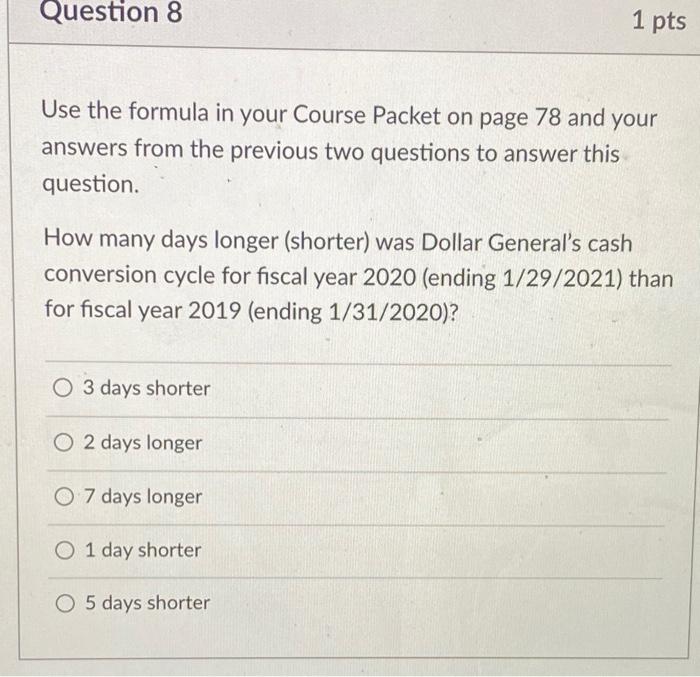

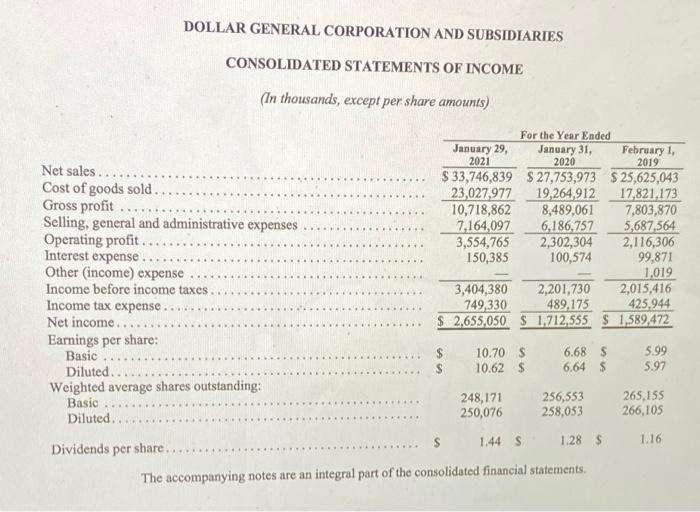

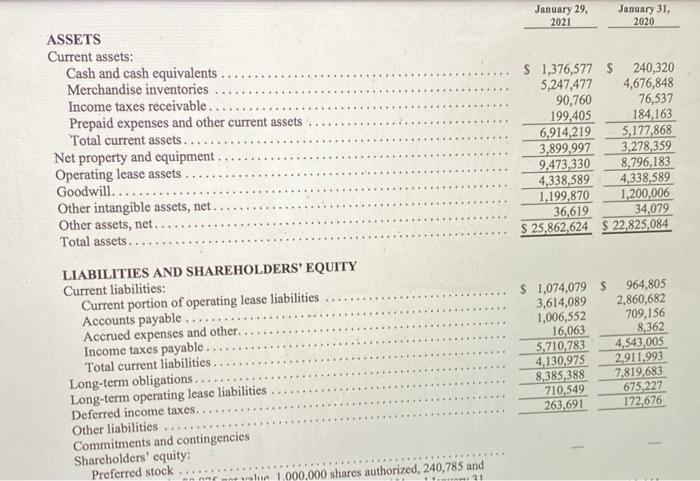

Question 8 1 pts Use the formula in your Course Packet on page 78 and your answers from the previous two questions to answer this question. How many days longer (shorter) was Dollar General's cash conversion cycle for fiscal year 2020 (ending 1/29/2021) than for fiscal year 2019 (ending 1/31/2020)? O 3 days shorter O 2 days longer O 7 days longer O 1 day shorter O 5 days shorter DOLLAR GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per share amounts) Net sales. Cost of goods sold Gross profit .... Selling, general and administrative expenses Operating profit. Interest expense Other (income) expense Income before income taxes Income tax expense.. Net income.... Earnings per share: Basic .... Diluted. Weighted average shares outstanding: Basic Diluted For the Year Ended January 29, January 31, February 1, 2021 2020 2019 $ 33,746,839 $ 27,753,973 $25,625,043 23,027,977 19,264,912 17,821,173 10,718,862 8,489,061 7,803,870 7,164,097 6,186,757 5,687,564 3,554,765 2,302,304 2,116,306 150,385 100,574 99,871 1,019 3,404,380 2,201,730 2,015,416 749,330 489,175 425,944 $ 2,655,050 S 1,712,555 $ 1,589,472 $ 10.70 $ 10.62 $ 6.68 $ 6.64 $ 5.99 5.97 248,171 250,076 256,553 258,053 265,155 266,105 1.16 Dividends per share S 1.44 $ 1.28 $ The accompanying notes are an integral part of the consolidated financial statements. January 29, 2021 January 31, 2020 ASSETS Current assets: Cash and cash equivalents. Merchandise inventories Income taxes receivable.. Prepaid expenses and other current assets Total current assets.. Net property and equipment. Operating lease assets... Goodwill... Other intangible assets, net. Other assets, net. Total assets. $ 1,376,577 $ 240,320 5,247,477 4,676,848 90,760 76,537 199,405 184,163 6,914,219 5,177,868 3,899,997 3,278,359 9.473,330 8,796,183 4,338,589 4,338,589 1.199,870 1,200,006 36,619 34,079 $ 25,862,624 $ 22,825,084 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of operating lease liabilities Accounts payable Accrued expenses and other. Income taxes payable. Total current liabilities Long-term obligations Long-term operating lease liabilities Deferred income taxes. Other liabilities Commitments and contingencies Shareholders' equity Preferred stock no 1.000.000 shares authorized, 240,785 and $ 1,074,079 $ 964,805 3,614,089 2,860,682 1,006,552 709,156 16,063 8.362 5,710,783 4,543,005 4,130,975 