Answered step by step

Verified Expert Solution

Question

1 Approved Answer

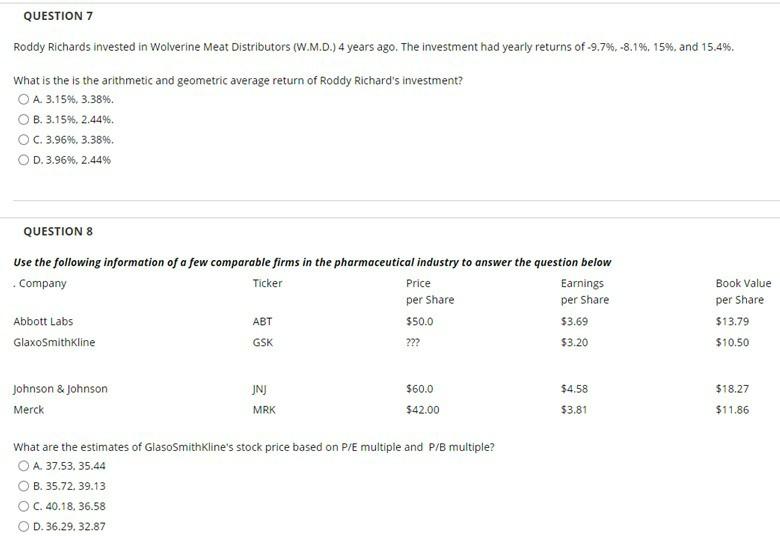

QUESTION 7 Roddy Richards invested in Wolverine Meat Distributors (W.M.D.) 4 years ago. The investment had yearly returns of-9.7%.-8.1%, 15%. and 15.4%. What is the

QUESTION 7 Roddy Richards invested in Wolverine Meat Distributors (W.M.D.) 4 years ago. The investment had yearly returns of-9.7%.-8.1%, 15%. and 15.4%. What is the is the arithmetic and geometric average return of Roddy Richard's investment? OA. 3.15%, 3.38%. B. 3.15%, 2.44%. C. 3.9696.3.3896. D. 3.96%, 2.4496 QUESTION 8 Use the following information of a few comparable firms in the pharmaceutical industry to answer the question below Company Ticker Price Earnings per Share per Share Abbott Labs ABT $50.0 $3.69 GlaxoSmithKline GSK $3.20 Book Value per Share $13.79 $10.50 ??? $18.27 Johnson & Johnson Merck JN MRK $60.0 $42.00 $4.58 $3.81 $11.86 What are the estimates of GlasoSmithKline's stock price based on P/E multiple and P/B multiple? O A. 37.53. 35.44 O B. 35.72.39.13 OC. 40.18. 36.58 OD.36.29.32.87

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started