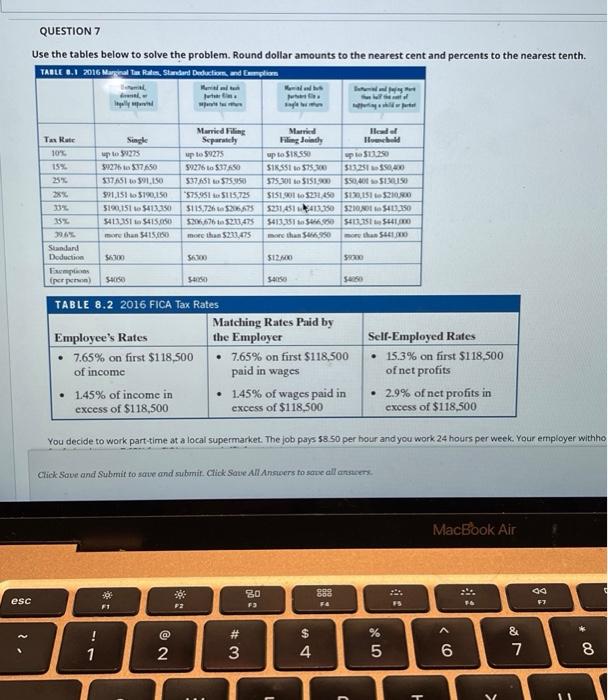

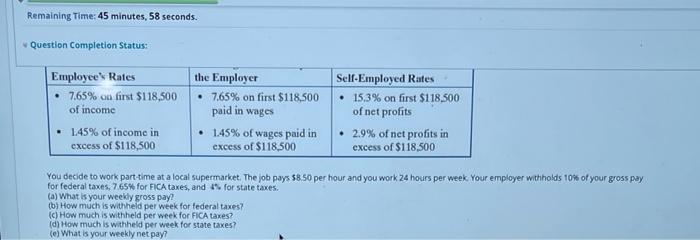

QUESTION 7 Use the tables below to solve the problem. Round dollar amounts to the nearest cent and percents to the nearest tenth. TABLE 8.1 2016 Marzenal Tas Rales Standard Deduction and Compliam With Bay Sur Tapally Tax Rate 102 15% Single up to 25 5927657450 337 A51391.150 $71.15105190,150 5190.151 6 5413.130 5413_315415.050 more than $415.050 Married Fling Separately up to 59275 59276.537.650 537.651 to $75.950 575.951 65115.725 5115,726526575 2765211475 more than $232,475 Married llow Fileg Jointly Il up to $18.950 up to 250 SIK 351 to 575,300 513.250.400 575.301 3151.500 550.000 SIMS S15130105232,450 $US $210.00 5231431413.150 5210 5401350 541333 Sekso 5451544100 more than 50 SLO 28% 33% $6300 $6,500 $12.00 SO Standard Doduction Frempah () 5650 5450 545 5460 TABLE 8.2 2016 FICA Tax Rates Matching Rates Paid by Employee's Rates the Employer 7.65% on first $118,500 7.65% on first $118,500 of income paid in wages 1.45% of income in 1.45% of wages paid in excess of $118,500 excess of $118,500 Self-Employed Rates 15.3% on first $118,500 of net profits 2.9% of net profits in excess of $118,500 . You decide to work part-time at a local supermarket. The job pays $8.50 per hour and you work 24 hours per week. Your employer withho Click Save and Submit to save and subunit. Click Save All Answers to save all are MacBook Air 30 F3 F2 esc F1 F2 F : 75 ! 1 @ 2 # 3 $ 4 % 5 & 7 6 8 T V 11 Remaining Time: 45 minutes, 58 seconds. Question Completion Status: Employee's Rates 7.65% on first $118,500 of income 145% of income in excess of $118,500 the Employer 7.65% on first $118,500 paid in wages 1.45% of wages paid in excess of $118.500 Self-Employed Rates 15,3% on first $118.500 of net profits 2.9% of net profits in excess of $118,500 You decide to work part time at a local supermarket. The job pays $8.50 per hour and you work 24 hours per week. Your employer withholds 10% of your gross pay for federal taxes, 7.65% for FICA taxes, and for state taxes. (a) What is your weekly gross pay? (b) How much is withheld per week for federal taxes? (c) How much is withheld per week for FICA taxes? (d) How much is withheld per week for state taxes? (e) What is your weekly net pay