2,911,993 8,385,388 7,819,683 710,549 675,227 263,691 172,676 11 Question 8 1 pts Use the formula in your Course Packet on page 78 and your answers from the previous two questions to answer this question. How many days longer (shorter) was Dollar General's cash conversion cycle for fiscal year 2020 (ending 1/29/2021) than for fiscal year 2019 (ending 1/31/2020)? O 3 days shorter O 2 days longer O 7 days longer O 1 day shorter O 5 days shorter DOLLAR GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per share amounts) Net sales. Cost of goods sold Gross profit .... Selling, general and administrative expenses Operating profit. Interest expense Other (income) expense Income before income taxes Income tax expense.. Net income.... Earnings per share: Basic .... Diluted. Weighted average shares outstanding: Basic Diluted For the Year Ended January 29, January 31, February 1, 2021 2020 2019 $ 33,746,839 $ 27,753,973 $25,625,043 23,027,977 19,264,912 17,821,173 10,718,862 8,489,061 7,803,870 7,164,097 6,186,757 5,687,564 3,554,765 2,302,304 2,116,306 150,385 100,574 99,871 1,019 3,404,380 2,201,730 2,015,416 749,330 489,175 425,944 $ 2,655,050 S 1,712,555 $ 1,589,472 $ 10.70 $ 10.62 $ 6.68 $ 6.64 $ 5.99 5.97 248,171 250,076 256,553 258,053 265,155 266,105 1.16 Dividends per share S 1.44 $ 1.28 $ The accompanying notes are an integral part of the consolidated financial statements. January 29, 2021 January 31, 2020 ASSETS Current assets: Cash and cash equivalents. Merchandise inventories Income taxes receivable.. Prepaid expenses and other current assets Total current assets.. Net property and equipment. Operating lease assets... Goodwill... Other intangible assets, net. Other assets, net. Total assets. $ 1,376,577 $ 240,320 5,247,477 4,676,848 90,760 76,537 199,405 184,163 6,914,219 5,177,868 3,899,997 3,278,359 9.473,330 8,796,183 4,338,589 4,338,589 1.199,870 1,200,006 36,619 34,079 $ 25,862,624 $ 22,825,084 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of operating lease liabilities Accounts payable Accrued expenses and other. Income taxes payable. Total current liabilities Long-term obligations Long-term operating lease liabilities Deferred income taxes. Other liabilities Commitments and contingencies Shareholders' equity Preferred stock no 1.000.000 shares authorized, 240,785 and $ 1,074,079 $ 964,805 3,614,089 2,860,682 1,006,552 709,156 16,063 8.362 5,710,783 4,543,005 4,130,975 2,911,993 8,385,388 7,819,683 710,549 675,227 263,691 172,676 11