Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 7 Question 3 5 pts Which approach to value generally estimates the highest value, and is least likely to be relied on by the

question 7

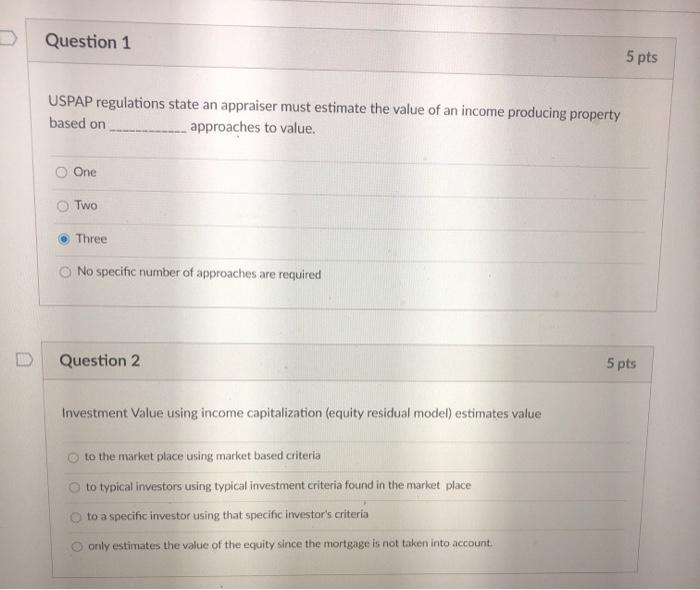

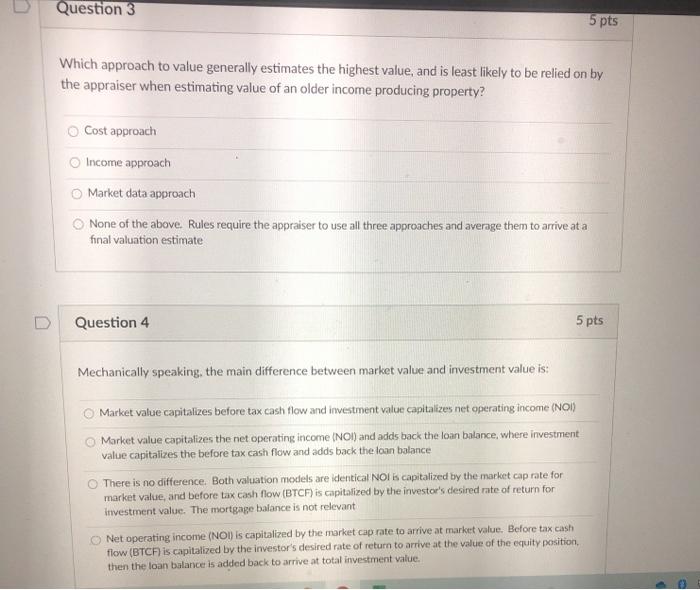

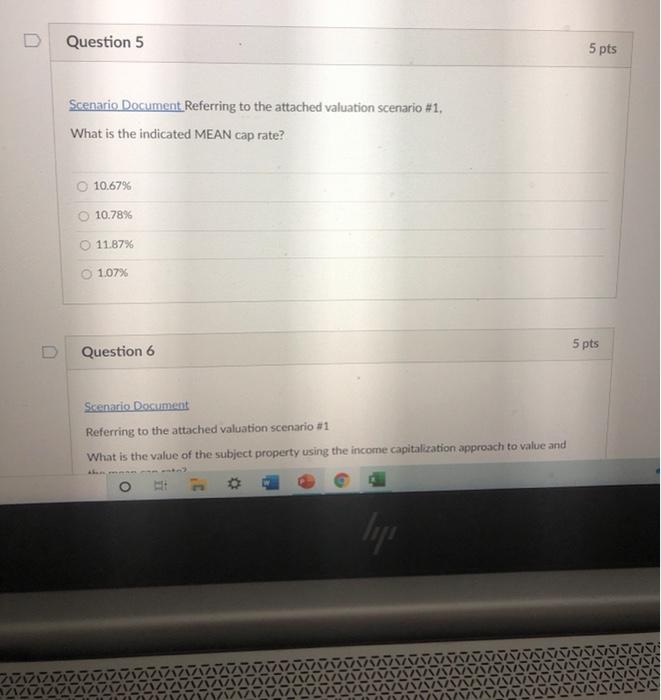

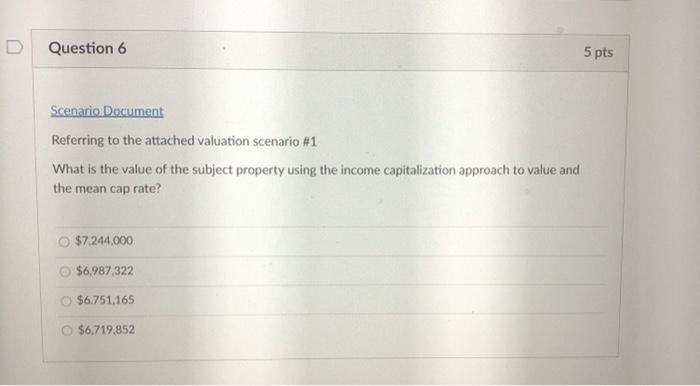

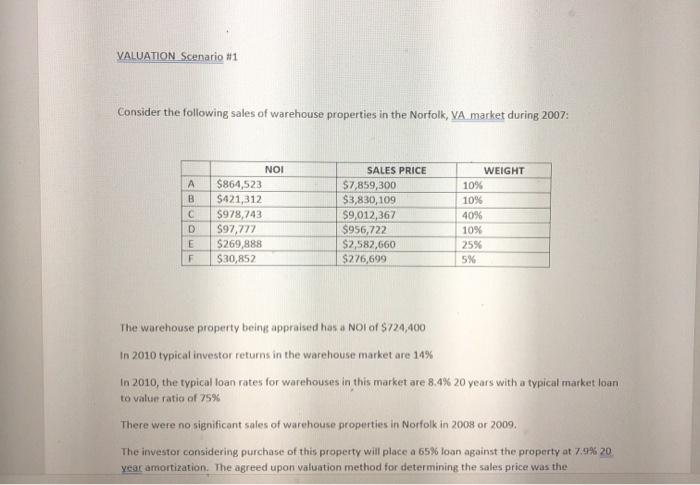

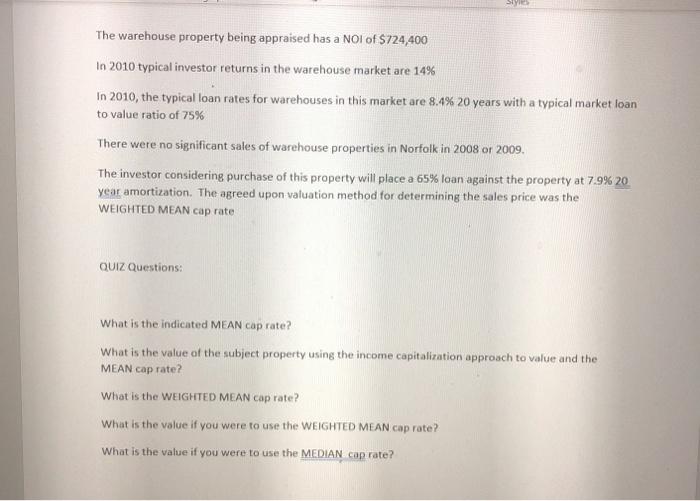

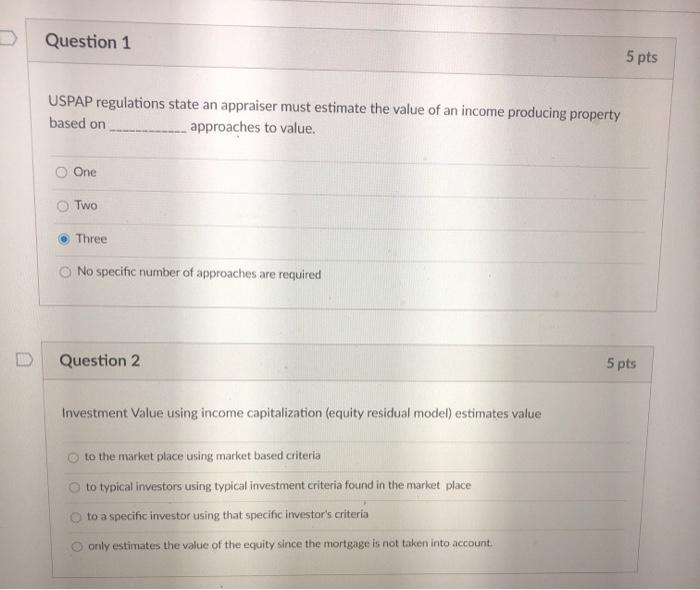

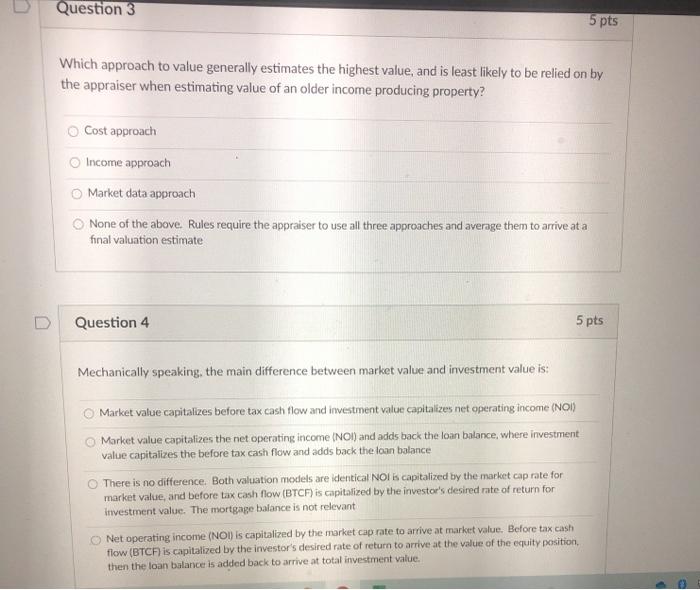

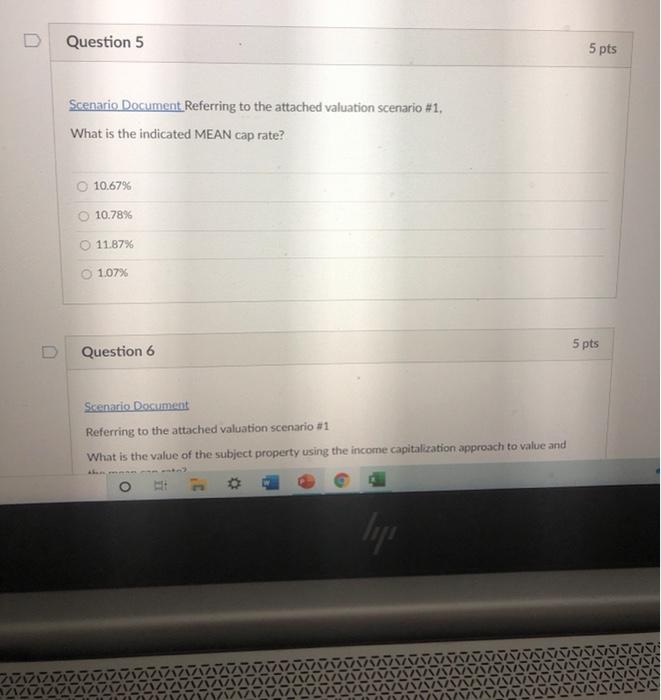

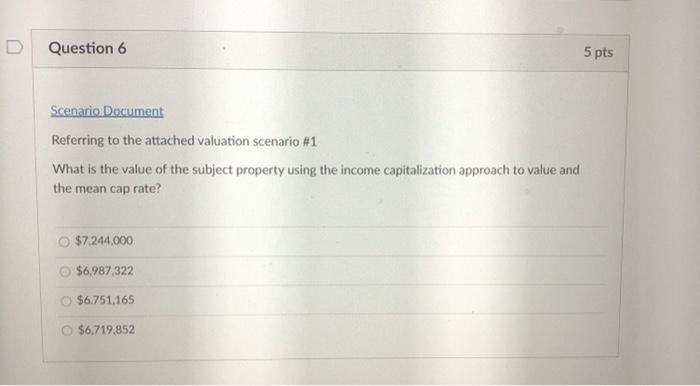

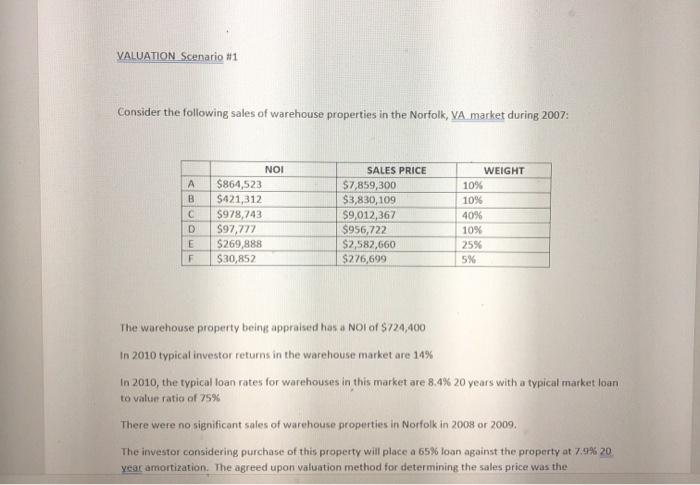

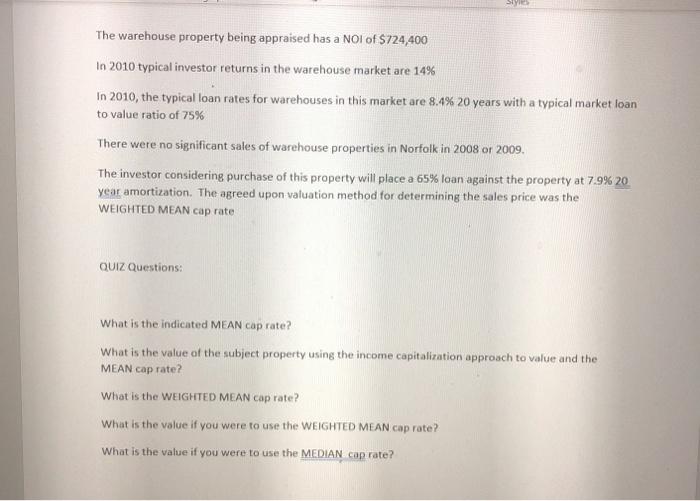

Question 3 5 pts Which approach to value generally estimates the highest value, and is least likely to be relied on by the appraiser when estimating value of an older income producing property? Cost approach Income approach Market data approach None of the above. Rules require the appraiser to use all three approaches and average them to arrive at a final valuation estimate Question 4 5 pts Mechanically speaking, the main difference between market value and investment value is: Market value capitalizes before tax cash flow and investment