Answered step by step

Verified Expert Solution

Question

1 Approved Answer

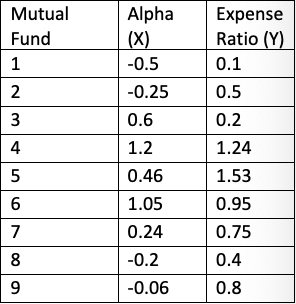

Question #7: You are interested in whether excess risk-adjusted return (alpha) is correlated with mutual fund expense ratios for US large-cap growth funds. The following

Question #7: You are interested in whether excess risk-adjusted return (alpha) is correlated with mutual fund expense ratios for US large-cap growth funds. The following table presents the sample.

A. Formulate null and alternative hypotheses consistent with the verbal description of the research goal.

B. Identify the test statistic for conducting a test of the hypotheses in Part A.

C. Justify your selection in Part B.

D. Determine whether or not to reject the null hypothesis at the 0.10, 0.05 and 0.02 level of significance.

\begin{tabular}{|l|l|l|} Mutual Fund & Alpha (X) & Expense Ratio (Y) \\ \hline 1 & 0.5 & 0.1 \\ \hline 2 & 0.25 & 0.5 \\ \hline 3 & 0.6 & 0.2 \\ \hline 4 & 1.2 & 1.24 \\ \hline 5 & 0.46 & 1.53 \\ \hline 6 & 1.05 & 0.95 \\ \hline 7 & 0.24 & 0.75 \\ \hline 8 & 0.2 & 0.4 \\ \hline 9 & 0.06 & 0.8 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} Mutual Fund & Alpha (X) & Expense Ratio (Y) \\ \hline 1 & 0.5 & 0.1 \\ \hline 2 & 0.25 & 0.5 \\ \hline 3 & 0.6 & 0.2 \\ \hline 4 & 1.2 & 1.24 \\ \hline 5 & 0.46 & 1.53 \\ \hline 6 & 1.05 & 0.95 \\ \hline 7 & 0.24 & 0.75 \\ \hline 8 & 0.2 & 0.4 \\ \hline 9 & 0.06 & 0.8 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started