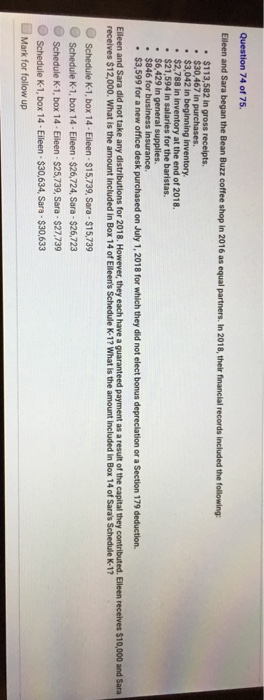

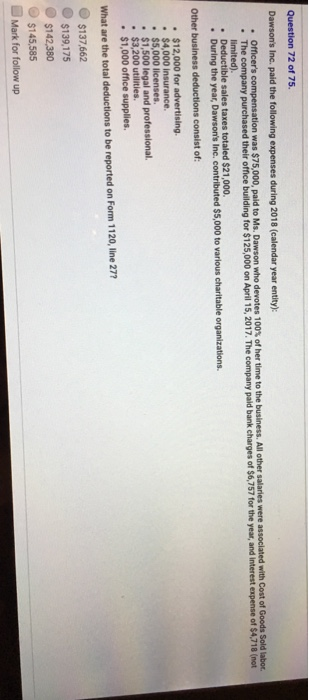

Question 74 of 75. Eleen and Sara began the Bean Buzz coffee shop in 2016 as equal partners. In 2018, their finan- ancial recor ds included the following .$113,582 in gross receipts $30,467 in purchases. $3,042 in beginning inventory $2,788 in inventory at the end of 2018. .$21,594 in salaries for the baristas. $6,429 in general supplies. .$846 for business insurance. $3,599 for a new office desk purchased on July 1, 2018 for which they did not elect bonus depreciation or a Section 179 deduction. Elleen and Sara did not take any distributions for 2018. However, they each have a quaranteed payment as a result of the capital they contributed. Eileen receives $10,000 and Sara receives $12,000. What is the amount included in Box 14 of Eleen's Schedule K-1? What is the amount included in Box 14 of Sara's Schedule K-1? Schedule K-1, box 14-Eileen-$15,739, Sara-$15,739 Schedule K-1, box 14-Eileen $26,724, Sara-$26,723 Schedule K-1, box 14-Eileen-$25,739, Sara - $27,739 Schedule K-1, box 14-Eileen-$30,634, Sara-$30,633 Mark for follow up Question 72 of 75. Dawson's Inc. paid the following expenses during 2018 (calendar year entity): .Officer's compensation was $75,000, paid to Ms. Dawson who devotes 100% of her time to the business. All other salaries were associated with Cost of Goods Sold labor. The company purchased their office building for $125,000 on April 15, 2017. The company paid bank charges of $6,757 for the year, and interest expense of $4,718 (not limited). Deductible sales taxes totaled $21,000. During the year, Dawson's Inc. contributed $5,000 to various charitable organizations. Other business deductions consist of: $12,000 for advertising. $4,000 insurance. $5,000 licenses. .$1,500 legal and professional. $3,200 utilities. $1,000 office supplies. What are the total deductions to be reported on Form 1120, line 277 $137,662 $139,175 $142,380 $145,585 Mark for follow up Question 74 of 75. Eleen and Sara began the Bean Buzz coffee shop in 2016 as equal partners. In 2018, their finan- ancial recor ds included the following .$113,582 in gross receipts $30,467 in purchases. $3,042 in beginning inventory $2,788 in inventory at the end of 2018. .$21,594 in salaries for the baristas. $6,429 in general supplies. .$846 for business insurance. $3,599 for a new office desk purchased on July 1, 2018 for which they did not elect bonus depreciation or a Section 179 deduction. Elleen and Sara did not take any distributions for 2018. However, they each have a quaranteed payment as a result of the capital they contributed. Eileen receives $10,000 and Sara receives $12,000. What is the amount included in Box 14 of Eleen's Schedule K-1? What is the amount included in Box 14 of Sara's Schedule K-1? Schedule K-1, box 14-Eileen-$15,739, Sara-$15,739 Schedule K-1, box 14-Eileen $26,724, Sara-$26,723 Schedule K-1, box 14-Eileen-$25,739, Sara - $27,739 Schedule K-1, box 14-Eileen-$30,634, Sara-$30,633 Mark for follow up Question 72 of 75. Dawson's Inc. paid the following expenses during 2018 (calendar year entity): .Officer's compensation was $75,000, paid to Ms. Dawson who devotes 100% of her time to the business. All other salaries were associated with Cost of Goods Sold labor. The company purchased their office building for $125,000 on April 15, 2017. The company paid bank charges of $6,757 for the year, and interest expense of $4,718 (not limited). Deductible sales taxes totaled $21,000. During the year, Dawson's Inc. contributed $5,000 to various charitable organizations. Other business deductions consist of: $12,000 for advertising. $4,000 insurance. $5,000 licenses. .$1,500 legal and professional. $3,200 utilities. $1,000 office supplies. What are the total deductions to be reported on Form 1120, line 277 $137,662 $139,175 $142,380 $145,585 Mark for follow up