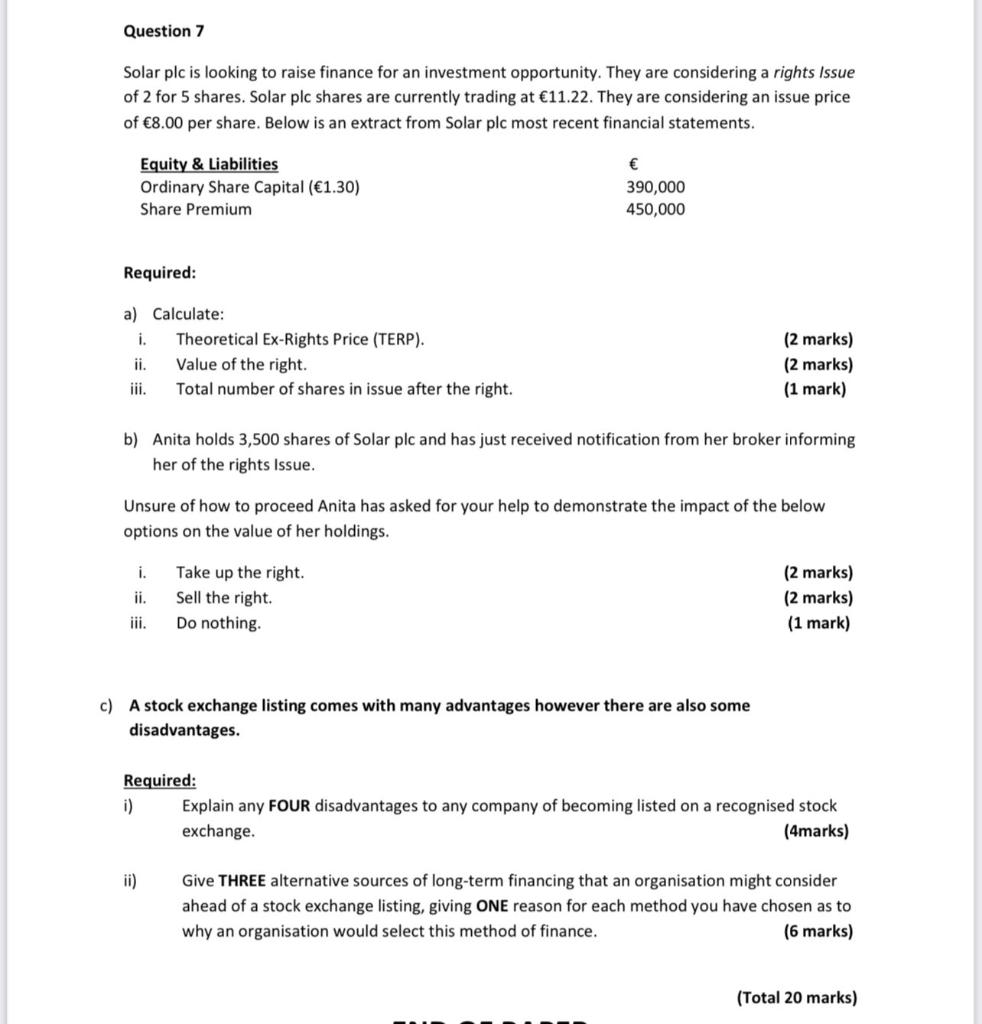

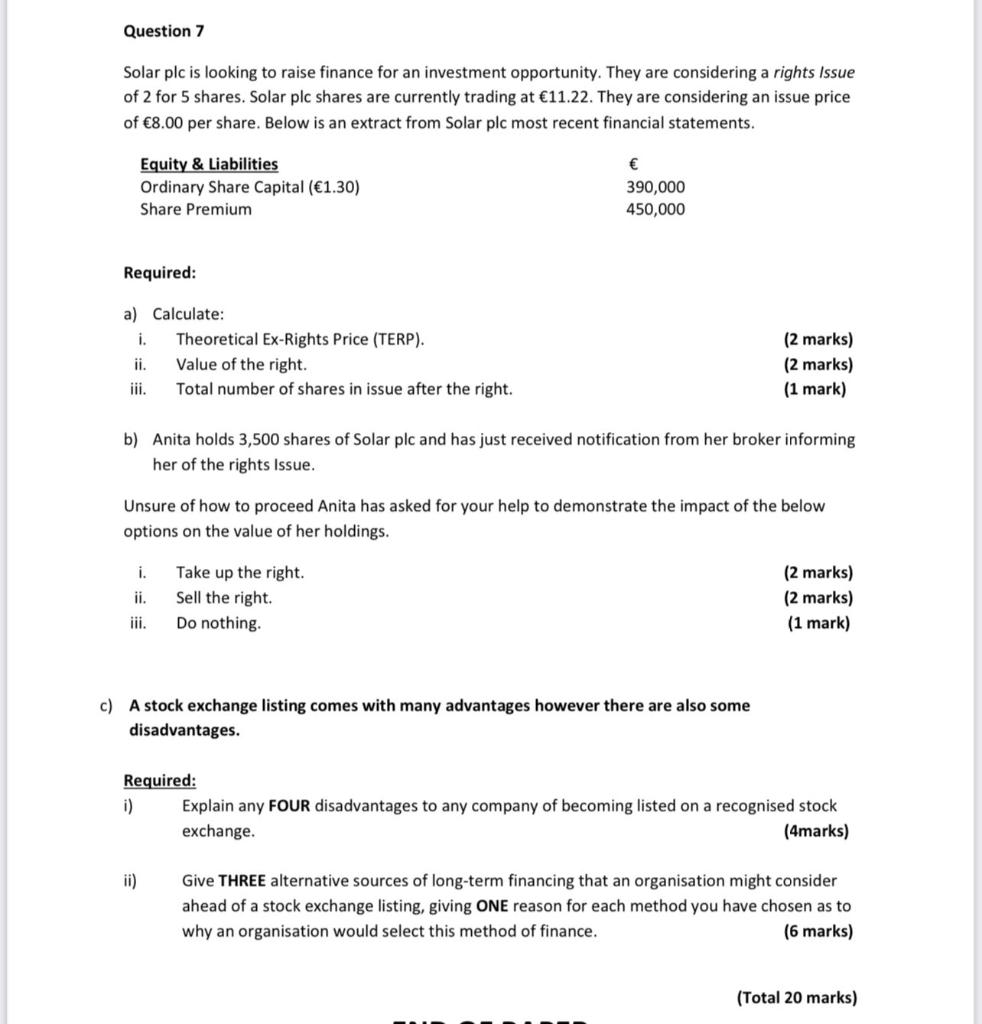

Question 7 Solar plc is looking to raise finance for an investment opportunity. They are considering a rights Issue of 2 for 5 shares. Solar plc shares are currently trading at 11.22. They are considering an issue price of 8.00 per share. Below is an extract from Solar plc most recent financial statements. Equity & Liabilities Ordinary Share Capital (1.30) Share Premium 390,000 450,000 Required: a) Calculate: i. Theoretical Ex-Rights Price (TERP). ii. Value of the right. iii. Total number of shares in issue after the right. (2 marks) (2 marks) (1 mark) b) Anita holds 3,500 shares of Solar plc and has just received notification from her broker informing her of the rights Issue. Unsure of how to proceed Anita has asked for your help to demonstrate the impact of the below options on the value of her holdings. i. ii. Take up the right. Sell the right. Do nothing. (2 marks) (2 marks) (1 mark) c) A stock exchange listing comes with many advantages however there are also some disadvantages. Required: i) Explain any FOUR disadvantages to any company of becoming listed on a recognised stock exchange. (4marks) ii) Give THREE alternative sources of long-term financing that an organisation might consider ahead of a stock exchange listing, giving ONE reason for each method you have chosen as to why an organisation would select this