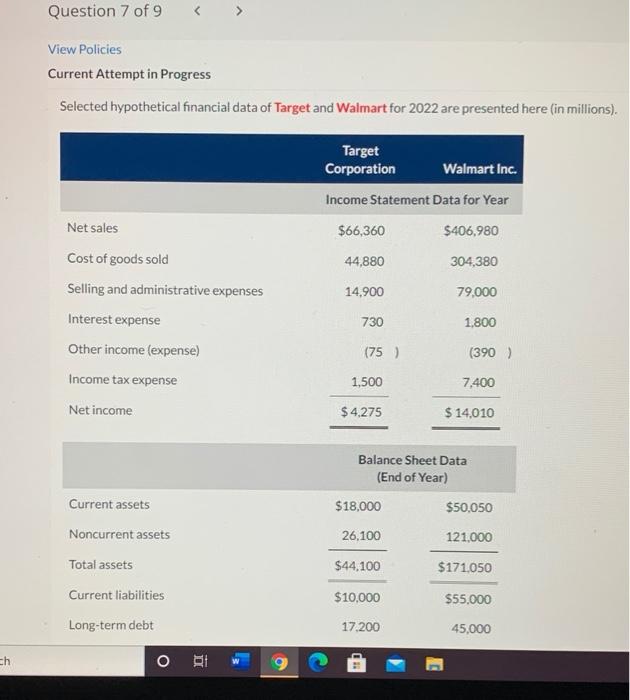

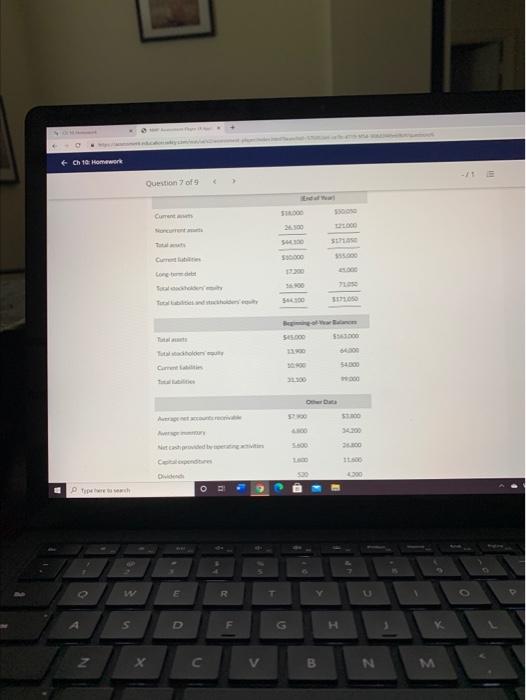

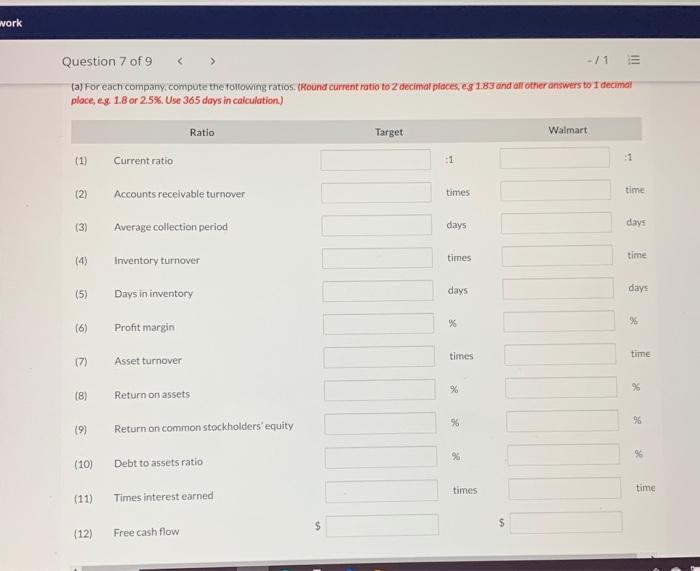

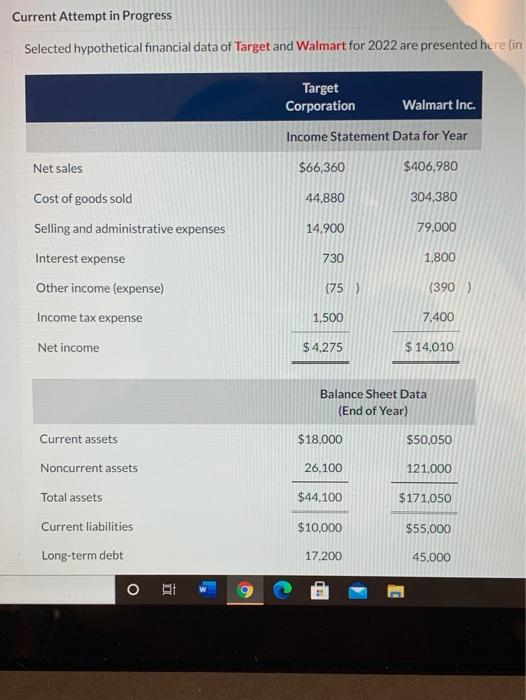

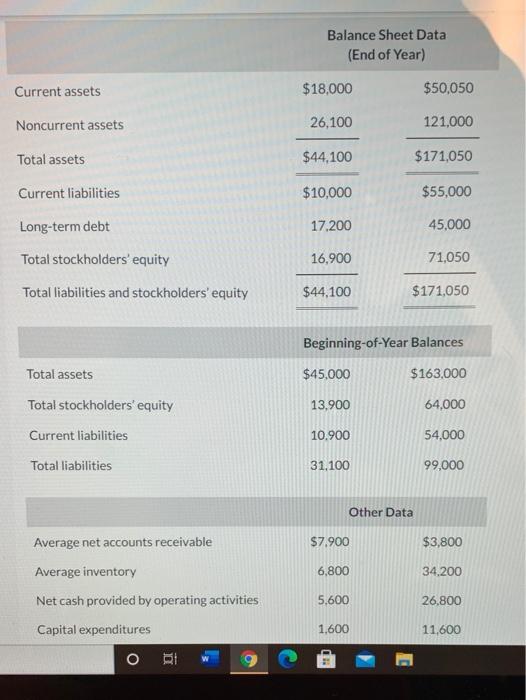

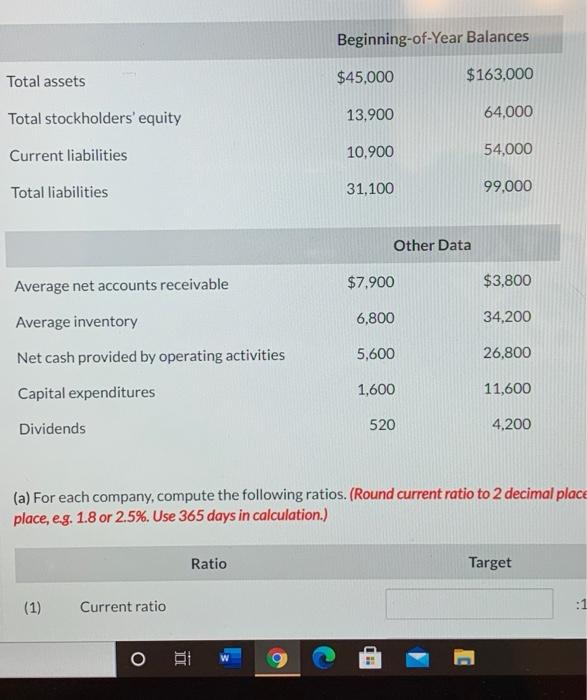

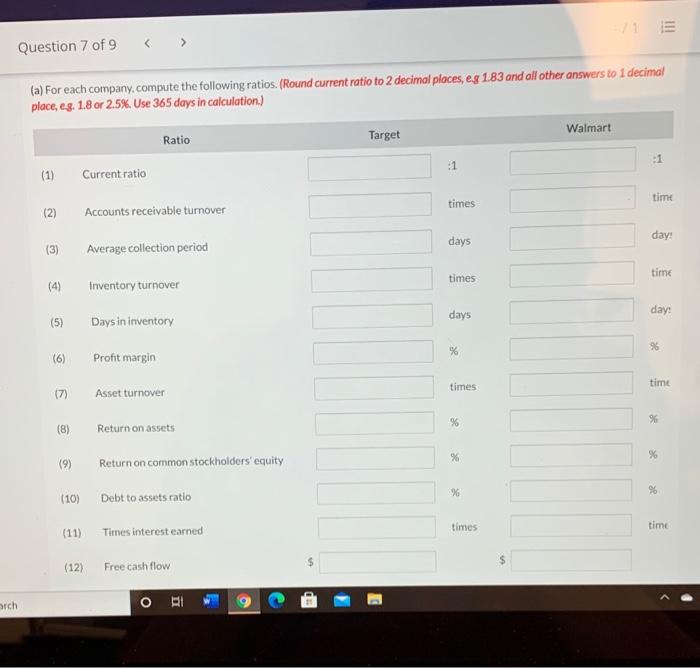

Question 7 of 9 View Policies Current Attempt in Progress Selected hypothetical financial data of Target and Walmart for 2022 are presented here (in millions). Target Corporation Walmart Inc. Income Statement Data for Year Net sales $66,360 $406,980 Cost of goods sold 44,880 304,380 Selling and administrative expenses 14,900 79,000 Interest expense 730 1,800 Other income (expense) (75) (390) Income tax expense 1,500 7,400 Net income $4,275 $ 14,010 Balance Sheet Data (End of Year) Current assets $18,000 $50,050 Noncurrent assets 26,100 121.000 Total assets $44.100 $171,050 Current liabilities $10,000 $55.000 Long-term debt 17.200 45,000 ch O BI g Ch 10 Home - Question of Current 504300 S000 con 5.000 Tudor Com 54.000 LO SO 200 00 300 Piper O 9 Q V E R T Y o S D G H 3 N x c. V B N M work Question 7 of 9 - / 1 (a) For each company.compute the following ratios. (Round current ratio to 2 decimal places, eg 183 and all other answers to I decima! place, es 1.8 or 2.5%. Use 365 days in calculation.) Ratio Target Walmart (1) 1 :1 Current ratio time times Accounts receivable