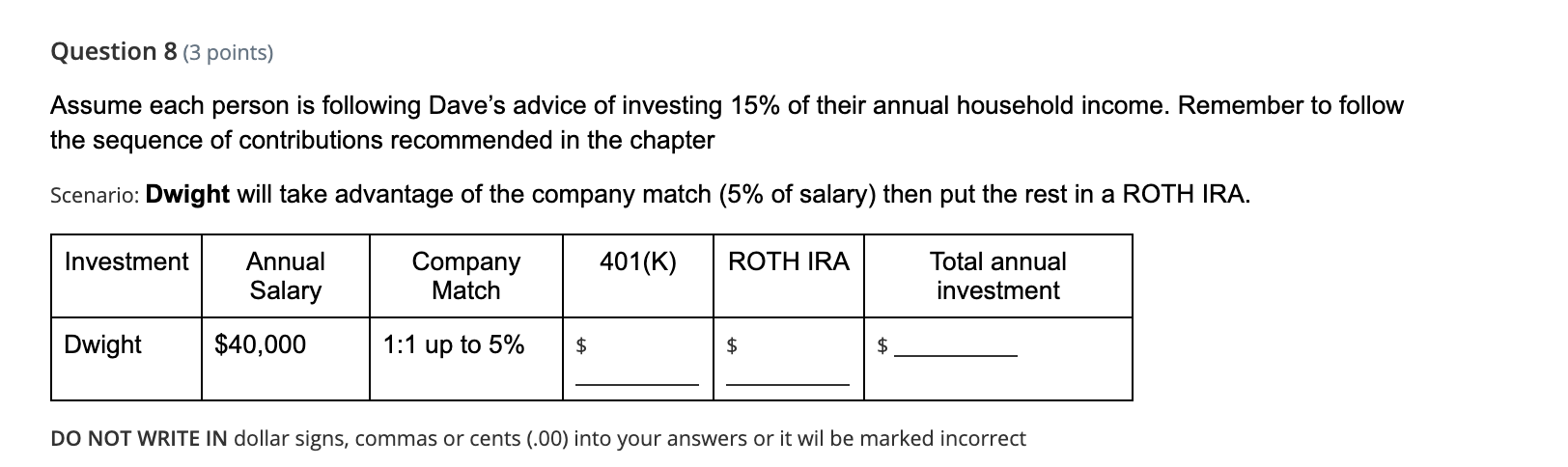

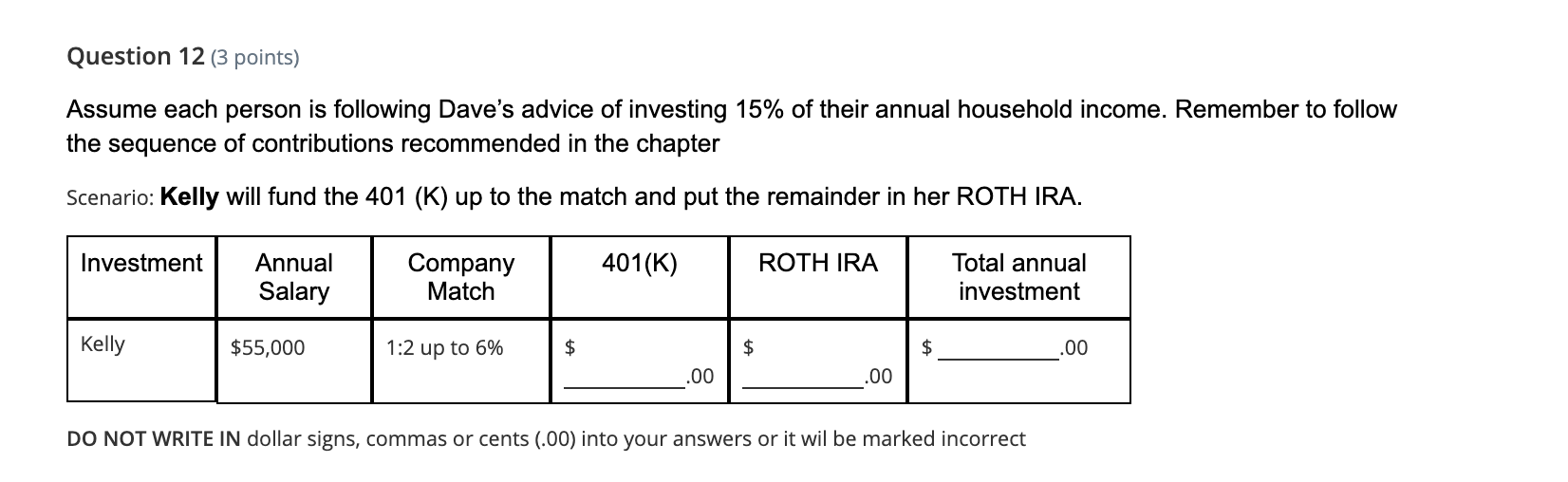

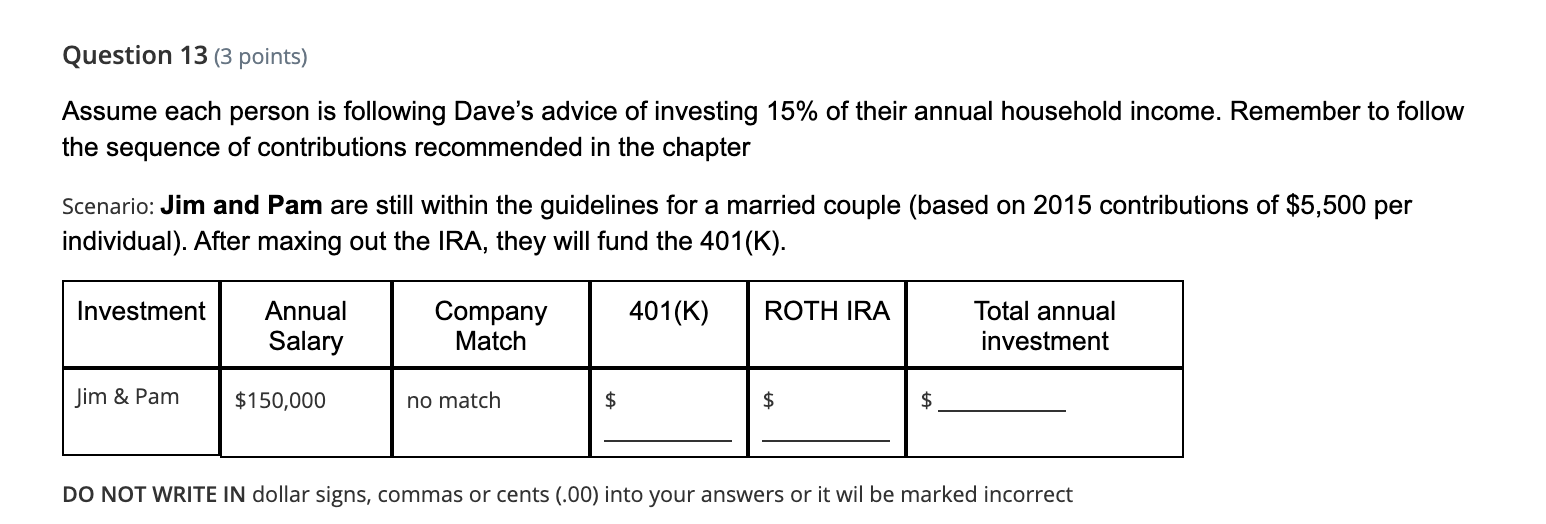

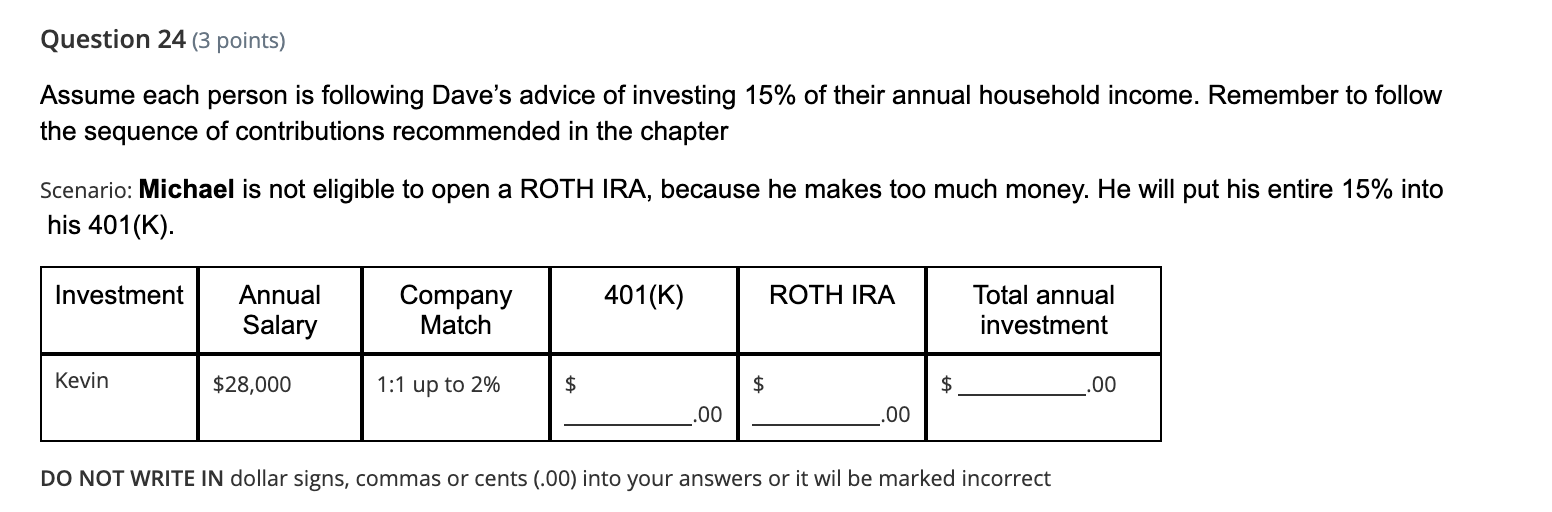

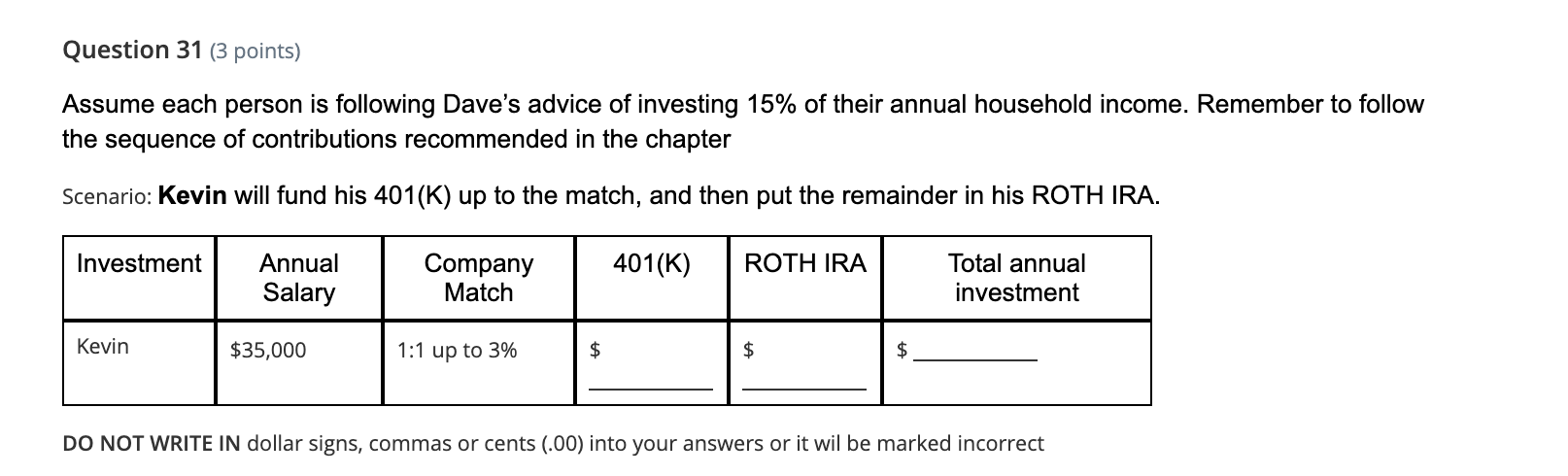

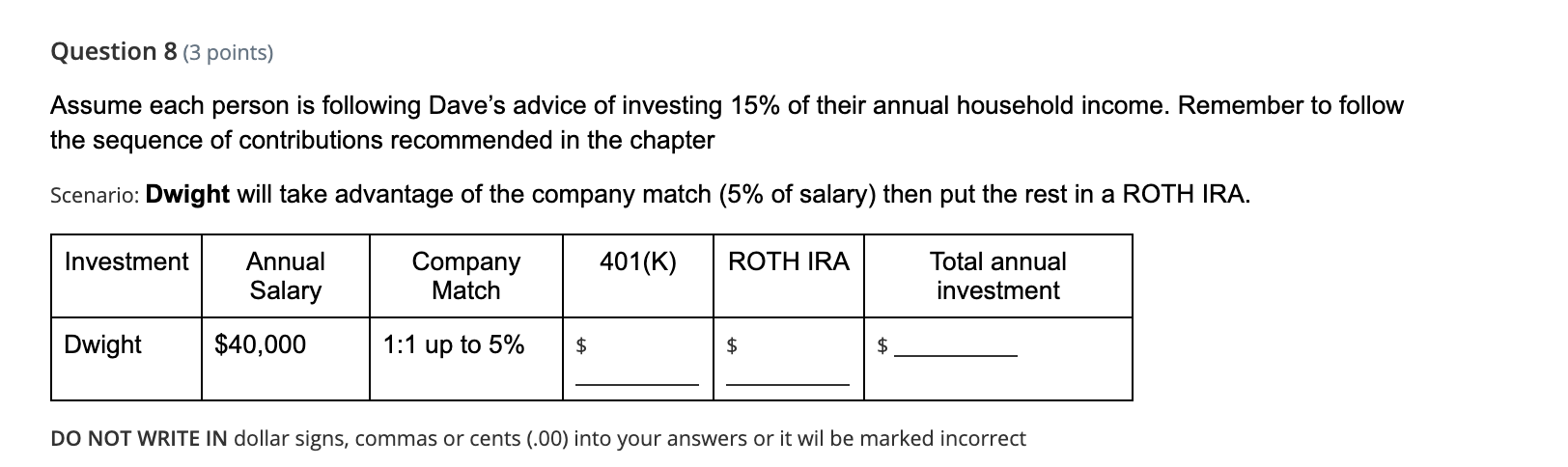

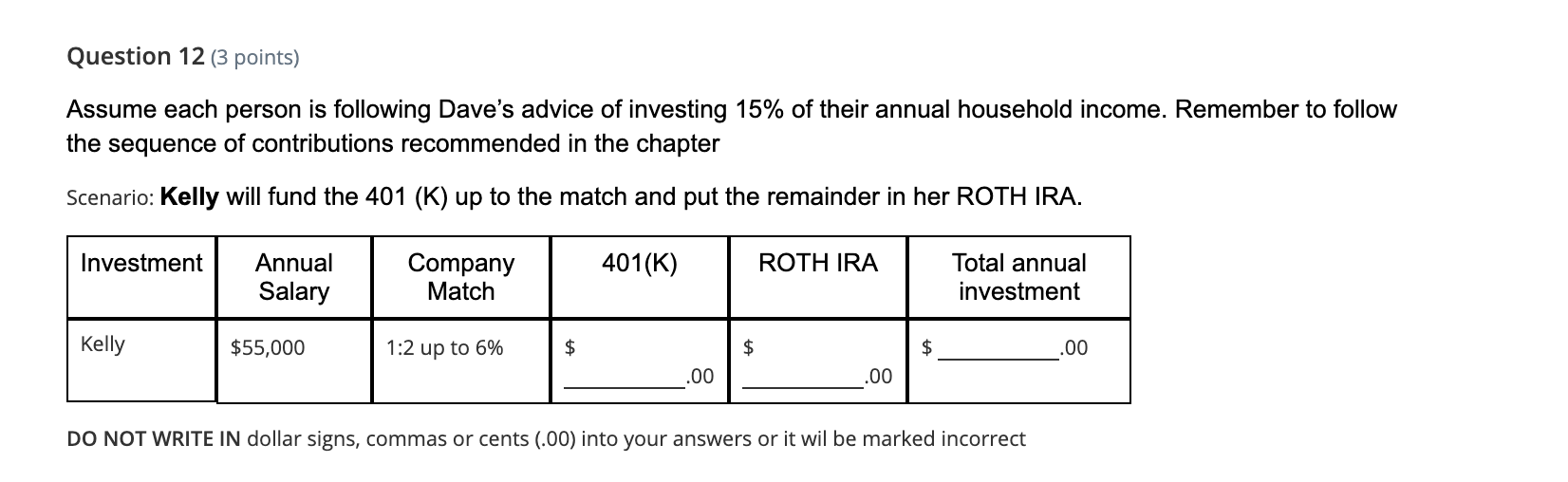

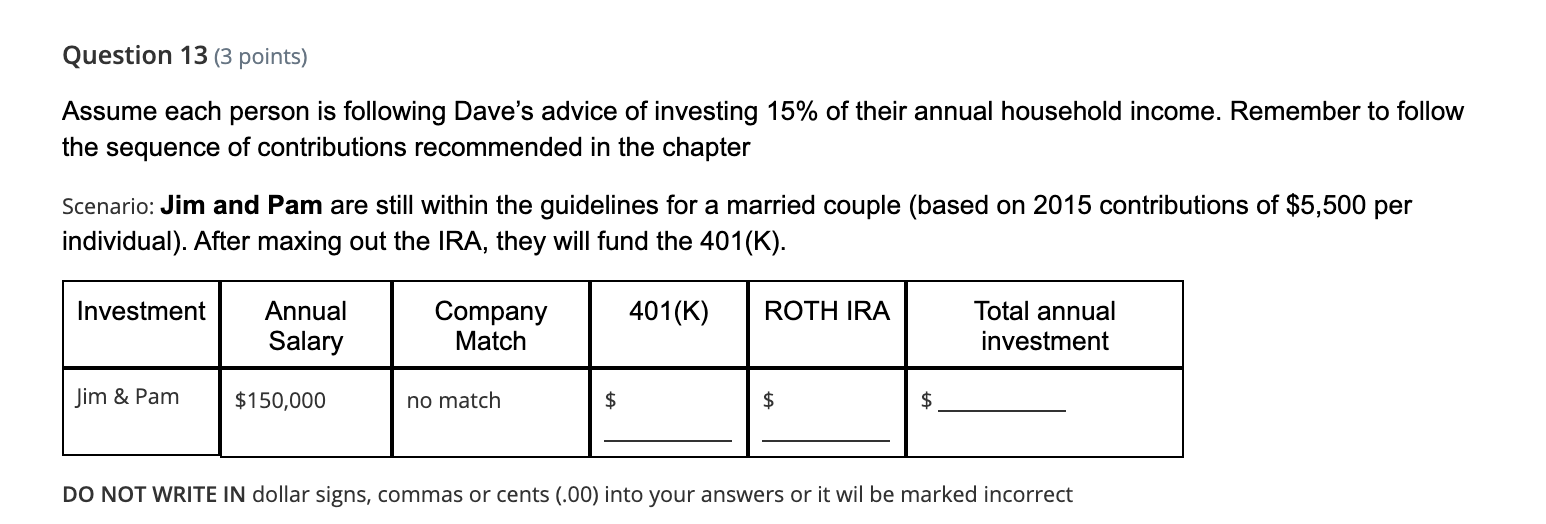

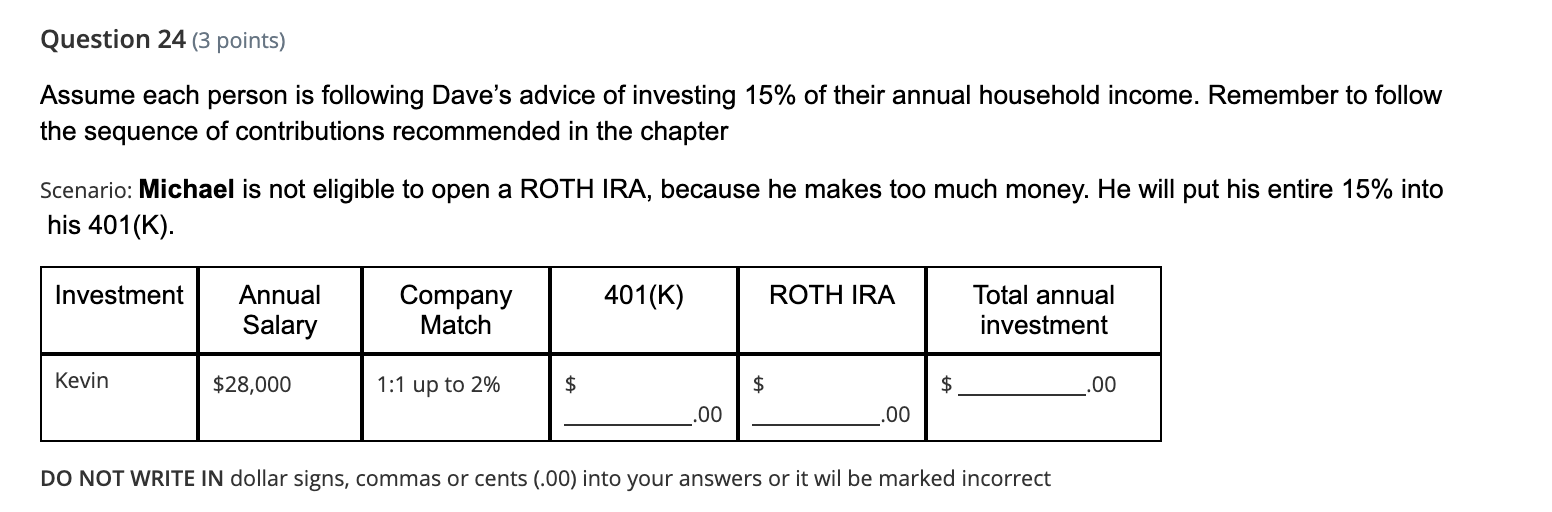

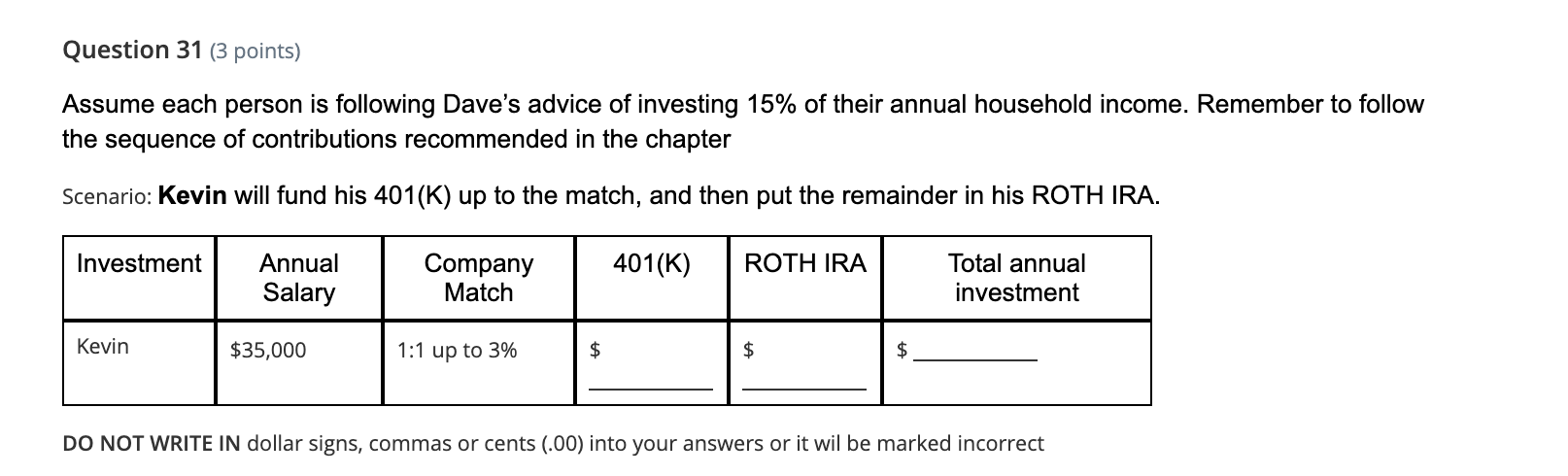

