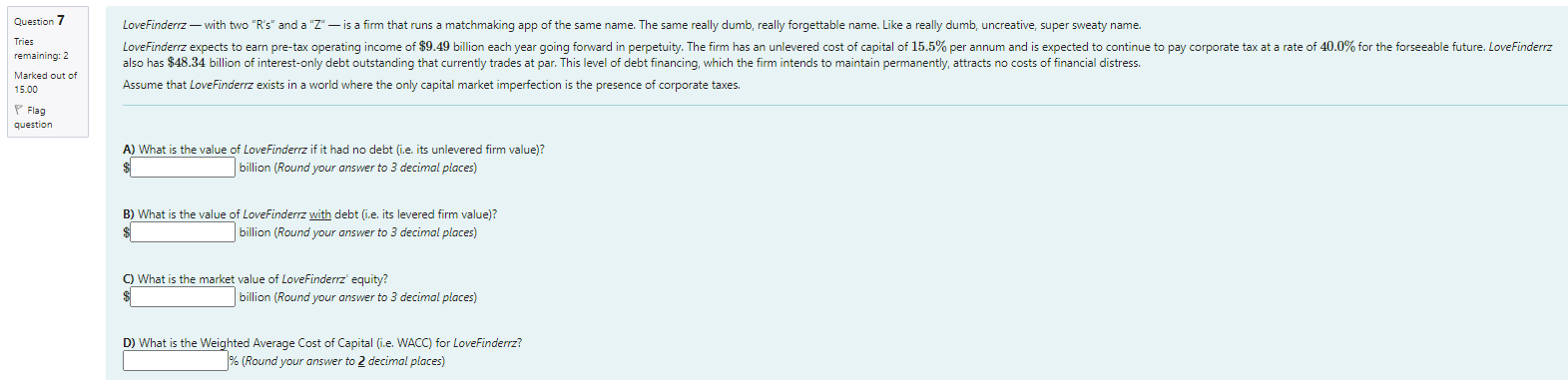

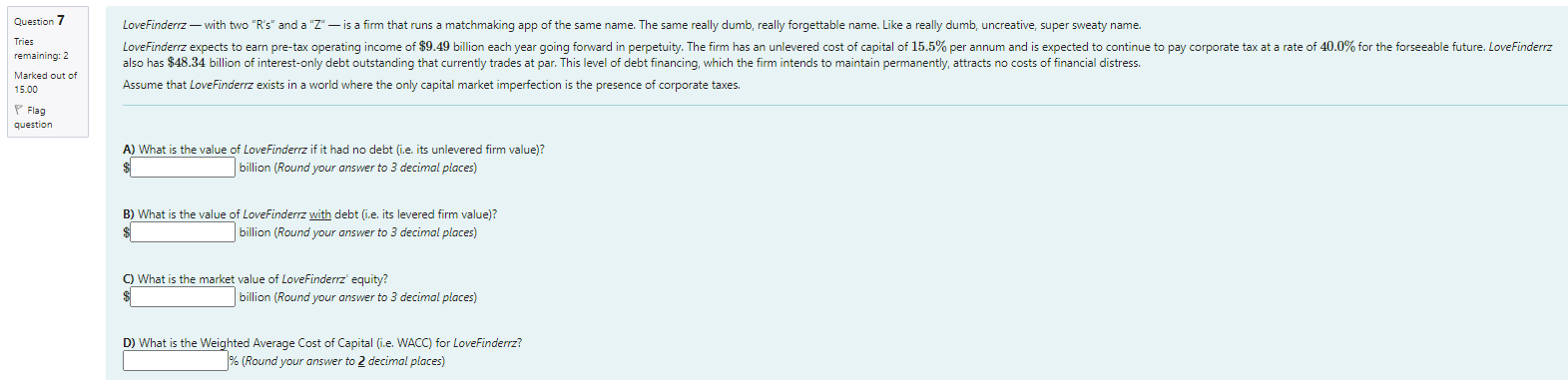

Question 7 Tries remaining: 2 Marked out of 15.00 LoveFinderrz with two "R's" and a "Z" is a firm that runs a matchmaking app of the same name. The same really dumb, really forgettable name. Like a really dumb, uncreative, super sweaty name LoveFinderrz expects to earn pre-tax operating income of $9.49 billion each year going forward in perpetuity. The firm has an unlevered cost of capital of 15.5% per annum and is expected to continue to pay corporate tax at a rate of 40.0% for the forseeable future. LoveFinderrz also has $48.34 billion of interest-only debt outstanding that currently trades at par. This level of debt financing, which the firm intends to maintain permanently, attracts no costs of financial distress. Assume that LoveFinderrz exists in a world where the only capital market imperfection is the presence of corporate taxes. P Flag question A) What is the value of LoveFinderrz if it had no debt (i.e. its unlevered firm value)? $ billion (Round your answer to 3 decimal places) B) What is the value of LoveFinderrz with debt (i.e. its levered firm value)? billion (Round your answer to 3 decimal places) C) What is the market value of LoveFinderrz' equity? billion (Round your answer to 3 decimal places) D) What is the Weighted Average Cost of Capital (i.e. WACC) for LoveFinderrz? % (Round your answer to 2 decimal places) Question 7 Tries remaining: 2 Marked out of 15.00 LoveFinderrz with two "R's" and a "Z" is a firm that runs a matchmaking app of the same name. The same really dumb, really forgettable name. Like a really dumb, uncreative, super sweaty name LoveFinderrz expects to earn pre-tax operating income of $9.49 billion each year going forward in perpetuity. The firm has an unlevered cost of capital of 15.5% per annum and is expected to continue to pay corporate tax at a rate of 40.0% for the forseeable future. LoveFinderrz also has $48.34 billion of interest-only debt outstanding that currently trades at par. This level of debt financing, which the firm intends to maintain permanently, attracts no costs of financial distress. Assume that LoveFinderrz exists in a world where the only capital market imperfection is the presence of corporate taxes. P Flag question A) What is the value of LoveFinderrz if it had no debt (i.e. its unlevered firm value)? $ billion (Round your answer to 3 decimal places) B) What is the value of LoveFinderrz with debt (i.e. its levered firm value)? billion (Round your answer to 3 decimal places) C) What is the market value of LoveFinderrz' equity? billion (Round your answer to 3 decimal places) D) What is the Weighted Average Cost of Capital (i.e. WACC) for LoveFinderrz? % (Round your answer to 2 decimal places)