turnover () (3 () days days Average collection period time times Inventory turnover (5) days days Days in inventory % 96 (6) Profit margin times time Asset turnover % % (8) 8 Return on assets % % (9) Return on common stockholders equity % % % (10) Debt to assets ratio times time (11) Times interest earned $ $ (12) Free cash flow Current Attempt in Progress Selected hypothetical financial data of Target and Walmart for 2022 are presented here (in Target Corporation Walmart Inc. Income Statement Data for Year Net sales $66,360 $406,980 Cost of goods sold 44,880 304,380 Selling and administrative expenses 14,900 79,000 Interest expense 730 1,800 Other income (expense) (75) (390) Income tax expense 1,500 7.400 Net income $ 4,275 $ 14,010 Balance Sheet Data (End of Year) Current assets $18,000 $50,050 Noncurrent assets 26.100 121,000 Total assets $44.100 $171,050 Current liabilities $10,000 $55,000 Long-term debt 17.200 45,000 O BE Balance Sheet Data (End of Year) Current assets $18,000 $50,050 Noncurrent assets 26,100 121,000 Total assets $44,100 $171,050 Current liabilities $10,000 $55,000 Long-term debt 17,200 45,000 Total stockholders' equity 16,900 71,050 Total liabilities and stockholders' equity $44,100 $171,050 Beginning-of-Year Balances Total assets $45,000 $163.000 Total stockholders' equity 13,900 64,000 Current liabilities 10.900 54,000 Total