Question 78 please. Thank you!

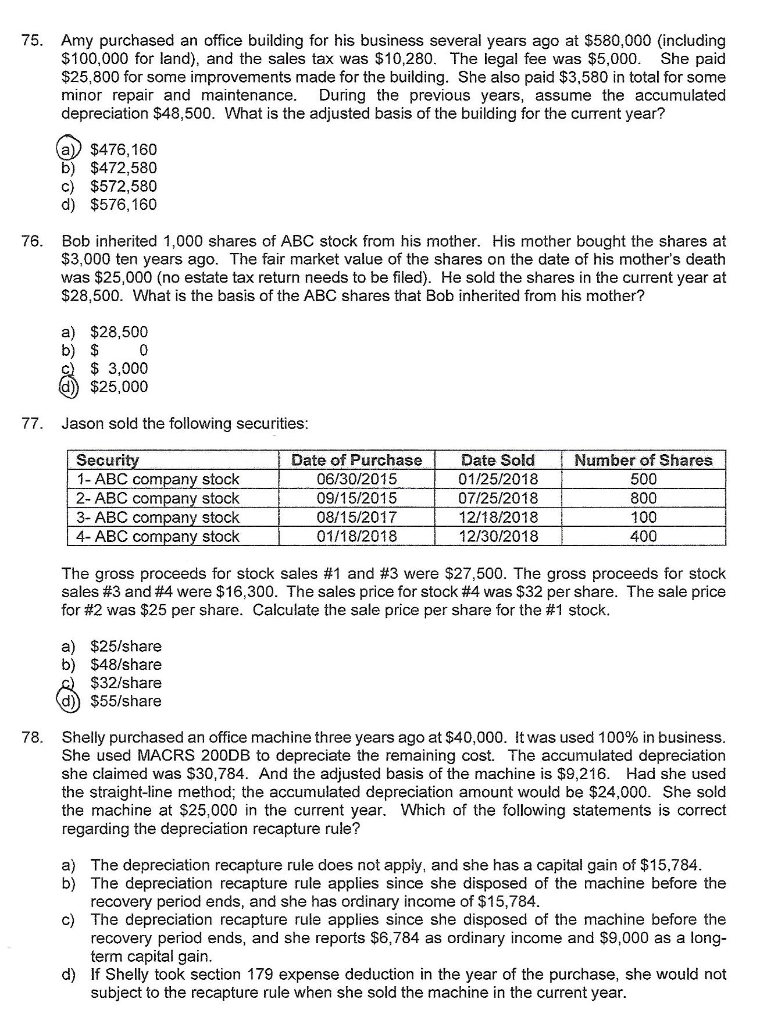

75. Amy purchased an office building for his business several years ago at $580,000 (including $100,000 for land), and the sales tax was $10,280. The legal fee was $5,000. She paid $25,800 for some improvements made for the building. She also paid $3,580 in total for some minor repair and maintenance. During the previous years, assume the accumulated depreciation $48,500. What is the adjusted basis of the building for the current year? (a) $476,160 b) $472,580 c) $572,580 d) $576,160 76. Bob inherited 1,000 shares of ABC stock from his mother. His mother bought the shares at $3,000 ten years ago. The fair market value of the shares on the date of his mother's death was $25,000 (no estate tax return needs to be filed). He sold the shares in the current year at $28,500. What is the basis of the ABC shares that Bob inherited from his mother? a) $28,500 b) $ 0 c) $ 3,000 d) $25,000 77. Jason sold the following securities: Security 1- ABC company stock 2- ABC company stock 3- ABC company stock 4- ABC company stock 1 Date of Purchase 06/30/2015 09/15/2015 08/15/2017 01/18/2018 Date Sold 01/25/2018 07/25/2018 12/18/2018 12/30/2018 Number of Shares 500 800 100 400 The gross proceeds for stock sales #1 and #3 were $27,500. The gross proceeds for stock sales #3 and #4 were $16,300. The sales price for stock #4 was $32 per share. The sale price for #2 was $25 per share. Calculate the sale price per share for the #1 stock. a) $25/share b) $48/share c) $32/share d) $55/share 78. Shelly purchased an office machine three years ago at $40,000. It was used 100% in business. She used MACRS 200DB to depreciate the remaining cost. The accumulated depreciation she claimed was $30,784. And the adjusted basis of the machine is $9,216. Had she used the straight-line method; the accumulated depreciation amount would be $24,000. She sold the machine at $25,000 in the current year. Which of the following statements is correct regarding the depreciation recapture rule? a) The depreciation recapture rule does not apply, and she has a capital gain of $15,784. b) The depreciation recapture rule applies since she disposed of the machine before the recovery period ends, and she has ordinary income of $15,784. The depreciation recapture rule applies since she disposed of the machine before the recovery period ends, and she reports $6,784 as ordinary income and $9,000 as a long- term capital gain. d) If Shelly took section 179 expense deduction in the year of the purchase, she would not subject to the recapture rule when she sold the machine in the current year