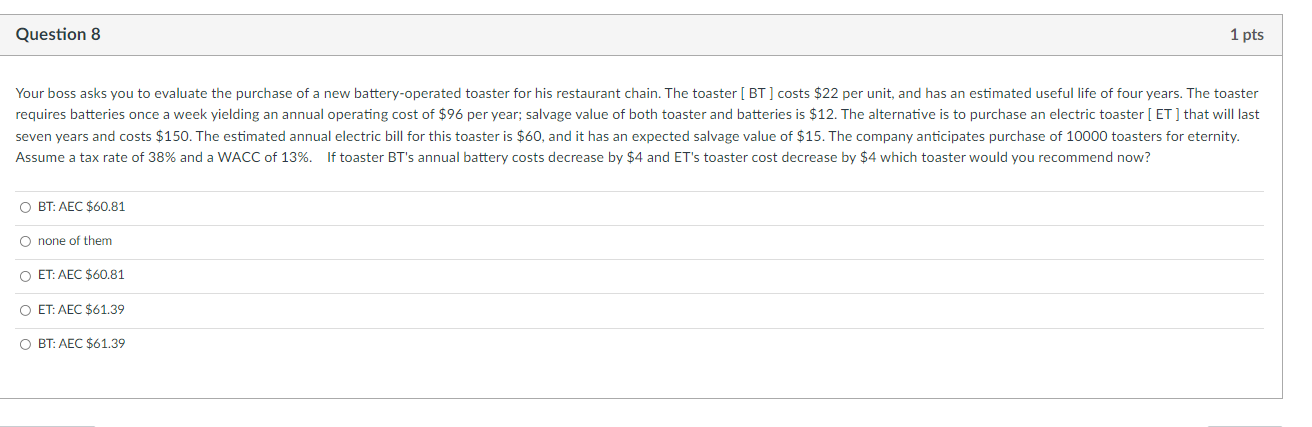

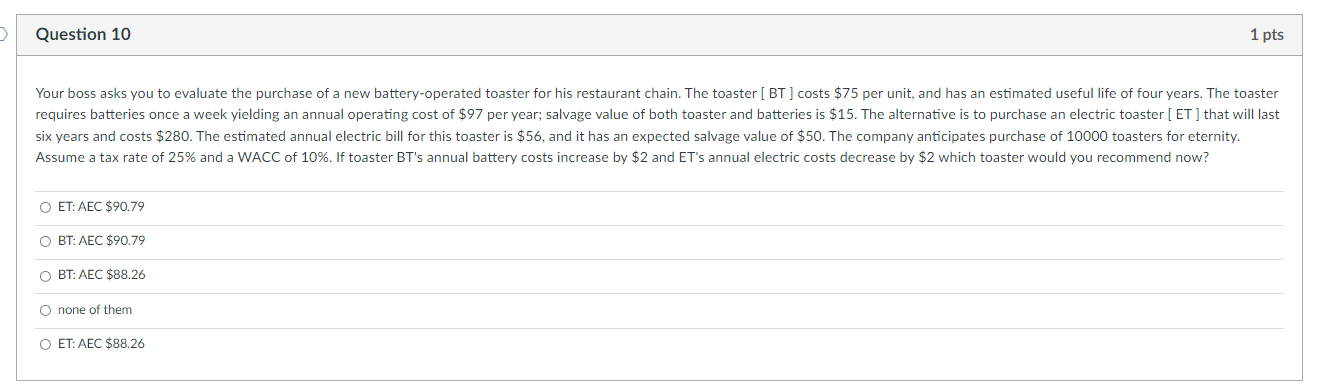

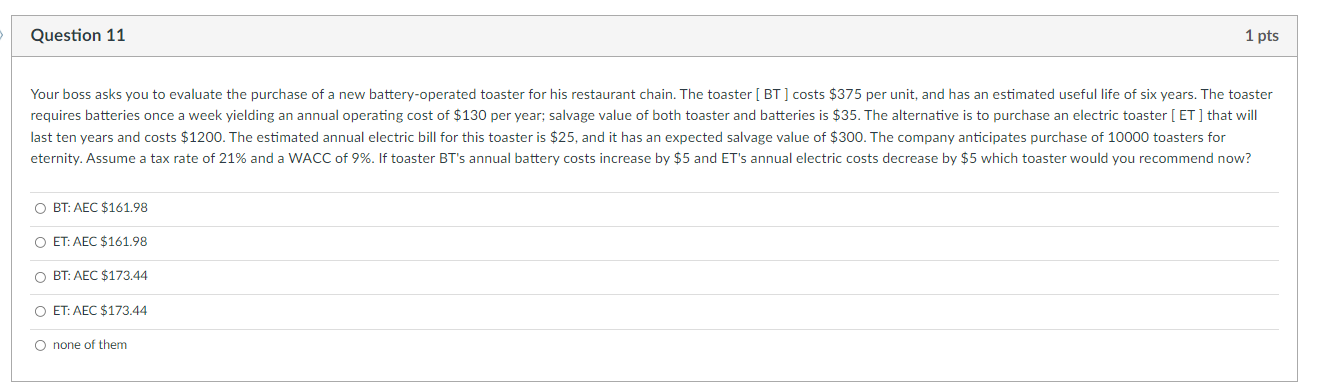

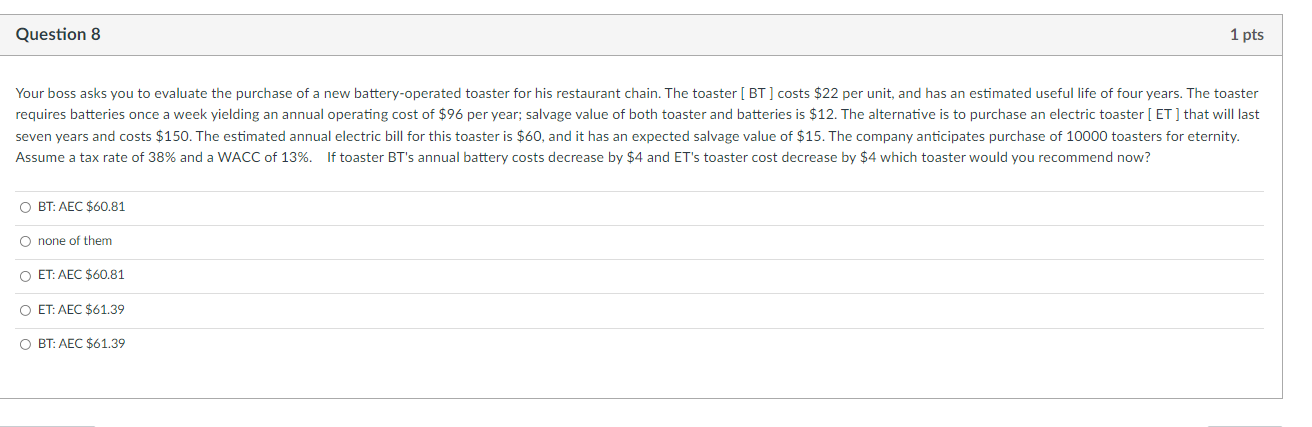

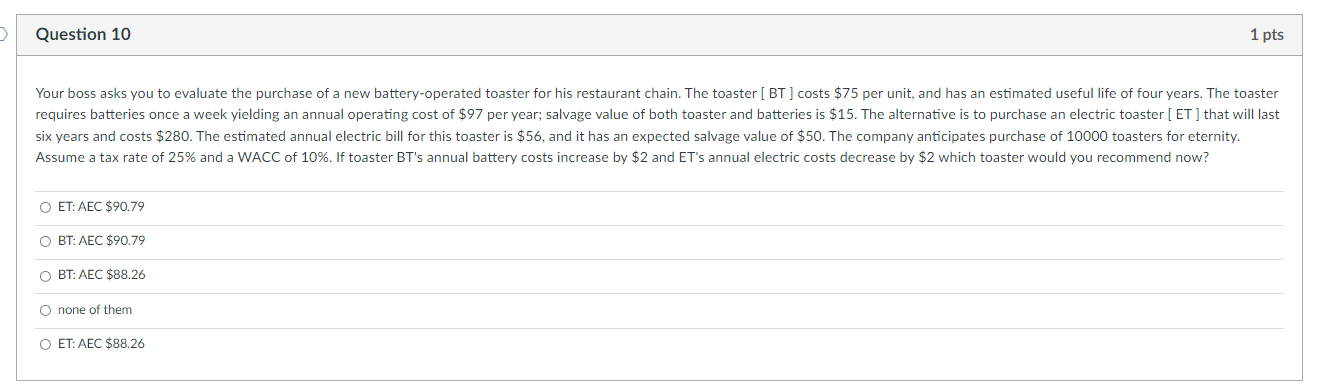

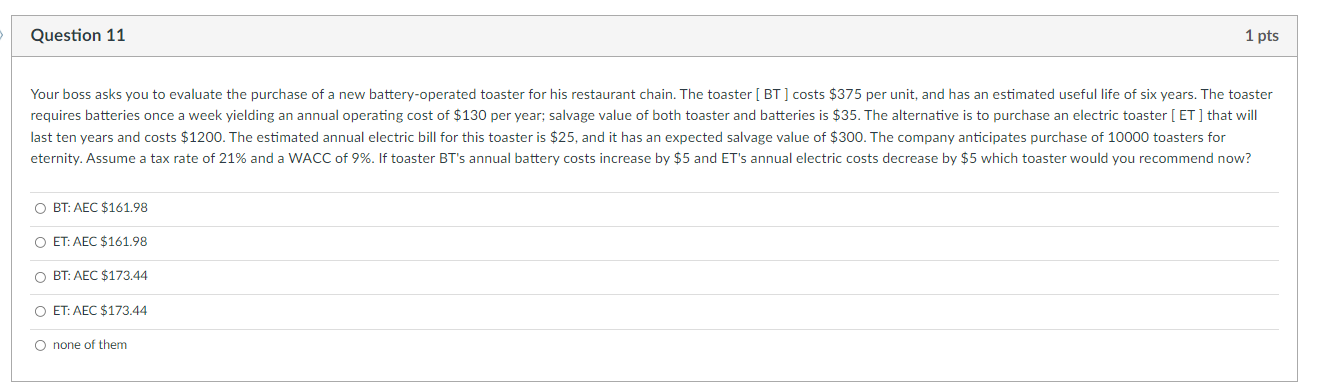

Question 8 1 pts Your boss asks you to evaluate the purchase of a new battery-operated toaster for his restaurant chain. The toaster (BT] costs $22 per unit, and has an estimated useful life of four years. The toaster requires batteries once a week yielding an annual operating cost of $96 per year; salvage value of both toaster and batteries is $12. The alternative is to purchase an electric toaster [ET] that will last seven years and costs $150. The estimated annual electric bill for this toaster is $60, and it has an expected salvage value of $15. The company anticipates purchase of 10000 toasters for eternity. Assume a tax rate of 38% and a WACC of 13%. If toaster BT's annual battery costs decrease by $4 and ET's toaster cost decrease by $4 which toaster would you recommend now? OBT: AEC $60.81 none of them ET: AEC $60.81 O ET: AEC $61.39 OBT: AEC $61.39 Question 10 1 pts Your boss asks you to evaluate the purchase of a new battery-operated toaster for his restaurant chain. The toaster (BT] costs $75 per unit, and has an estimated useful life of four years. The toaster requires batteries once a week yielding an