value capitalizes net operating income (NO) Market value capitalizes the net operating income (NOI) and adds back the loan balance, where investment value capitalizes the before tax cash flow and adds back the loan balance There is no difference. Both valuation models are identical NOI E capitalized by the market cap rate for market value, and before tax cash flow (BTCF) is capitalized by the investor's desired rate of return for investment value. The mortgage balance is not relevant Net operating income (NOI) is capitalized by the market cap rate to arrive at market value. Before tax cash flow (BTCF) is capitalized by the investor's desired rate of return to arrive at the value of the equity position, then the loan balance is added back to arrive at total investment value. Question 5 5 pts Scenario Document Referring to the attached valuation scenario #1, What is the indicated MEAN cap rate? 10.679 10.78% 11.87% 1.07% 5 pts Question 6 Skenario Document Referring to the attached valuation scenario #1 What is the value of the subject property using the income capitalization approach to value and Question 6 5 pts Scenario Document Referring to the attached valuation scenario #1 What is the value of the subject property using the income capitalization approach to value and the mean cap rate? $7244,000 $6,987,322 $6.751.165 $6.719,852 Question 7 5 pts Referring to the attached valuation scenario #1 Scenario Document What is the weighted mean cap rate? 10.73% 11.01% O 10.78% 11.20% Question 8 15 pts VALUATION Scenario #1 Consider the following sales of warehouse properties in the Norfolk, VA market during 2007: B C D E F NOI $864,523 $421,312 $978,743 $97,777 $269,888 $30,852 SALES PRICE $7,859,300 $3,830,109 $9.012,367 $956,722 $2,582,660 $276,699 WEIGHT 10% 10% 40% 10% 25% 5% The warehouse property being appraised has a NOI of $724,400 In 2010 typical investor returns in the warehouse market are 14% In 2010, the typical loan rates for warehouses in this market are 8.4% 20 years with a typical market loan to value ratio of 75% There were no significant sales of warehouse properties in Norfolk in 2008 or 2009. The investor considering purchase of this property will place a 65% loan against the property at 7.9% 20 year amortization. The agreed upon valuation method for determining the sales price was the ST The warehouse property being appraised has a NOI of S724,400 In 2010 typical investor returns in the warehouse market are 14% In 2010, the typical loan rates for warehouses in this market are 8.4% 20 years with a typical market loan to value ratio of 75% There were no significant sales of warehouse properties in Norfolk in 2008 or 2009. The investor considering purchase of this property will place a 65% loan against the property at 7.9% 20 year amortization. The agreed upon valuation method for determining the sales price was the WEIGHTED MEAN cap rate QUIZ Questions: What is the indicated MEAN cap rate? What is the value of the subject property using the income capitalization approach to value and the MEAN cap rate? What is the WEIGHTED MEAN cap rate? What is the value if you were to use the WEIGHTED MEAN cap rate? What is the value if you were to use the MEDIAN cap rate? What is the value if you were to use the MODE cap rate? What is the cap rate using Mortgage Equity Analysis? What is the value using a cap rate from mortgage equity analysis? Which cap rate do you consider most relevant to an appraisal of this property and why? Based on the criteria of the potential investor noted above what is the investment value? Should the potential investor buy this property based on this data

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started