Question 8 (3 points) Assume each person is following Dave's advice of investing 15% of their annual household income. Remember to follow the sequence of contributions recommended in the chapter Scenario: Dwight will take advantage of the company match (5% of salary) then put the rest in a ROTH IRA. Investment Annual Salary Company Match 401(K) ROTH IRA Total annual investment Dwight $40,000 1:1 up to 5% $ ta DO NOT WRITE IN dollar signs, commas or cents (.00) into your answers or it wil be marked incorrect Question 12 (3 points) Assume each person is following Dave's advice of investing 15% of their annual household income. Remember to follow the sequence of contributions recommended in the chapter Scenario: Kelly will fund the 401 (K) up to the match and put the remainder in her ROTH IRA. Investment 401 ROTH IRA Annual Salary Company Match Total annual investment Kelly $55,000 1:2 up to 6% $ _ _.00 DO NOT WRITE IN dollar signs, commas or cents (.00) into your answers or it wil be marked incorrect Question 31 (3 points) Assume each person is following Dave's advice of investing 15% of their annual household income. Remember to follow the sequence of contributions recommended in the chapter Scenario: Kevin will fund his 401(K) up to the match, and then put the remainder in his ROTH IRA. Investment Annual Salary Company Match 401(K) ROTH IRA Total annual investment Kevin $35,000 1:1 up to 3% DO NOT WRITE IN dollar signs, commas or cents (.00) into your answers or it wil be marked incorrect Question 8 (3 points) Assume each