Answered step by step

Verified Expert Solution

Question

1 Approved Answer

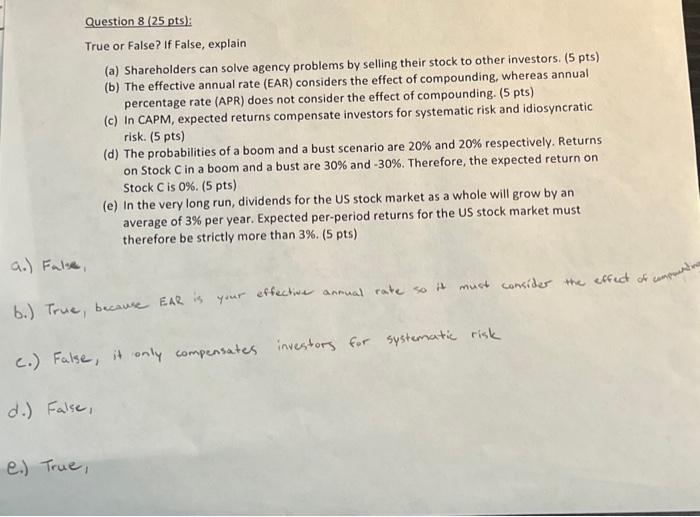

Question 8 (25 pts): True or False? If False, explain (a) Shareholders can solve agency problems by selling their stock to other investors. (5 pts)

Question 8 (25 pts): True or False? If False, explain (a) Shareholders can solve agency problems by selling their stock to other investors. (5 pts) (b) The effective annual rate (EAR) considers the effect of compounding, whereas annual percentage rate (APR) does not consider the effect of compounding. (5 pts) (c) In CAPM, expected returns compensate investors for systematic risk and idiosyncratic risk. (5 pts) a.) False, b.) True, because EAR is your effective annual rate so it must consider the effect of compounding d.) False, (d) The probabilities of a boom and a bust scenario are 20% and 20% respectively. Returns on Stock C in a boom and a bust are 30% and -30%. Therefore, the expected return on Stock C is 0%. (5 pts) (e) In the very long run, dividends for the US stock market as a whole will grow by an average of 3% per year. Expected per-period returns for the US stock market must therefore be strictly more than 3%. (5 pts) C.) False, it only compensates investors for systematic risk e.) True,

Part B and C are correct so explain why Part A and D are false and then explain why Part E is true

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started