Answered step by step

Verified Expert Solution

Question

1 Approved Answer

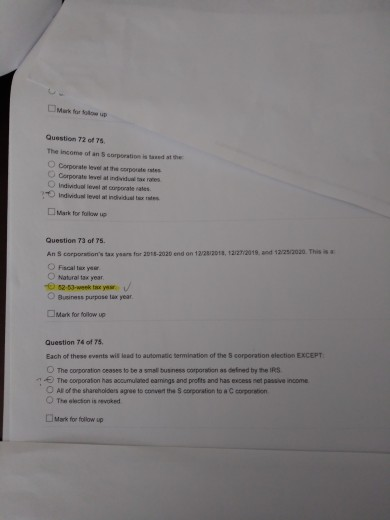

Question 72 of 75 - Individuella corporate Individueel wind Question 73 of 75. An Scorporation as year for 2016-2020 end on 12/ 2 013, 1312/2018

Question 72 of 75 - Individuella corporate Individueel wind Question 73 of 75. An Scorporation as year for 2016-2020 end on 12/ 2 013, 1312/2018 and 12/20/2020. This is Natural tax year 052-6-weeks Business purpose lax year CMark forfollow up Question 74 of 75 Each of these events will lead to automatic termination of the corporation election EXCEPT The corporation ceases to be a small business Corporation as defined by the IRS 1. The corporation has com e earings and profits and has excess net passive income All of the shareholders agree to convert the corporation to a C corporation The action is ek Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started