person is following Dave's advice of investing 15% of their annual household income. Remember to follow the sequence of contributions recommended in the chapter Scenario: Dwight will take advantage of the company match (5% of salary) then put the rest in a ROTH IRA. Investment Annual Salary Company Match 401(K) ROTH IRA Total annual investment Dwight $40,000 1:1 up to 5% $ ta DO NOT WRITE IN dollar signs, commas or cents (.00) into your answers or it wil be marked incorrect Question 12 (3 points) Assume each person is following Dave's advice of investing 15% of their annual household income. Remember to follow the sequence of contributions recommended in the chapter Scenario: Kelly will fund the 401 (K) up to the match and put the remainder in her ROTH IRA. Investment 401 ROTH IRA Annual Salary Company Match Total annual investment Kelly $55,000 1:2 up to 6% $ _ _.00 DO NOT WRITE IN dollar signs, commas or cents (.00) into your answers or it wil be marked incorrect Question 31 (3 points) Assume each person is following Dave's advice of investing 15% of their annual household income. Remember to follow the sequence of contributions recommended in the chapter Scenario: Kevin will fund his 401(K) up to the match, and then put the remainder in his ROTH IRA. Investment Annual Salary Company Match 401(K) ROTH IRA Total annual investment Kevin $35,000 1:1 up to 3% DO NOT WRITE IN dollar signs, commas or cents (.00) into your answers or it wil be marked incorrect