liabilities 31.100 99,000 Other Data Average net accounts receivable $7.900 $3,800 Average inventory 6,800 34.200 Net cash provided by operating activities 5,600 26.800 Capital expenditures 1,600 11,600 O BI Beginning-of-Year Balances Total assets $45,000 $163,000 13,900 64,000 Total stockholders' equity Current liabilities 10.900 54,000 Total liabilities 31,100 99.000 Other Data Average net accounts receivable $7.900 $3,800 Average inventory 6,800 34,200 Net cash provided by operating activities 5,600 26,800 Capital expenditures 1,600 11,600 Dividends 520 4,200 (a) For each company, compute the following ratios. (Round current ratio to 2 decimal place place, eg. 1.8 or 2.5%. Use 365 days in calculation.) Ratio Target (1) Current ratio Question 7 of 9 (a) For each company, compute the following ratios. (Round current ratio to 2 decimal places, eg 183 and all other answers to 1 decimal place, es. 18 or 2.5%. Use 365 days in calculation) Walmart Target Ratio :1 :1 1 (1) Current ratio time times (2) Accounts receivable turnover day: days (3) Average collection period time times (4) Inventory turnover days day: (5) Days in inventory 96 % (6) Profit margin times time (7) Asset turnover % 96 % (8) Return on assets % % (9) Return on common stockholders' equity % 90 (10) Debt to assets ratio times time (11) Times interest earned $ (12) Free cash flow arch ORE g