annual operating cost of $97 per year; salvage value of both toaster and batteries is $15. The alternative is to purchase an electric toaster [ET] that will last six years and costs $280. The estimated annual electric bill for this toaster is $56, and it has an expected salvage value of $50. The company anticipates purchase of 10000 toasters for eternity. Assume a tax rate of 25% and a WACC of 10%. If toaster BT's annual battery costs increase by $2 and ET's annual electric costs decrease by $2 which toaster would you recommend now? O ET: AEC $90.79 OBT: AEC $90.79 OBT: AEC $88.26 O none of them O ET: AEC $88.26 Question 11 1 pts Your boss asks you to evaluate the purchase of a new battery-operated toaster for his restaurant chain. The toaster (BT] costs $375 per unit, and has an estimated useful life of six years. The toaster requires batteries once a week yielding an annual operating cost of $130 per year; salvage value of both toaster and batteries is $35. The alternative is to purchase an electric toaster [ET] that will last ten years and costs $1200. The estimated annual electric bill for this toaster is $25, and it has an expected salvage value of $300. The company anticipates purchase of 10000 toasters for eternity. Assume a tax rate of 21% and a WACC of 9%. If toaster BT's annual battery costs increase by $5 and ET's annual electric costs decrease by $5 which toaster would you recommend now? O BT: AEC $161.98 O ET: AEC $161.98 OBT: AEC $173.44 O ET: AEC $173.44 O none of them Question 8 1 pts Your boss asks you to evaluate the purchase of a new battery-operated toaster for his restaurant chain. The toaster (BT] costs $22 per unit, and has an estimated useful life of four years. The toaster requires batteries once a week yielding an annual operating cost of $96 per year; salvage value of both toaster and batteries is $12. The alternative is to purchase an electric toaster [ET] that will last seven years and costs $150. The estimated annual electric bill for this toaster is $60, and it has an expected salvage value of $15. The company anticipates purchase of 10000 toasters for eternity. Assume a tax rate of 38% and a WACC of 13%. If toaster BT's annual battery costs decrease by $4 and ET's toaster cost decrease by $4 which toaster would you recommend now? OBT: AEC $60.81 none of them ET: AEC $60.81 O ET: AEC $61.39 OBT: AEC $61.39 Question 10 1 pts Your boss asks you to evaluate the purchase of a new battery-operated toaster for his restaurant chain. The toaster (BT] costs $75 per unit, and has an estimated useful life of four years. The toaster requires batteries once a week yielding an annual operating cost of $97 per year; salvage value of both toaster and batteries is $15. The alternative is to purchase an