Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 7 Suppose you gathered historical exchange rates data for $/, regressed the spot rate change (St+1-Si) on forward differential (F-S), and obtained the

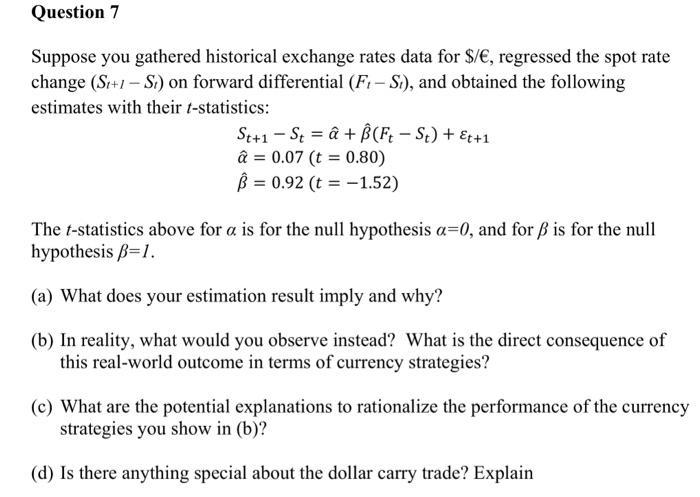

Question 7 Suppose you gathered historical exchange rates data for $/, regressed the spot rate change (St+1-Si) on forward differential (F-S), and obtained the following estimates with their t-statistics: St+1-St+B(Ft - St) + Et+1 = = 0.07 (t = 0.80) B = 0.92 (t=-1.52) The t-statistics above for a is for the null hypothesis a=0, and for is for the null hypothesis B=1. (a) What does your estimation result imply and why? (b) In reality, what would you observe instead? What is the direct consequence of this real-world outcome in terms of currency strategies? (c) What are the potential explanations to rationalize the performance of the currency strategies you show in (b)? (d) Is there anything special about the dollar carry trade? Explain

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a The estimation result implies that the spot rate change is positively related to the forward differential The tstatistic of 080 indicates that the estimated intercept is significantly different from ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started