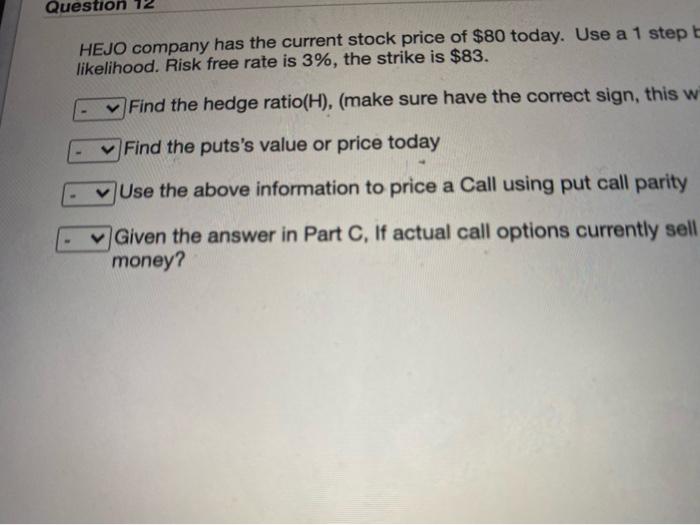

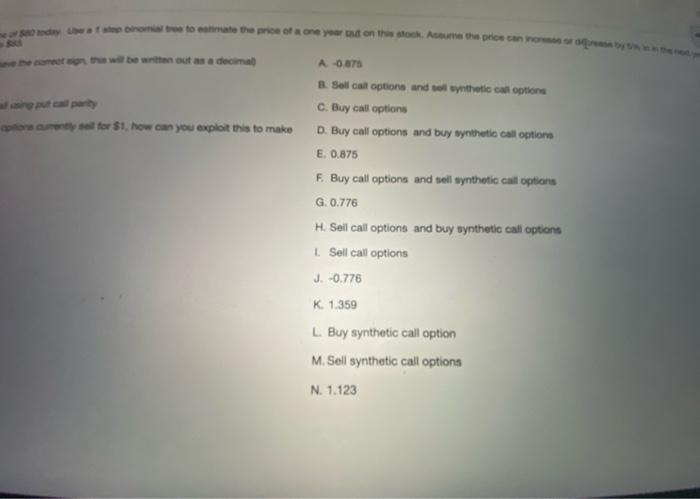

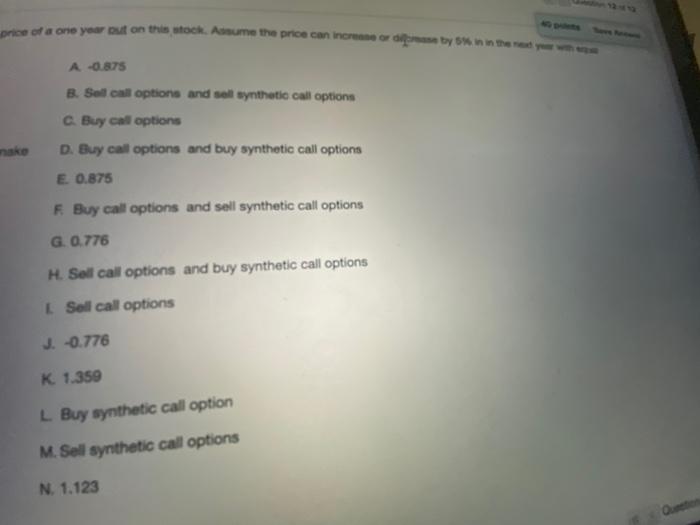

Question 72 HEJO company has the current stock price of $80 today. Use a 1 step likelihood. Risk free rate is 3%, the strike is $83. Find the hedge ratio(H), (make sure have the correct sign, this w Find the puts's value or price today Use the above information to price a Call using put call parity Given the answer in Part C, If actual call options currently sell money? on to a profa one year out on the stock. Resurse the price can be month will be without as a decimal A 0.875 B. Soll call options and synthetical options C. Buy call options portor $1. how can you exploit this to make D. Buy call options and buy synthetic call options E. 0.875 E Buy call options and tell synthetic call options G. 0.776 H. Sell call options and buy synthetic call options Sell call options J. -0.776 K 1.359 L Buy synthetic call option M. Soll synthetic call options N. 1.123 price of a one you out on this stock. Anume the price con nosoby one A -0.875 B. Sel call options and sell synthetic call options c. Buy cal options D. Buy call options and buy synthetic call options nake E 0.875 Buy call options and sell synthetic call options G 0.776 H. Soll call options and buy synthetic call options L Soll call options J. -0.776 K 1.359 L Buy synthetic call option M. Sell synthetic call options N. 1.123 Question 72 HEJO company has the current stock price of $80 today. Use a 1 step likelihood. Risk free rate is 3%, the strike is $83. Find the hedge ratio(H), (make sure have the correct sign, this w Find the puts's value or price today Use the above information to price a Call using put call parity Given the answer in Part C, If actual call options currently sell money? on to a profa one year out on the stock. Resurse the price can be month will be without as a decimal A 0.875 B. Soll call options and synthetical options C. Buy call options portor $1. how can you exploit this to make D. Buy call options and buy synthetic call options E. 0.875 E Buy call options and tell synthetic call options G. 0.776 H. Sell call options and buy synthetic call options Sell call options J. -0.776 K 1.359 L Buy synthetic call option M. Soll synthetic call options N. 1.123 price of a one you out on this stock. Anume the price con nosoby one A -0.875 B. Sel call options and sell synthetic call options c. Buy cal options D. Buy call options and buy synthetic call options nake E 0.875 Buy call options and sell synthetic call options G 0.776 H. Soll call options and buy synthetic call options L Soll call options J. -0.776 K 1.359 L Buy synthetic call option M. Sell synthetic call options N. 1.123