Answered step by step

Verified Expert Solution

Question

1 Approved Answer

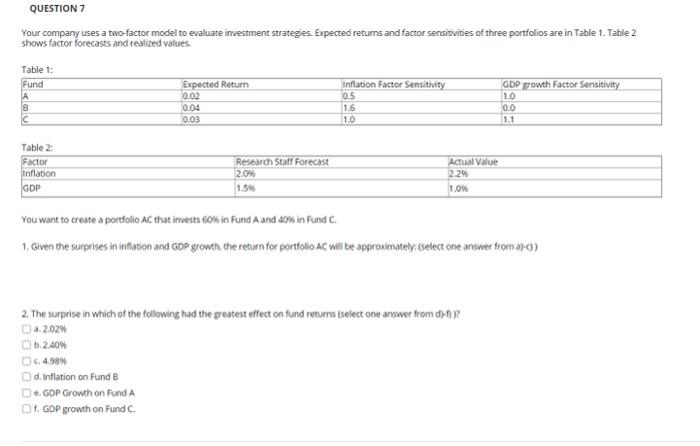

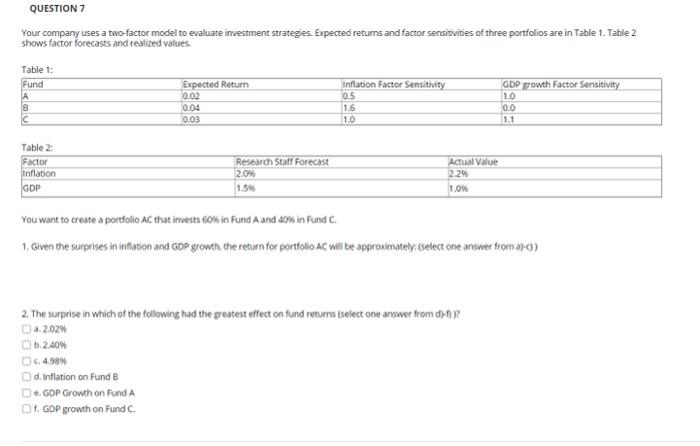

QUESTION 7 Your company uses a two-factor model to evaluate investment strategies. Expected retums and factor sensitivities of three portfolios are in Table 1. Table

QUESTION 7 Your company uses a two-factor model to evaluate investment strategies. Expected retums and factor sensitivities of three portfolios are in Table 1. Table 2 shows factor forecasts and realized values. GDP growth Factor Sensitivity Table 1: Fund A B c Expected Return 0.02 0.04 0.03 Inflation Factor Sensitivity 05 1.6 10 10 0.0 1.1 Table 2: Factor Inflation GDP Research Staff Forecast 2.04 1.54 Actual Value 2.29 1.08 You want to create a portfolio AC that invests 60 in Fund A and 20% in Fund C. 1. Given the surprises in inflation and GDP growth the return for portfolio AC will be approximately select one answer from aro) 2. The surprise in which of the following had the greatest effect on fund returns (select one answer from do a.2024 6.2.40% 6.4.98% di Inflation on Fund B O. GOP Growth on Fund A Of. GDP growth on Fund

QUESTION 7 Your company uses a two-factor model to evaluate investment strategies. Expected retums and factor sensitivities of three portfolios are in Table 1. Table 2 shows factor forecasts and realized values. GDP growth Factor Sensitivity Table 1: Fund A B c Expected Return 0.02 0.04 0.03 Inflation Factor Sensitivity 05 1.6 10 10 0.0 1.1 Table 2: Factor Inflation GDP Research Staff Forecast 2.04 1.54 Actual Value 2.29 1.08 You want to create a portfolio AC that invests 60 in Fund A and 20% in Fund C. 1. Given the surprises in inflation and GDP growth the return for portfolio AC will be approximately select one answer from aro) 2. The surprise in which of the following had the greatest effect on fund returns (select one answer from do a.2024 6.2.40% 6.4.98% di Inflation on Fund B O. GOP Growth on Fund A Of. GDP growth on Fund

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started