electric toaster [ET] that will last six years and costs $280. The estimated annual electric bill for this toaster is $56, and it has an expected salvage value of $50. The company anticipates purchase of 10000 toasters for eternity. Assume a tax rate of 25% and a WACC of 10%. If toaster BT's annual battery costs increase by $2 and ET's annual electric costs decrease by $2 which toaster would you recommend now? O ET: AEC $90.79 OBT: AEC $90.79 OBT: AEC $88.26 O none of them O ET: AEC $88.26 Question 11 1 pts Your boss asks you to evaluate the purchase of a new battery-operated toaster for his restaurant chain. The toaster (BT] costs $375 per unit, and has an estimated useful life of six years. The toaster requires batteries once a week yielding an annual operating cost of $130 per year; salvage value of both toaster and batteries is $35. The alternative is to purchase an electric toaster [ET] that will last ten years and costs $1200. The estimated annual electric bill for this toaster is $25, and it has an expected salvage value of $300. The company anticipates purchase of 10000 toasters for eternity. Assume a tax rate of 21% and a WACC of 9%. If toaster BT's annual battery costs increase by $5 and ET's annual electric costs decrease by $5 which toaster would you recommend now? O BT: AEC $161.98 O ET: AEC $161.98 OBT: AEC $173.44 O ET: AEC $173.44 O none of them