method of finance. (6 marks) (Total 20 marks) Question 7 Solar plc is looking to raise finance for an investment opportunity. They are considering a rights Issue of 2 for 5 shares. Solar plc shares are currently trading at 11.22. They are considering an issue price of 8.00 per share. Below is an extract from Solar plc most recent financial statements. Equity & Liabilities Ordinary Share Capital (1.30) Share Premium 390,000 450,000 Required: a) Calculate: i. Theoretical Ex-Rights Price (TERP). ii. Value of the right. iii. Total number of shares in issue after the right. (2 marks) (2 marks) (1 mark) b) Anita holds 3,500 shares of Solar plc and has just received notification from her broker informing her of the rights Issue. Unsure of how to proceed Anita has asked for your help to demonstrate the impact of the below options on the value of her holdings. i. ii. Take up the right. Sell the right. Do nothing. (2 marks) (2 marks) (1 mark) c) A stock exchange listing comes with many advantages however there are also some disadvantages. Required: i) Explain any FOUR disadvantages to any company of becoming listed on a recognised stock exchange. (4marks) ii) Give THREE alternative sources of long-term financing that an organisation might consider ahead of a stock exchange listing, giving ONE reason for each method you have chosen as to why an organisation would select this method of finance. (6 marks) (Total 20 marks)